Earnings Play: HCA Healthcare

On Monday, before market, HCA Healthcare (HCA) is anticipated to report third quarter EPS of $2.28 compared to $2.23 a year ago on revenue of approximately $13.0 billion vs. $12.7 billion last year. HCA Healthcare is one of the largest for-profit hospital operators in the U.S. and its current analyst consensus rating is 17 buys, 7 holds and 0 sells, according to Bloomberg.

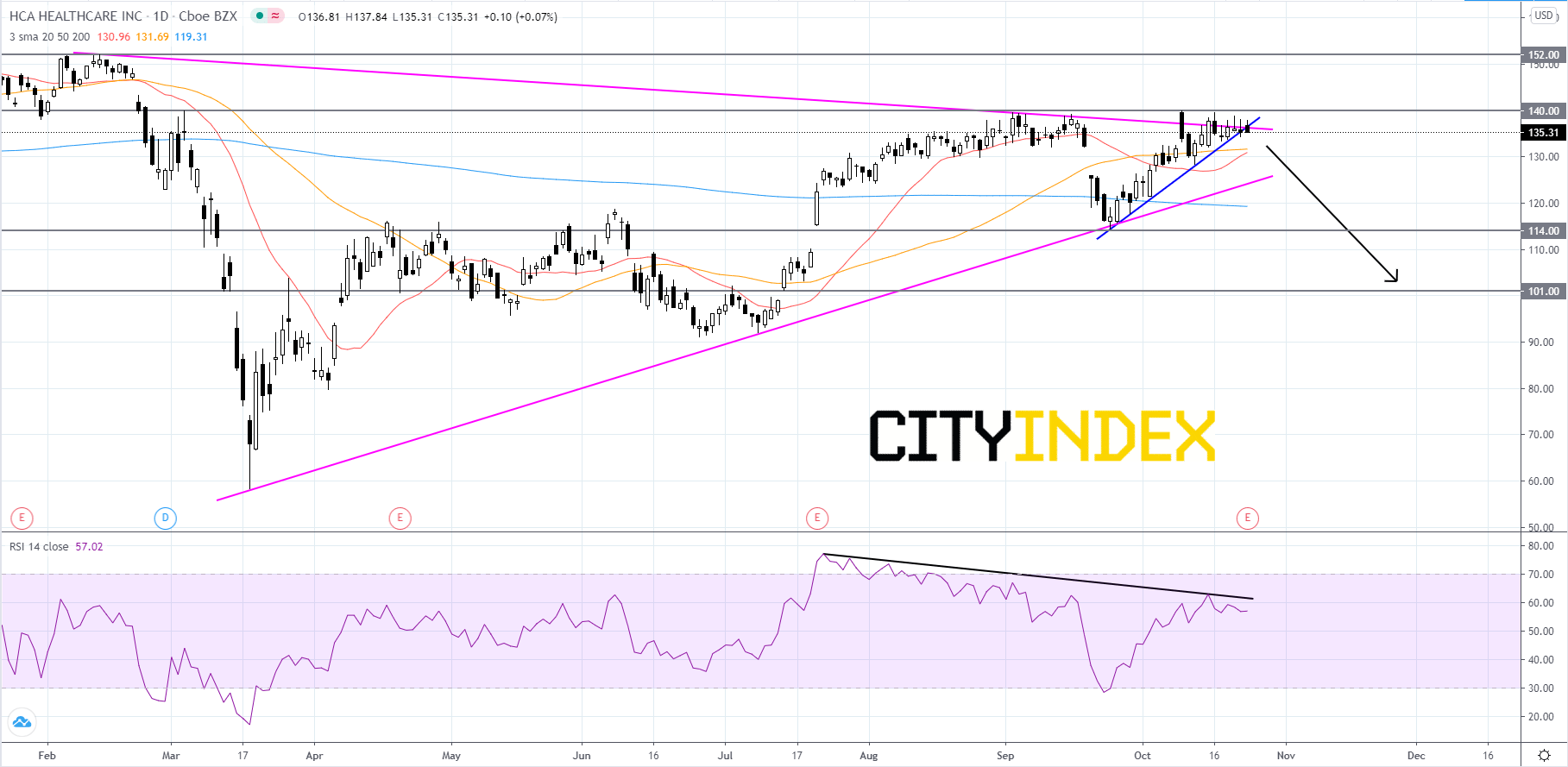

Looking at a daily chart, HCA Healthcare's stock price appears to have formed a intermediate-term symmetrical triangle pattern that began to form in the early months of 2020. On a more short-term basis the company has been advancing in an uptrend since late September. Price is currently being stopped at the upper trendline of the symmetrical triangle and in the last 5 days of trading most of the candle sticks have formed short real bodies with long wicks hinting at indecision. The RSI is showing divergence as price made a slightly higher high in October than it did in early September and the RSI made a lower high. Price will likely begin a new short-term downtrend and head for 114.00. Price will probably find support at 114.00 and chop around before reaching for 101.00. On the other hand, if price can manage to get over 140.00 then it could retest the record high of roughly 152.00. If price gets above 152.00, then it could continue to rise.

Source: GAIN Capital, TradingView

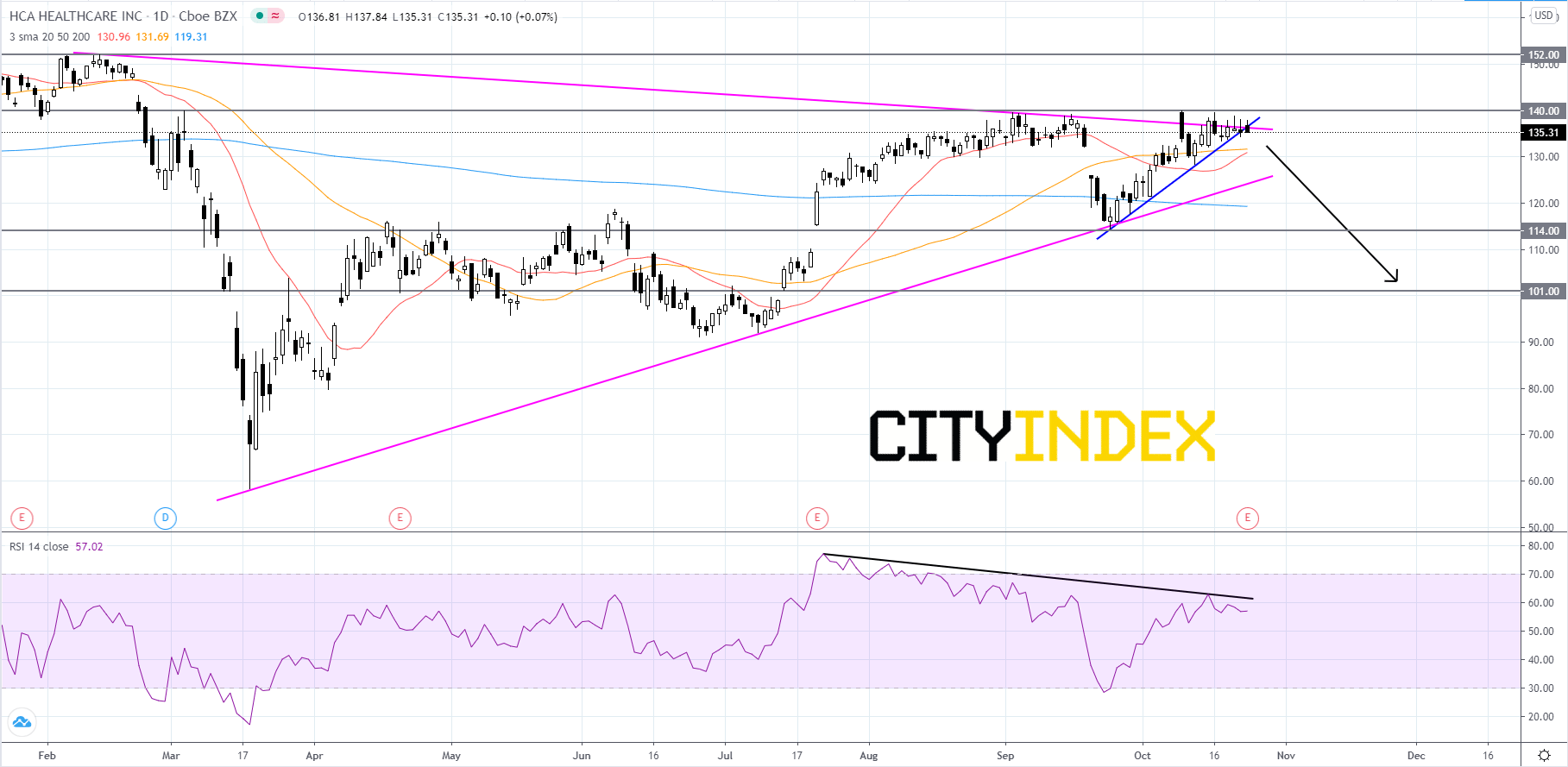

Looking at a daily chart, HCA Healthcare's stock price appears to have formed a intermediate-term symmetrical triangle pattern that began to form in the early months of 2020. On a more short-term basis the company has been advancing in an uptrend since late September. Price is currently being stopped at the upper trendline of the symmetrical triangle and in the last 5 days of trading most of the candle sticks have formed short real bodies with long wicks hinting at indecision. The RSI is showing divergence as price made a slightly higher high in October than it did in early September and the RSI made a lower high. Price will likely begin a new short-term downtrend and head for 114.00. Price will probably find support at 114.00 and chop around before reaching for 101.00. On the other hand, if price can manage to get over 140.00 then it could retest the record high of roughly 152.00. If price gets above 152.00, then it could continue to rise.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM