Earnings Play: Estee Lauder

On Thursday, before market, Estee Lauder (EL) is expected to release fourth quarter LPS of $0.20 compared to an EPS of $0.64 the prior year on sales of approximately $2.4 billion vs. $3.6 billion last year. Estee Lauder is the world leader in the global prestige beauty market and on August 13th the Co announced a joint development agreement with Atropos Therapeutics, a developer of senescence modulating chemicals, in an effort for the company to enter the botanical skin care space.

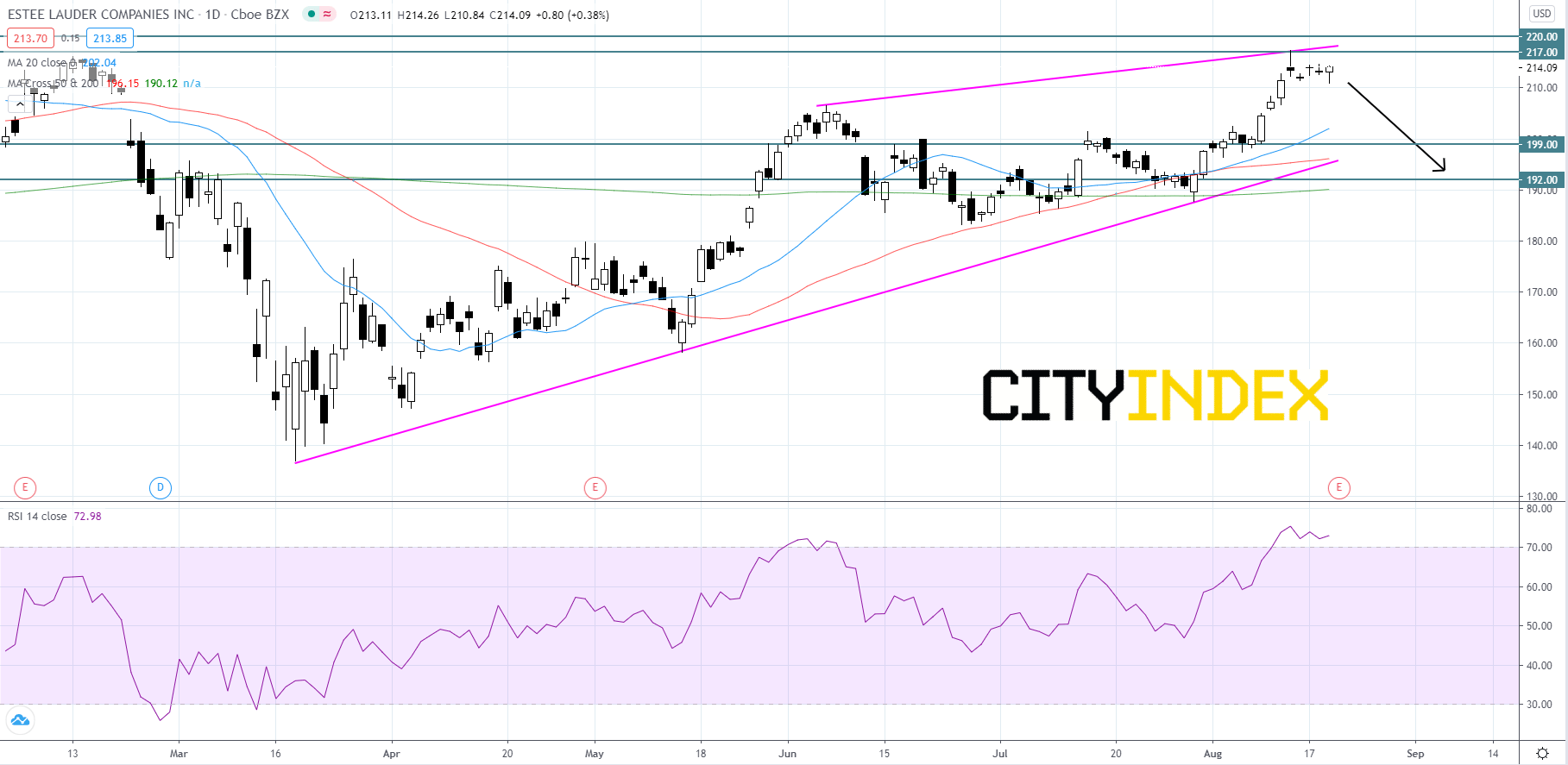

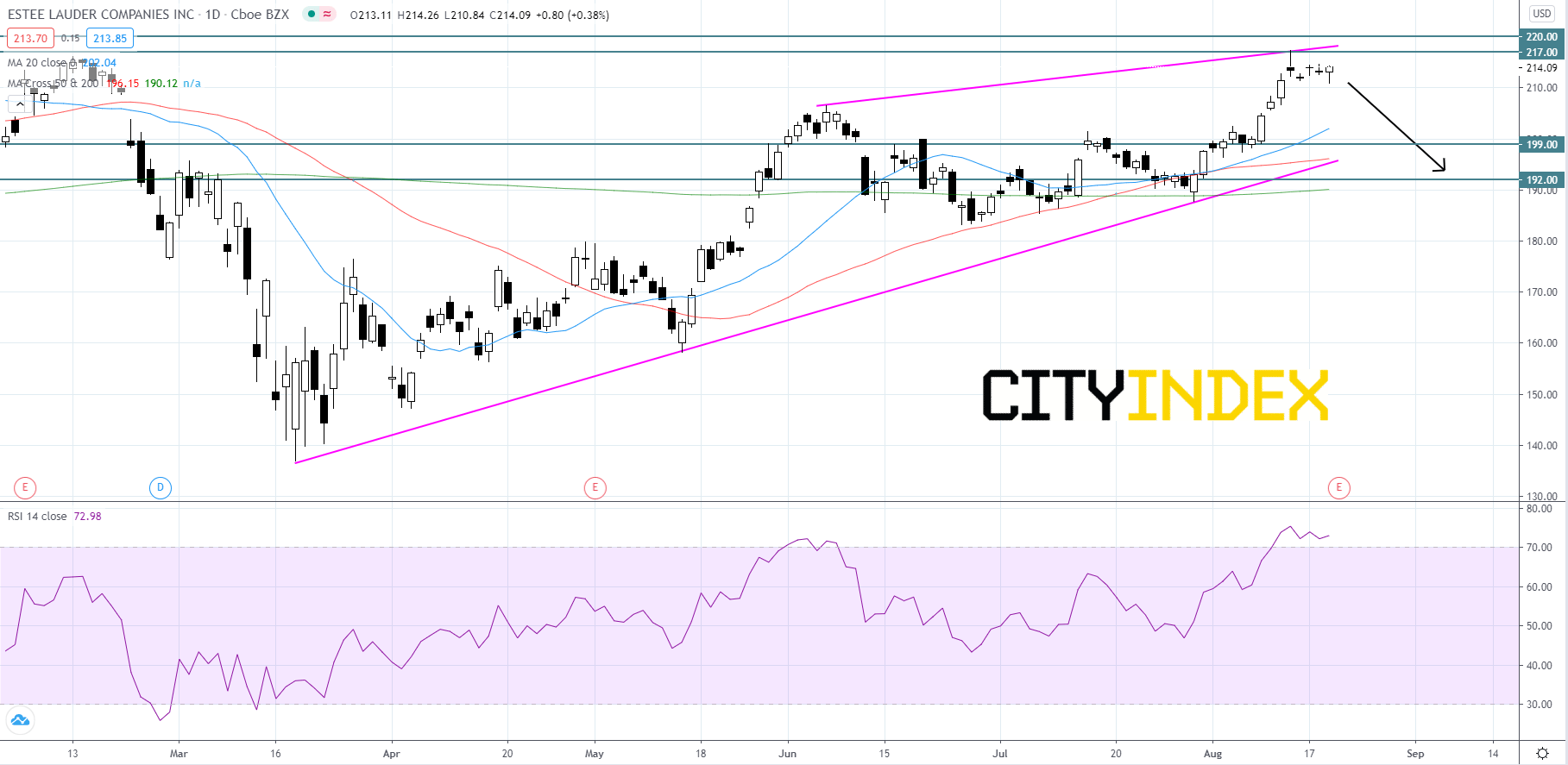

Looking at a daily chart, Estee Lauder's stock price is advancing within an ascending wedge pattern that began as an uptrend in mid-March. The RSI is in overbought territory sitting at 73. Since August 13th, after price reached the top trendline the candle sticks have been forming spinning tops with short tails. These candle sticks represent very low price fluctuations in the daily movement which could mean that the buyers have dried up. Given that price has reached the top trendline of the ascending wedge pattern, along with the overbought RSI reading and spinning top candle sticks, the set-up is bearish. Price will likely pull back to the 199.00 support level. If price breaks below 199.00, it could see further decline to 192.00. However, if price breaks above resistance at 217.00, it could be looking to retest the all time high at 220.00.

Source: GAIN Capital, TradingView

Looking at a daily chart, Estee Lauder's stock price is advancing within an ascending wedge pattern that began as an uptrend in mid-March. The RSI is in overbought territory sitting at 73. Since August 13th, after price reached the top trendline the candle sticks have been forming spinning tops with short tails. These candle sticks represent very low price fluctuations in the daily movement which could mean that the buyers have dried up. Given that price has reached the top trendline of the ascending wedge pattern, along with the overbought RSI reading and spinning top candle sticks, the set-up is bearish. Price will likely pull back to the 199.00 support level. If price breaks below 199.00, it could see further decline to 192.00. However, if price breaks above resistance at 217.00, it could be looking to retest the all time high at 220.00.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM