Earnings Play: Guidewire Software

On Tuesday, after market, Guidewire Software (GWRE) is anticipated to release first quarter LPS of $0.05 compared to an EPS of $0.13 last year on revenue of approximately $164.5 million vs. $157.0 million in the previous year. The company provides software solutions for property and casualty insurers, and its expected move based on front-month options is 7.7%.

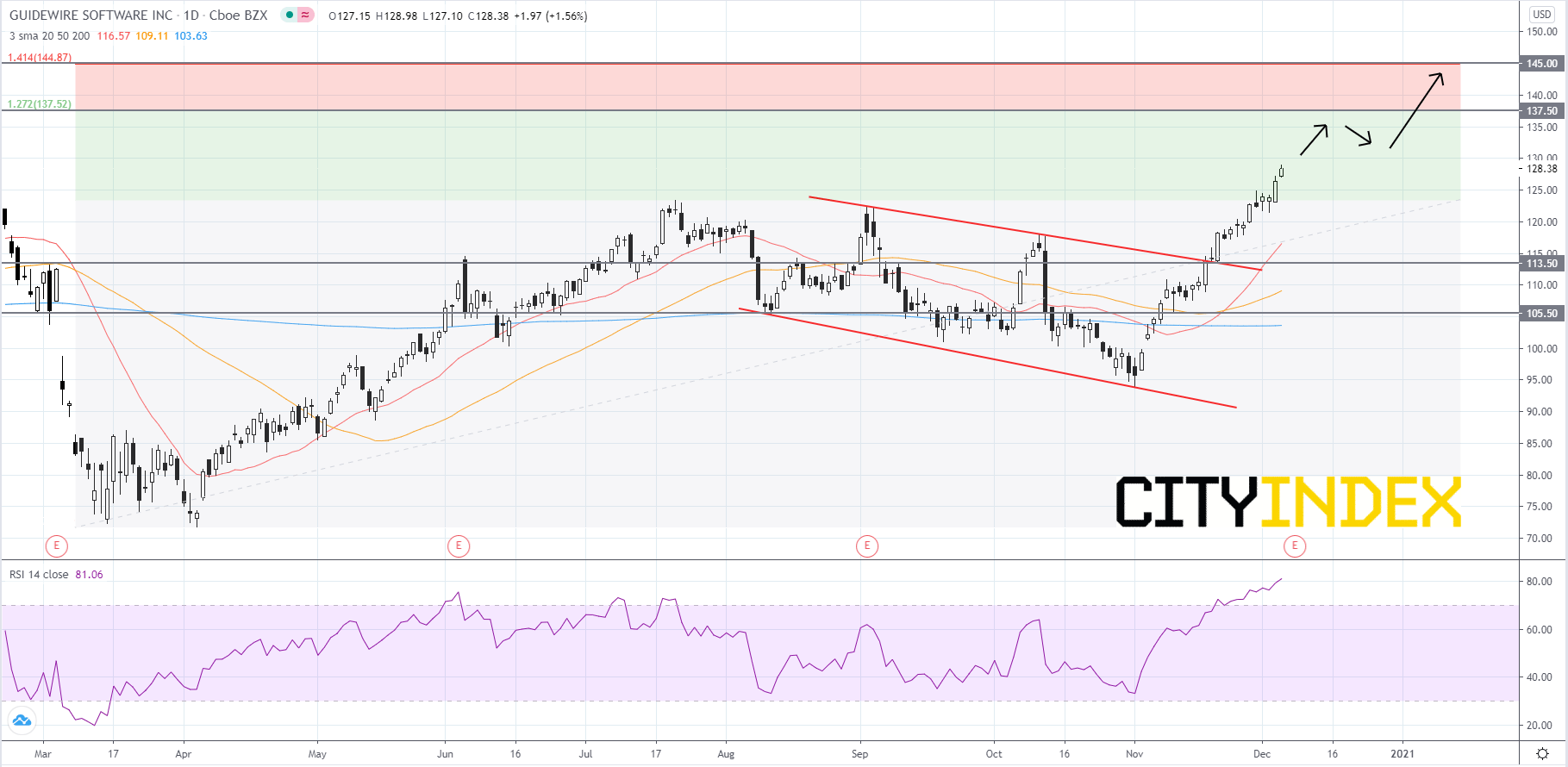

Looking at a daily chart, Guidewire's stock price has just made a new intraday record high after breaking out to the upside of an intermediate-term bull flag pattern in mid to late-November. The RSI is in a strong uptrend and currently in overbought territory over 80. The simple moving averages are setup in a bullish manner, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. Price will likely continue to advance towards the first Fibonacci target of 137.50. Price may find resistance at 137.50, so traders should expect a pull back before a breakout occurs. If price can get over 137.50 then the next Fibonacci target is 145.00. If price get over 145.00 it could potentially keep running higher. If price pulls back then traders should use the 20-day SMA as rough support, because price used the 20-day SMA as rough support in the uptrend preceding the flag. If price breaks away from the 20-day SMA on the downside, then traders should look to 113.50 for a possible bounce off of the breakout level. If price falls below 113.50 it would be a bearish signal that could send price back to 105.50.

Source: GAIN Capital, TradingView

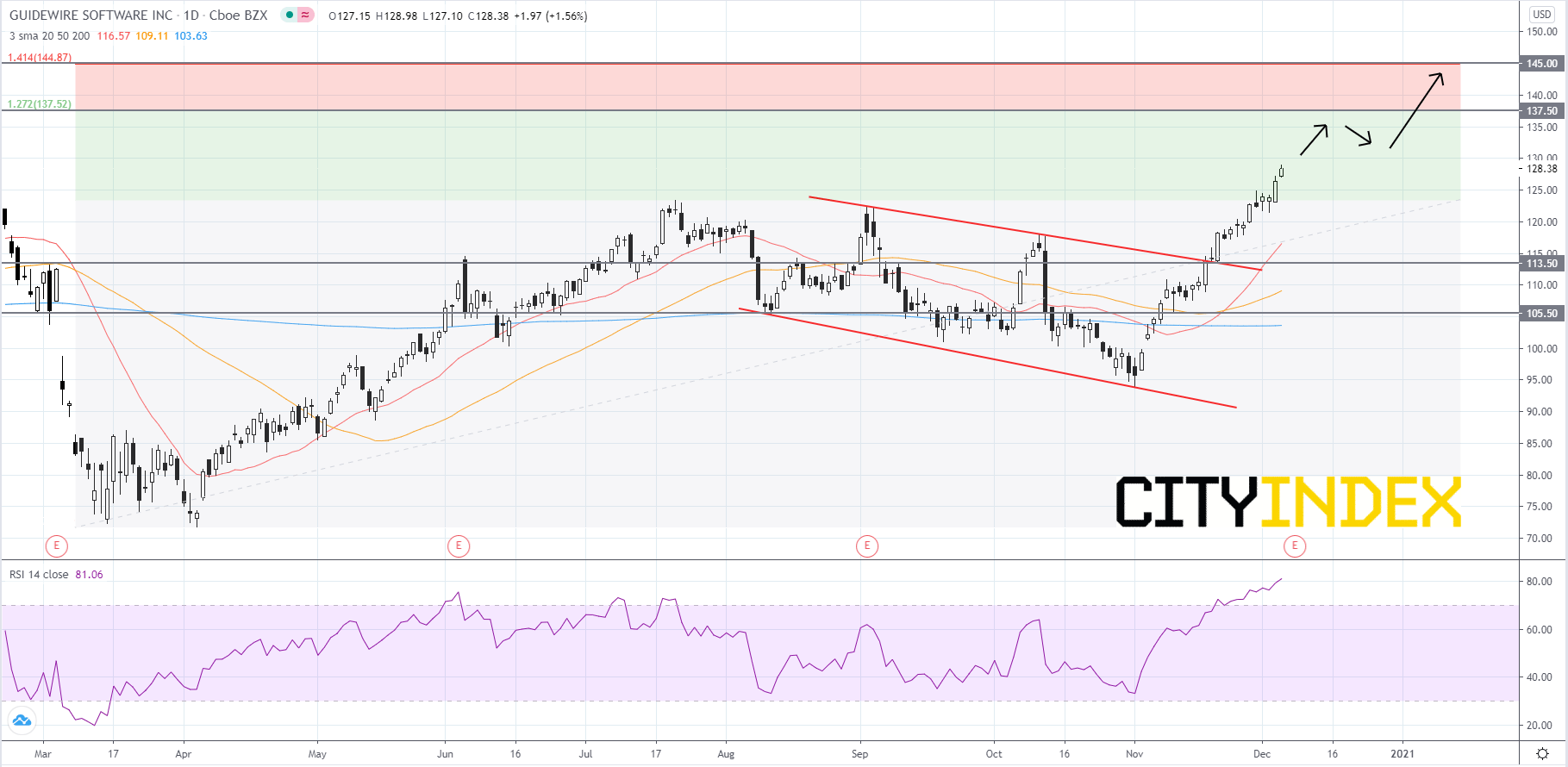

Looking at a daily chart, Guidewire's stock price has just made a new intraday record high after breaking out to the upside of an intermediate-term bull flag pattern in mid to late-November. The RSI is in a strong uptrend and currently in overbought territory over 80. The simple moving averages are setup in a bullish manner, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. Price will likely continue to advance towards the first Fibonacci target of 137.50. Price may find resistance at 137.50, so traders should expect a pull back before a breakout occurs. If price can get over 137.50 then the next Fibonacci target is 145.00. If price get over 145.00 it could potentially keep running higher. If price pulls back then traders should use the 20-day SMA as rough support, because price used the 20-day SMA as rough support in the uptrend preceding the flag. If price breaks away from the 20-day SMA on the downside, then traders should look to 113.50 for a possible bounce off of the breakout level. If price falls below 113.50 it would be a bearish signal that could send price back to 105.50.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM