Earnings Play: Deere

On Wednesday, before market, Deere (DE) is expected to report fourth quarter EPS of $1.49 compared to $2.14 last year on revenue of approximately $7.6 billion vs. $8.7 billion in the previous year. Deere is the world's leading manufacturer of agricultural equipment and its current analyst consensus rating is 14 buys, 4 holds and 3 sells, according to Bloomberg.

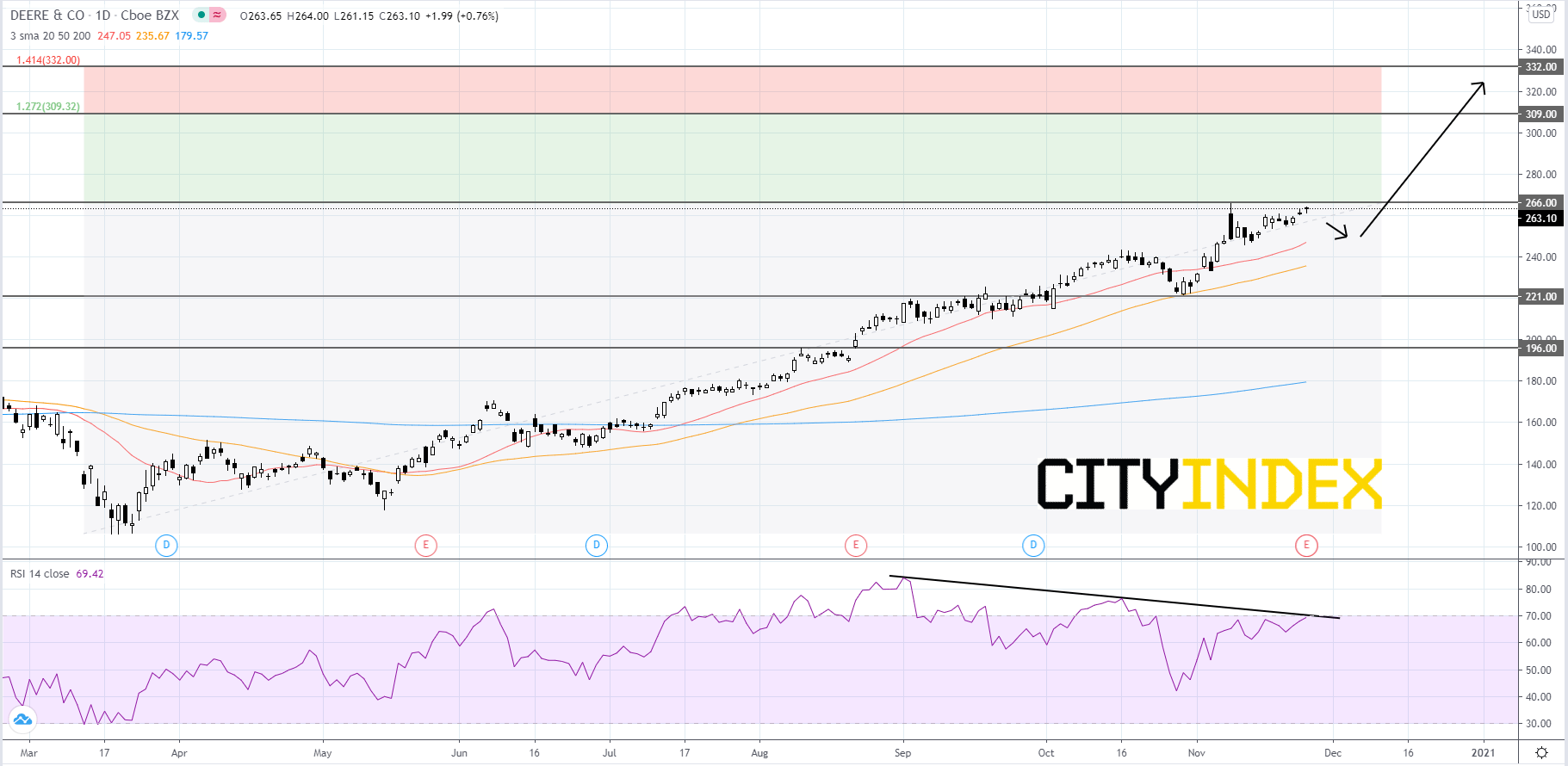

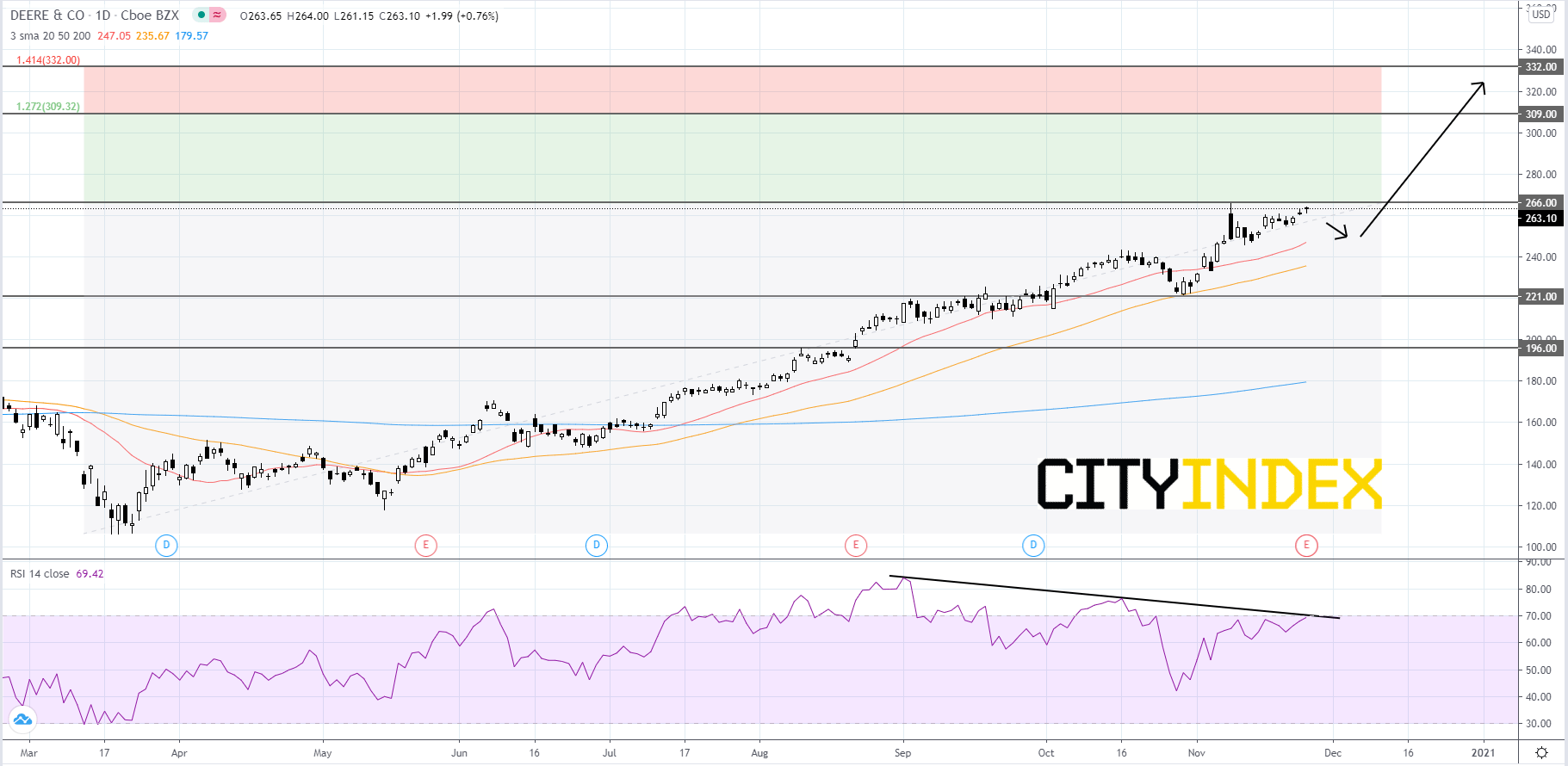

Looking at a daily chart, Deere's stock price has been in a strong uptrend since mid-March. The RSI is just below 70 and showing unconfirmed bearish divergence. The simple moving averages (SMA) are set-up in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Price will likely continue to advance towards the record high of roughly 266.00. If price can breakout to the upside of 266.00, then its first Fibonacci target would be 309.00. If price can get above 309.00, then it could reach for 332.00. Price could experience a slight pull back before advancing and traders should look to the 50-day SMA as support. If price closes below the 50-day SMA, it would be a bearish signal that could send price down to 221.00. If price fails to bounce off of 221.00, then price could fall further to 196.00.

Source: GAIN Capital, TradingView

Looking at a daily chart, Deere's stock price has been in a strong uptrend since mid-March. The RSI is just below 70 and showing unconfirmed bearish divergence. The simple moving averages (SMA) are set-up in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Price will likely continue to advance towards the record high of roughly 266.00. If price can breakout to the upside of 266.00, then its first Fibonacci target would be 309.00. If price can get above 309.00, then it could reach for 332.00. Price could experience a slight pull back before advancing and traders should look to the 50-day SMA as support. If price closes below the 50-day SMA, it would be a bearish signal that could send price down to 221.00. If price fails to bounce off of 221.00, then price could fall further to 196.00.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM