Earnings Play: Costco

Today, after market, Costco Wholesale (COST) is expected to release fourth quarter EPS of $2.85 compared to $2.69 last year on revenue of approximately $52.5 billion vs. $47.5 billion a year earlier. The company operates a chain of warehouse stores and its expected move based on front-month options is 4.0%. The last time the company reported earnings the stock fell 0.4%.

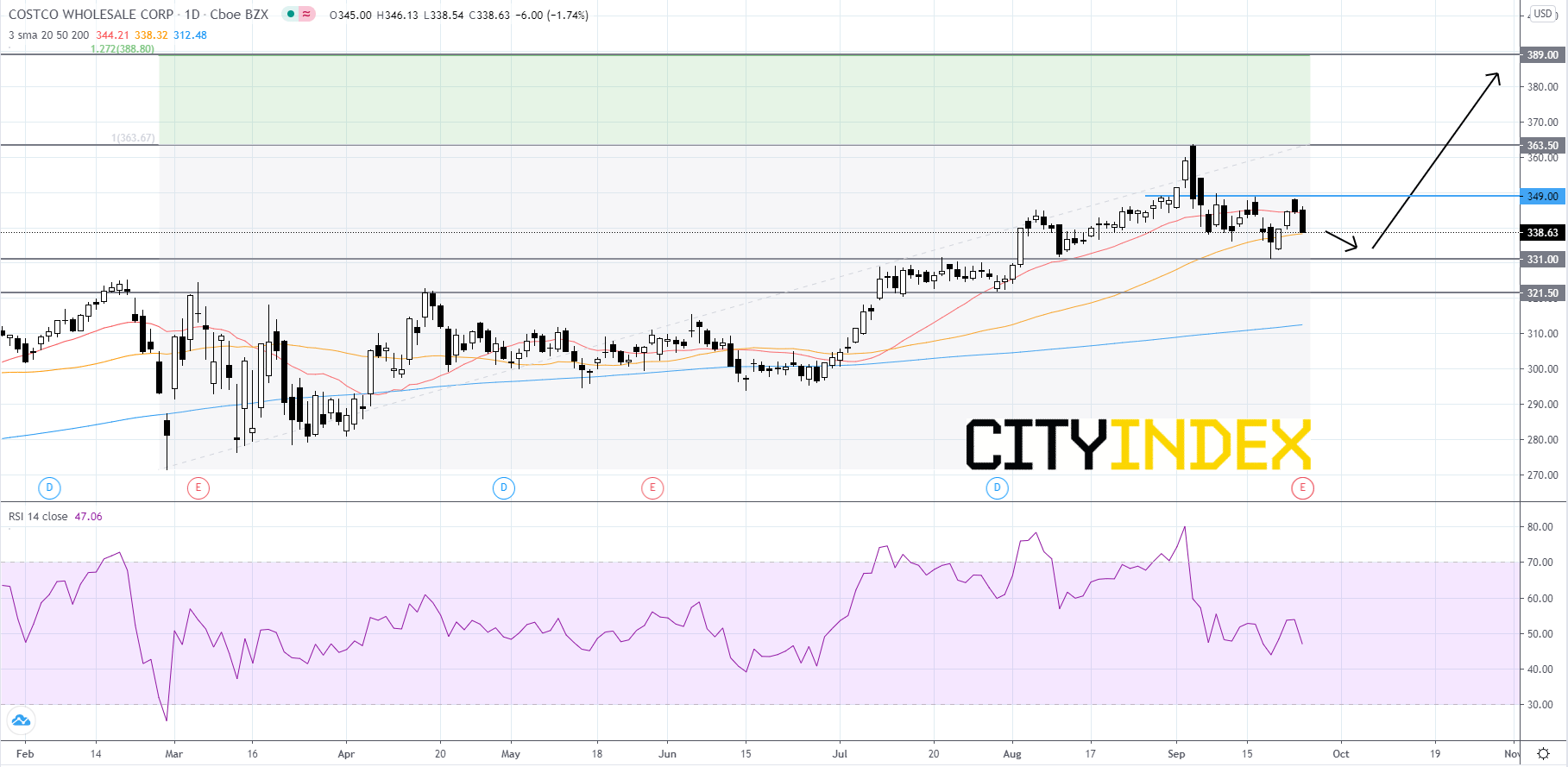

Technically speaking, on a daily chart, Costco's stock price has been in a short-term uptrend since July after a choppy consolidation period. The RSI is currently holding around the 50 level. Price is just barely holding above the 50-day simple moving average (SMA) and range bound in between 331.00 and 349.00. Since price is currently in an uptrend we have a biased for price to advance. Therefore, price will likely breakout to the upside of 349.00 and attempt to retest the all-time high of about 363.50. If price can get above its record high, that would be a very bullish signal that could send price up to its first Fibonacci target at 389.00. However, if price breaks out to the downside of 331.00, then traders should look to 321.50 for a possible bounce. If price breaks below its 321.50 support level it would be a bearish signal, as price could slip further and potentially begin a new short-term downtrend.

Source: GAIN Capital, TradingView

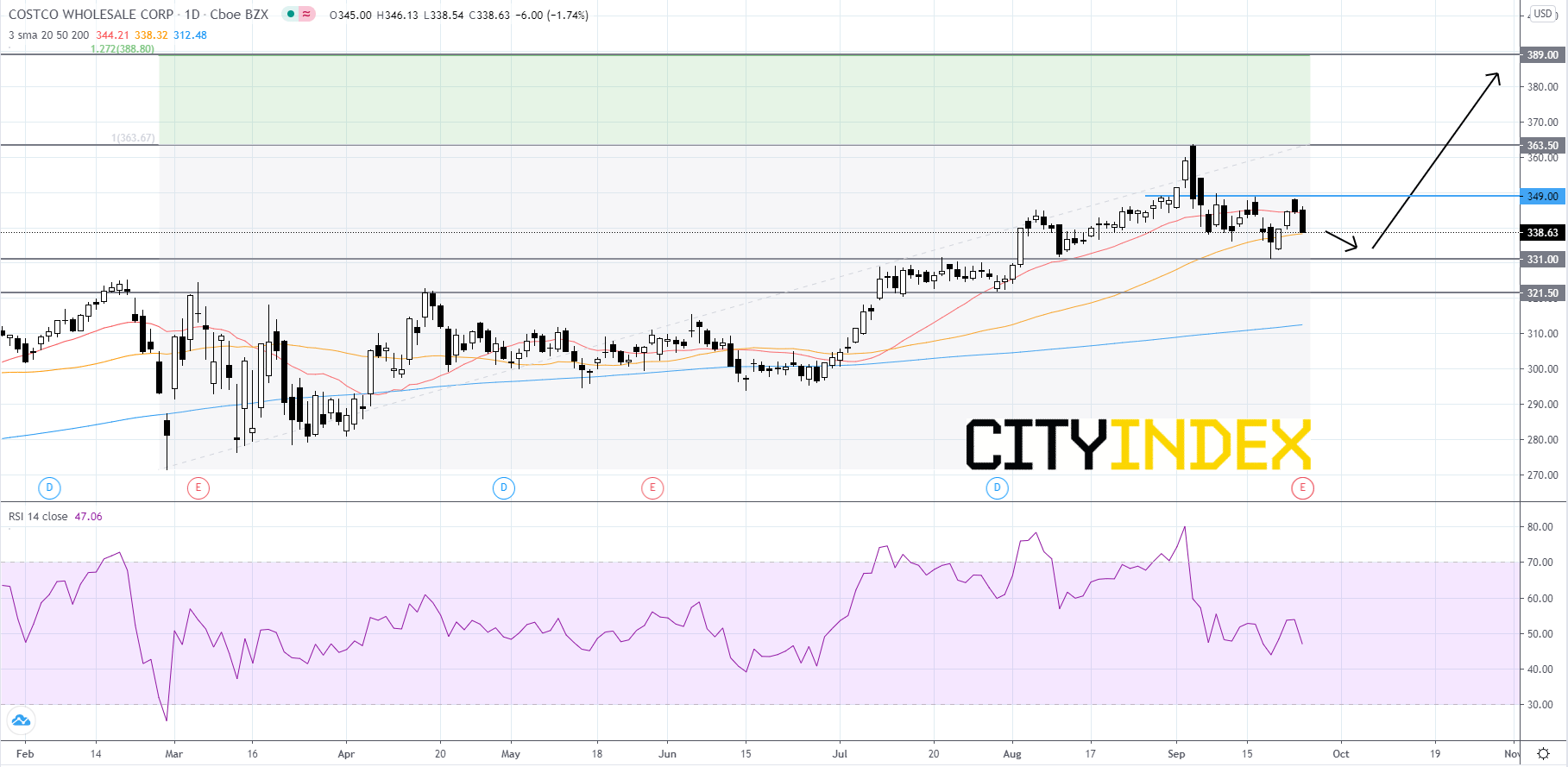

Technically speaking, on a daily chart, Costco's stock price has been in a short-term uptrend since July after a choppy consolidation period. The RSI is currently holding around the 50 level. Price is just barely holding above the 50-day simple moving average (SMA) and range bound in between 331.00 and 349.00. Since price is currently in an uptrend we have a biased for price to advance. Therefore, price will likely breakout to the upside of 349.00 and attempt to retest the all-time high of about 363.50. If price can get above its record high, that would be a very bullish signal that could send price up to its first Fibonacci target at 389.00. However, if price breaks out to the downside of 331.00, then traders should look to 321.50 for a possible bounce. If price breaks below its 321.50 support level it would be a bearish signal, as price could slip further and potentially begin a new short-term downtrend.

Source: GAIN Capital, TradingView

Latest market news

Today 10:37 AM

Today 08:25 AM