Earnings Play: Facebook

Today, after market, Facebook (FB) is expected to post third quarter EPS of $1.91 compared to $2.12 last year on revenue of approximately $19.8 billion vs. $17.7 billion a year earlier. The company operates the largest online social network platform in the world and its expected move based on front-month options is 6.3%. The last time the company reported earnings the stock spiked 8.2%.

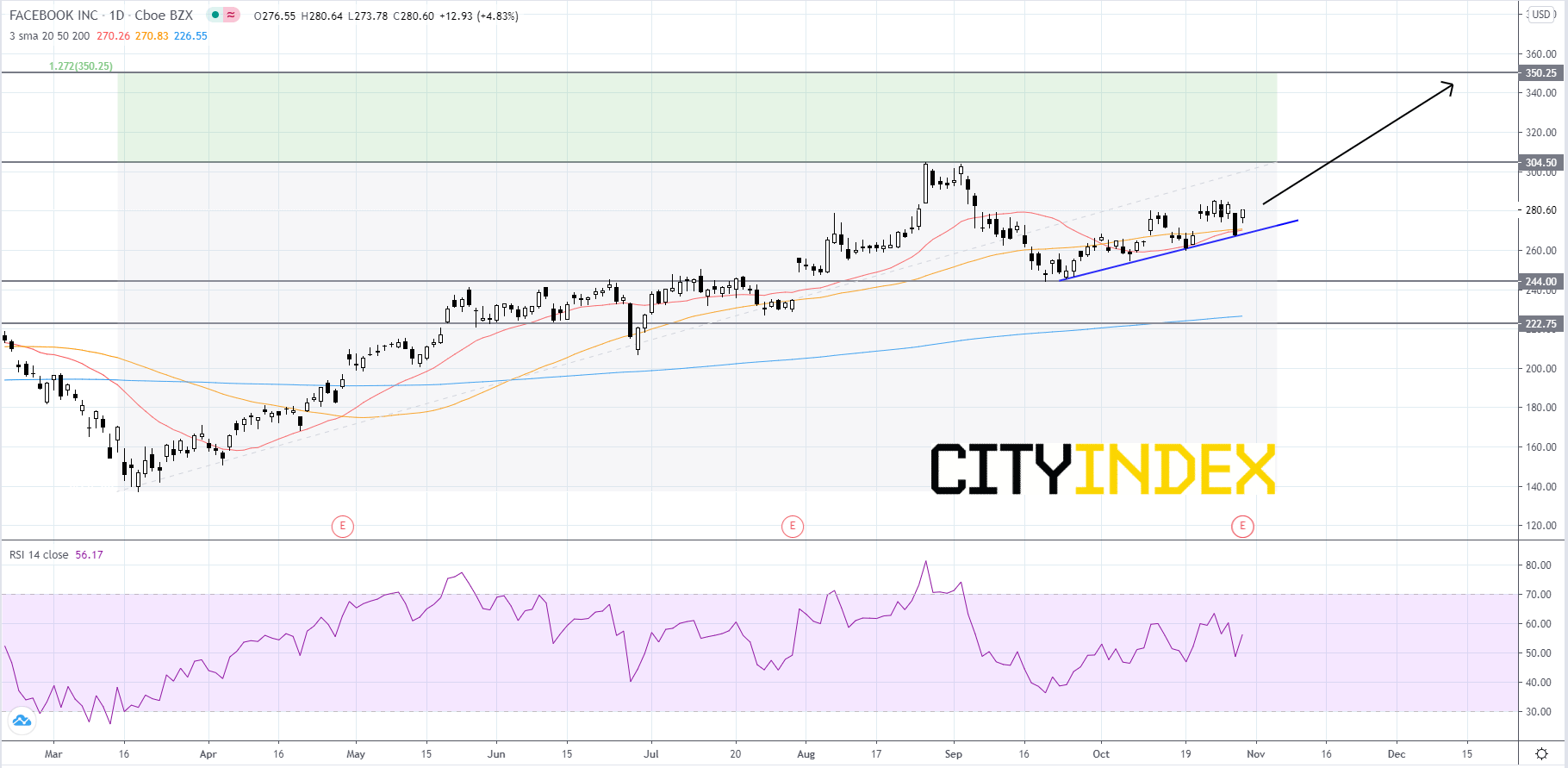

Technically speaking, on a daily chart, Facebook's stock price is currently holding above a short-term bullish trendline that began to form in mid to late-September. The RSI is over 50 and has been rising with price since it found support at 244.00. Facebook is currently holding above both its 20-day simple moving average (SMA) and 50-day SMA, a positive signal. Price will likely continue to use the rising trendline as support and advance to retest its record high around 304.50. If price can breakout and close above the 304.50 resistance level, then price will probably head towards the first Fibonacci target of 350.25. On the flip side, if price breaks below the rising trendline it would be a negative signal that could send price back to the 244.00 support level. If price fails to rebound off of the 244.00 support level it would be a bearish signal that could potentially send prices back to 222.75.

Source: GAIN Capital, TradingView

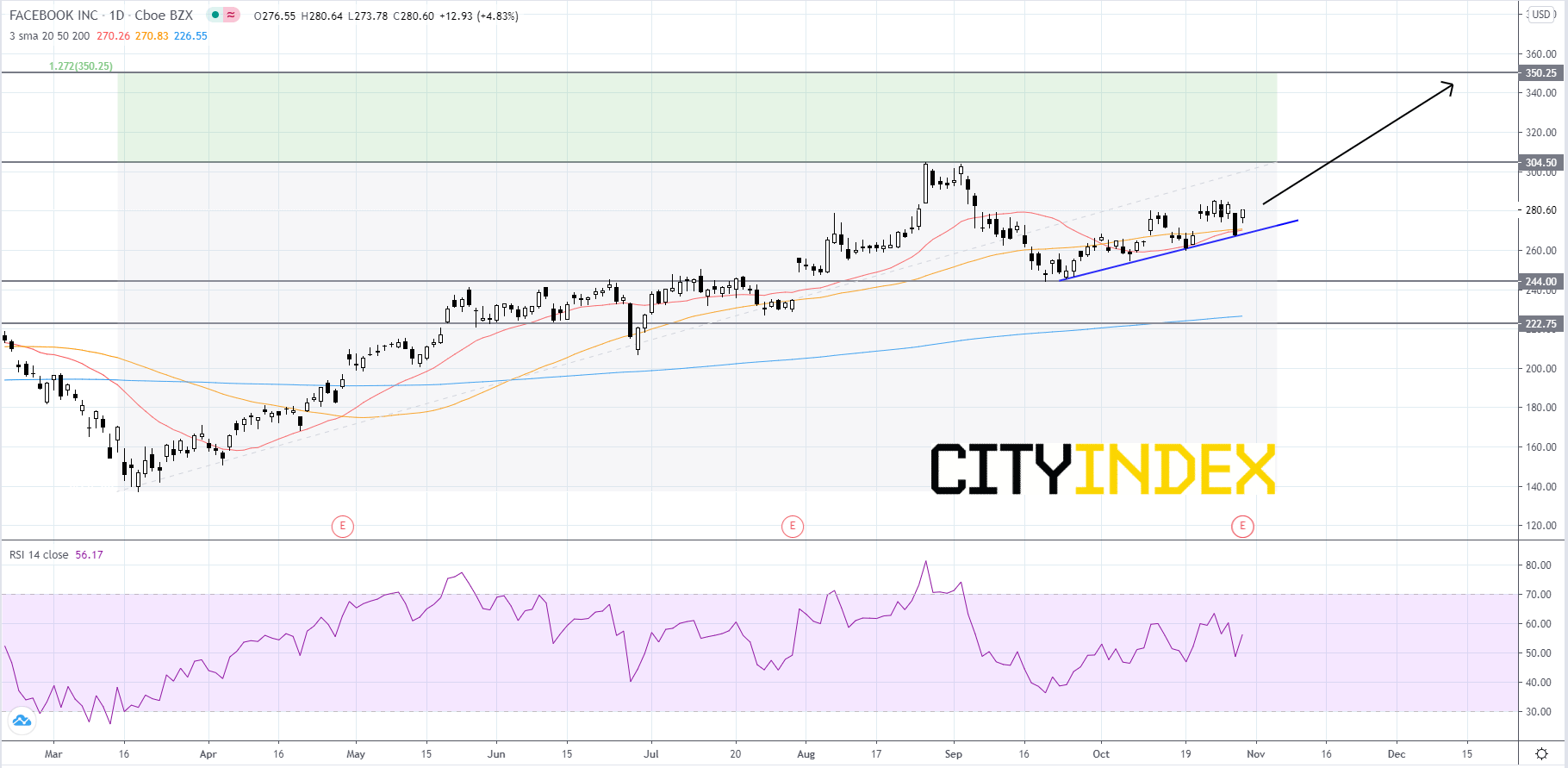

Technically speaking, on a daily chart, Facebook's stock price is currently holding above a short-term bullish trendline that began to form in mid to late-September. The RSI is over 50 and has been rising with price since it found support at 244.00. Facebook is currently holding above both its 20-day simple moving average (SMA) and 50-day SMA, a positive signal. Price will likely continue to use the rising trendline as support and advance to retest its record high around 304.50. If price can breakout and close above the 304.50 resistance level, then price will probably head towards the first Fibonacci target of 350.25. On the flip side, if price breaks below the rising trendline it would be a negative signal that could send price back to the 244.00 support level. If price fails to rebound off of the 244.00 support level it would be a bearish signal that could potentially send prices back to 222.75.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM