Earnings Play: Domino's Pizza

On Thursday, before market, Domino's Pizza (DPZ) is expected to release third quarter EPS of $2.78 compared to $2.05 last year on revenue of approximately $953.0 million vs. $820.8 million a year ago. The company is the world leader in pizza delivery and on October 7th, Domino's announced that it will hire 2,000 new employees across Canada.

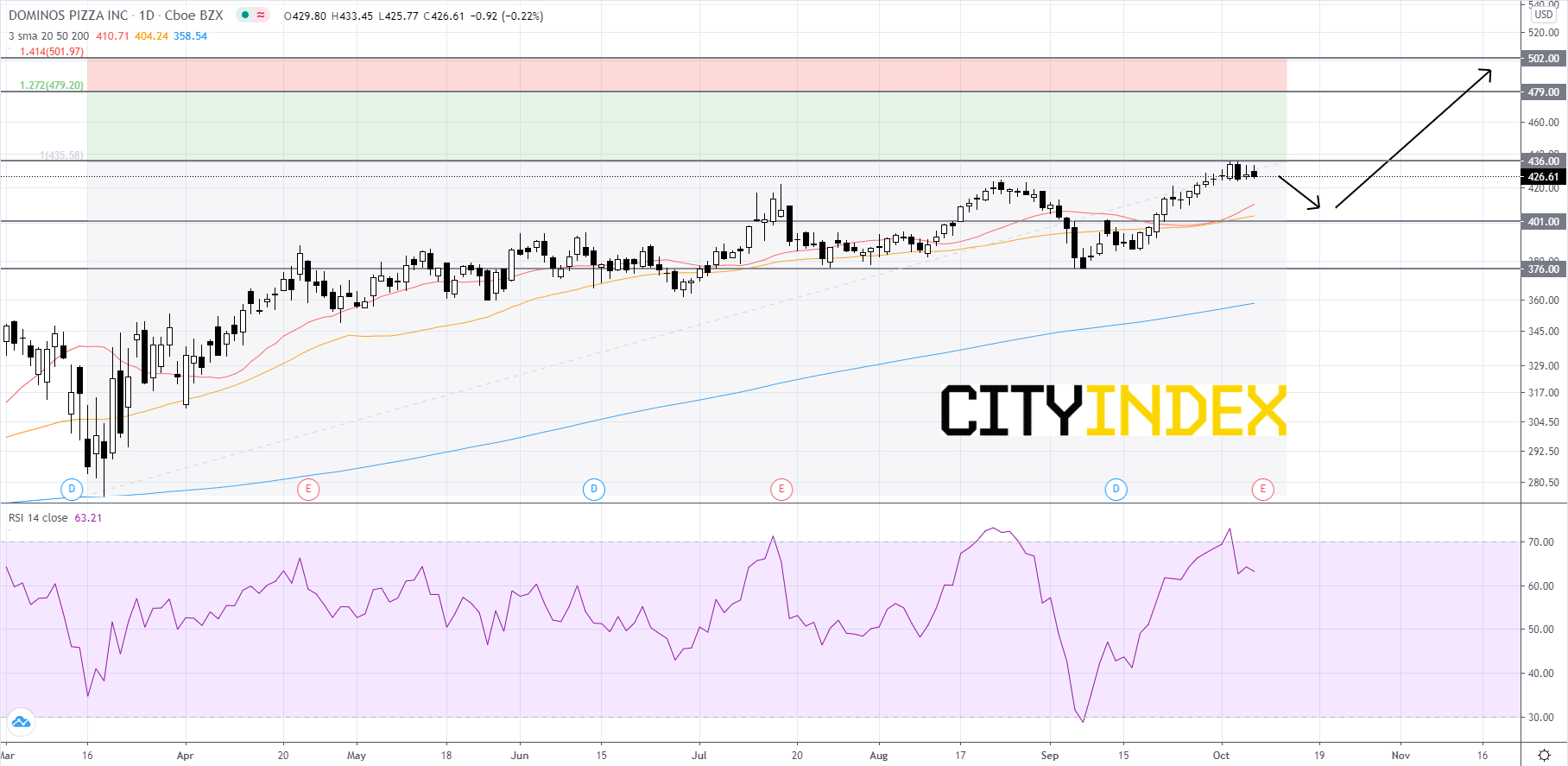

Technically speaking, on a daily chart, Domino's stock price is currently sitting just below the all-time high of roughly 436.00 and has been in a strong long-term uptrend since 2009. The RSI is holding around 64 after pulling back from overbought territory. Given the short-term uptrend that price has been in since September 8th and the falling RSI, price will likely lose some momentum and fall back to its 401.00 support level. At 401.00 traders should look for a bounce to retest the record high of about 436.00. If price can breakout above the 436.00 high, then it would clear a path for price to reach for its first Fibonacci target at 479.00. If price can get above 479.00, it could then reach for the large round number of approximately 500.00 near the second Fibonacci target. On the other hand, if price does not hold above 401.00, then speculators should look to 376.00 for a rebound. If price cannot hold above 376.00, then Domino's could fall a bit further before finding support.

Source: GAIN Capital, TradingView

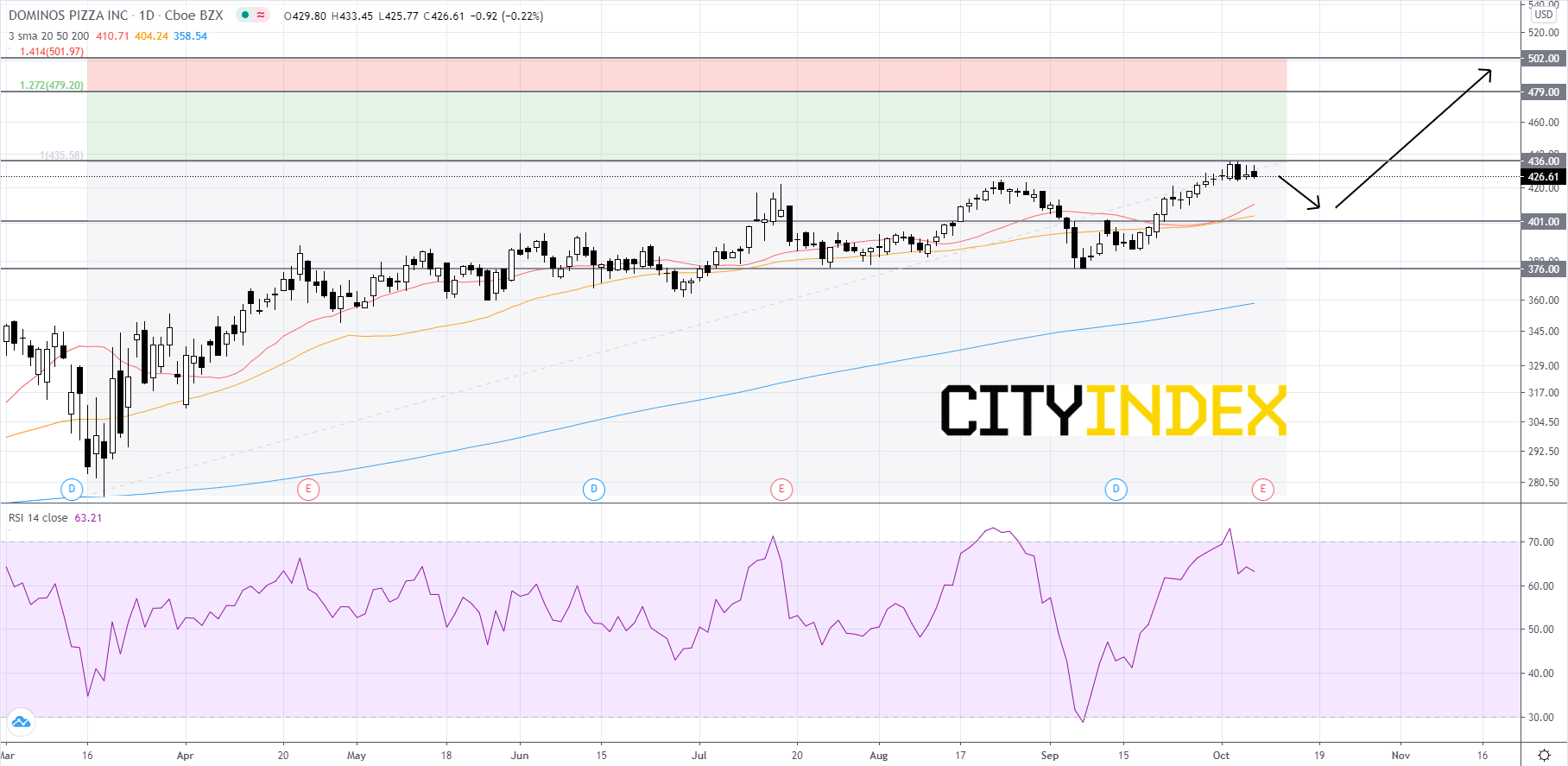

Technically speaking, on a daily chart, Domino's stock price is currently sitting just below the all-time high of roughly 436.00 and has been in a strong long-term uptrend since 2009. The RSI is holding around 64 after pulling back from overbought territory. Given the short-term uptrend that price has been in since September 8th and the falling RSI, price will likely lose some momentum and fall back to its 401.00 support level. At 401.00 traders should look for a bounce to retest the record high of about 436.00. If price can breakout above the 436.00 high, then it would clear a path for price to reach for its first Fibonacci target at 479.00. If price can get above 479.00, it could then reach for the large round number of approximately 500.00 near the second Fibonacci target. On the other hand, if price does not hold above 401.00, then speculators should look to 376.00 for a rebound. If price cannot hold above 376.00, then Domino's could fall a bit further before finding support.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM