Earnings Play: General Mills

On Wednesday, before market, General Mills (GIS) is expected to report fourth quarter EPS of $1.06 compared to $0.83 a year ago on revenue of approximately $5.0B vs. $4.2B last year. The company operates a global packaged food business and its current analyst consensus rating is 6 buys, 11 holds and 3 sells, according to Bloomberg.

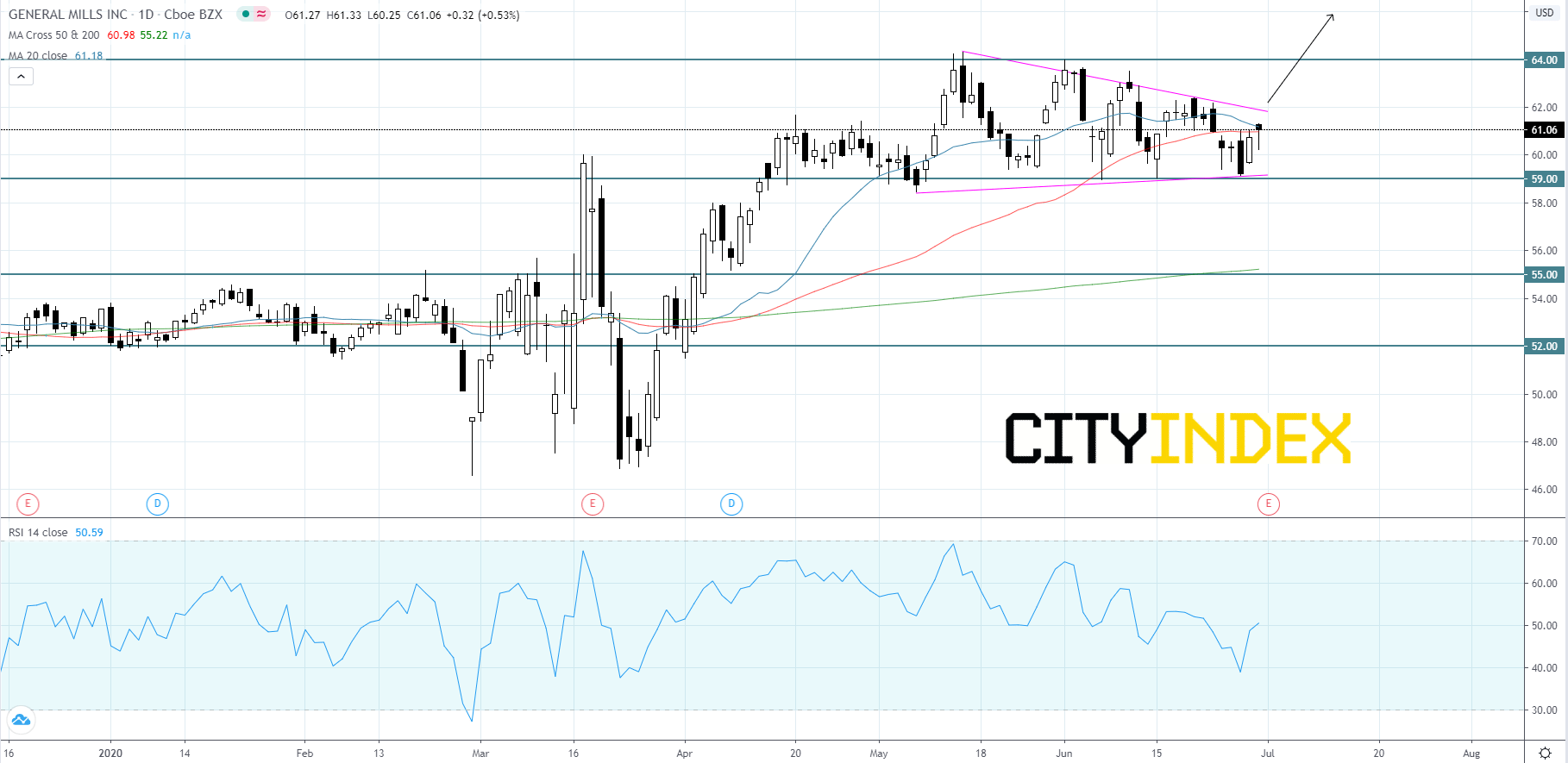

Looking at a daily chart, General Mills stock price has been declining inside of a symmetrical triangle pattern that began to form in early to mid-May. The RSI has been falling since late-April and is currently sitting on the 50 level. The 20-day moving average appears to be on a path to cross below the 50-day moving average in the near future. Even though the chart looks like it is setting up for a downward move, the symmetrical triangle is actually a bullish pattern. Price is expected to hold above the lower trend line before rising to break above the upper trend line. Price will likely rally towards the 2020 high of $64.00. If price reaches the $64.00 level we could see a push onward to make new yearly highs given the volatility in the market. If price cannot hold above the lower trend line around the $59.00 support level then price will likely continue to fall to the $55.00 level.

Source: GAIN Capital, TradingView

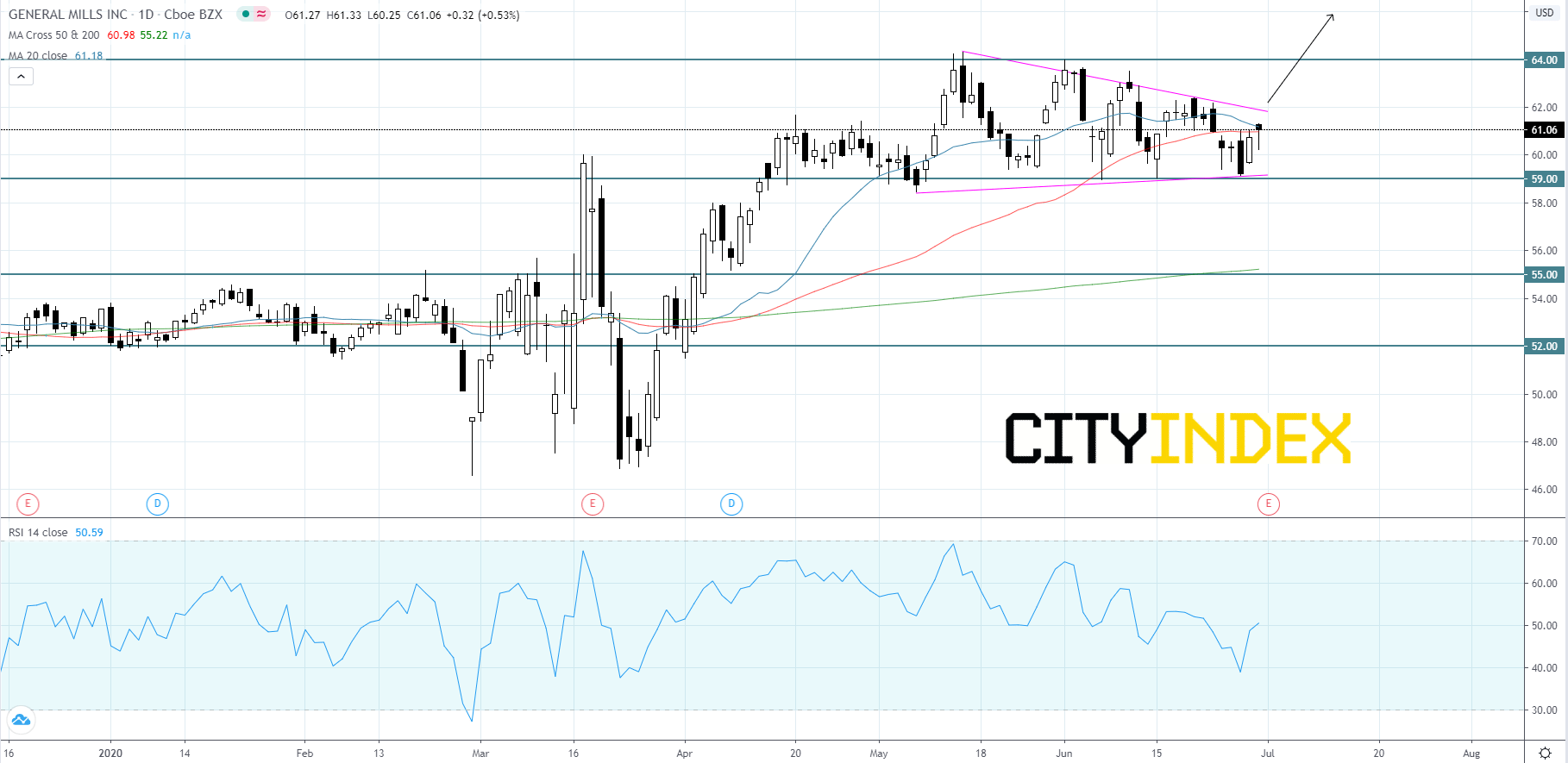

Looking at a daily chart, General Mills stock price has been declining inside of a symmetrical triangle pattern that began to form in early to mid-May. The RSI has been falling since late-April and is currently sitting on the 50 level. The 20-day moving average appears to be on a path to cross below the 50-day moving average in the near future. Even though the chart looks like it is setting up for a downward move, the symmetrical triangle is actually a bullish pattern. Price is expected to hold above the lower trend line before rising to break above the upper trend line. Price will likely rally towards the 2020 high of $64.00. If price reaches the $64.00 level we could see a push onward to make new yearly highs given the volatility in the market. If price cannot hold above the lower trend line around the $59.00 support level then price will likely continue to fall to the $55.00 level.

Source: GAIN Capital, TradingView

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM