Earnings Play: Cooper Companies

Today, after market, Cooper Companies (COO) is expected to report fourth quarter EPS of $3.09 compared to $3.30 last year on revenue of approximately $676.3 million vs. $691.6 million a year earlier. The company manufactures contact lens and medical products, and its stock price is anticipated to move up or down by 6.7% based on options volatility. The stock rose 5.4% after they last reported earnings.

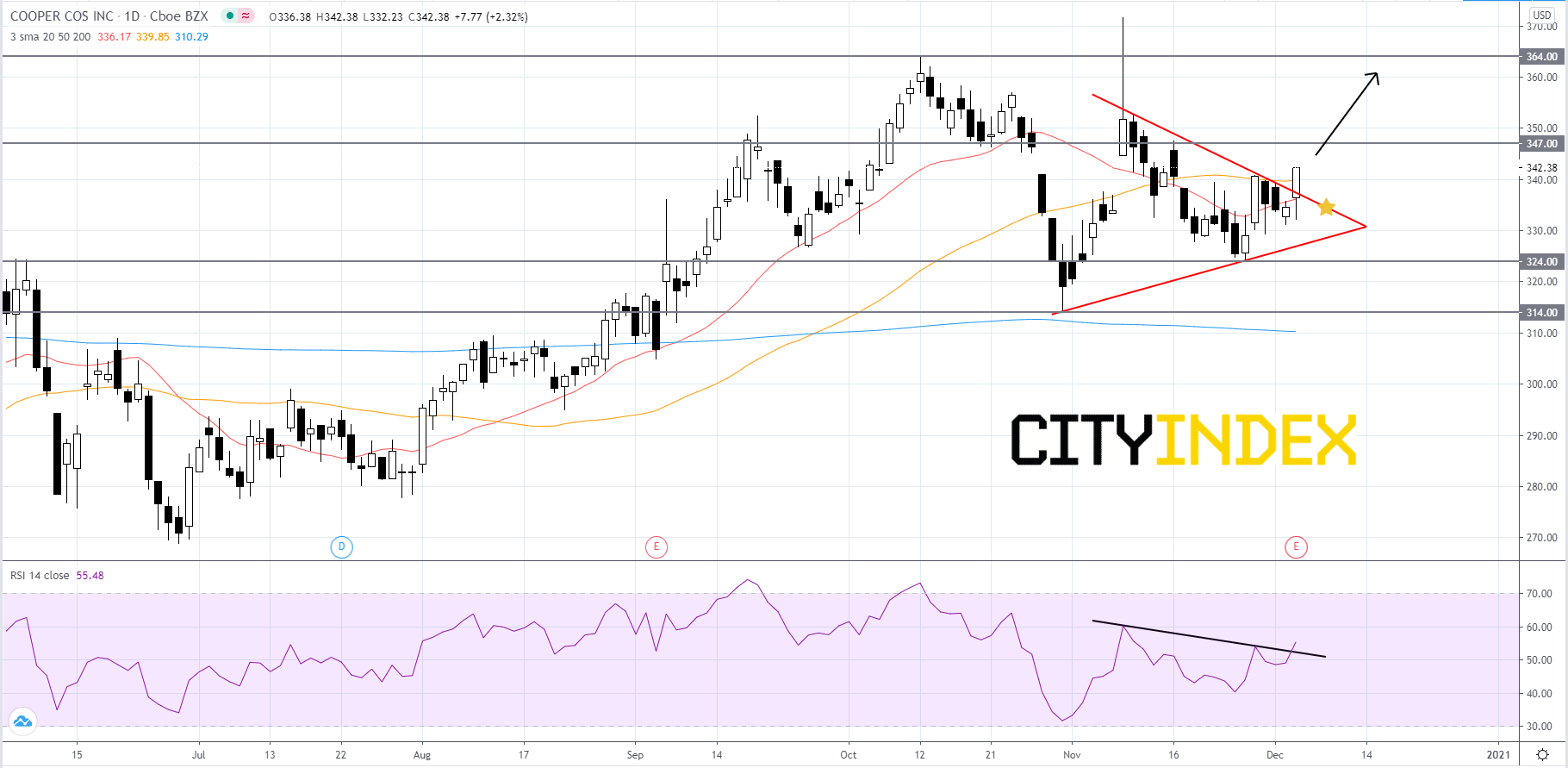

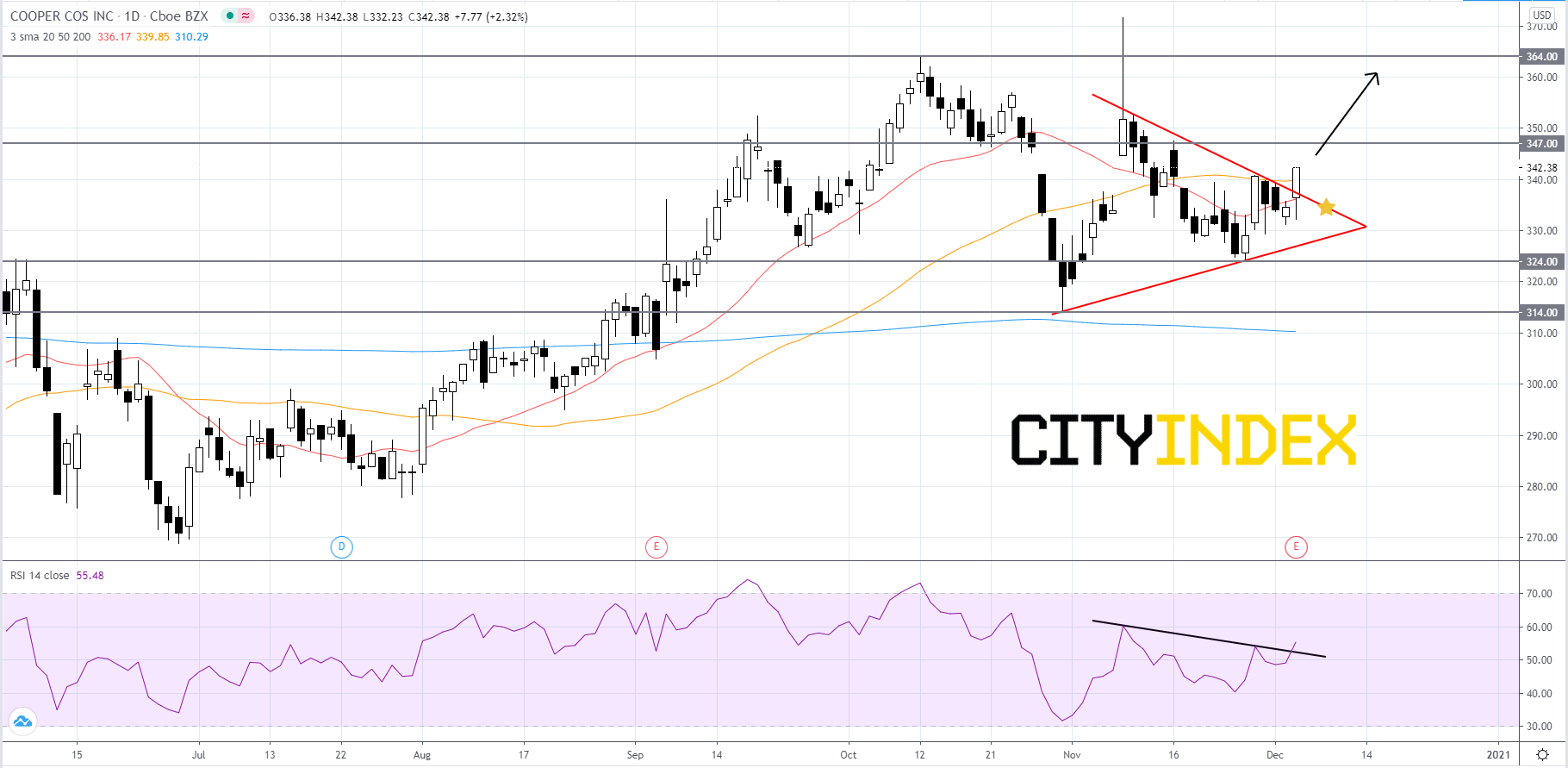

Technically speaking, on a daily chart, Cooper's stock price has just broken out to the upside of a short-term symmetrical triangle pattern that began to form in early-November. The RSI is above 50 and just crossed above a bearish trendline. The simple moving averages (SMA) are arranged in a mixed to bullish manner, as the 50-day SMA is above the 20-day SMA and the 20-day SMA is above the 200-day SMA. If the 20-day SMA crosses to the upside of the 50-day SMA it would be a bullish signal. It should also be noted that the 200-day SMA is currently angled downward, therefore traders on the long side should be cautious. Price is likely to continue to advance towards 347.00. If price can get over 347.00 then its next target would be 364.00. On the over hand, if price closes below the upper trendline of the symmetrical triangle pattern then price could pull back to the 324.00 support level. If price is unable to bounce off of 324.00 it would be a bearish signal that could send price back down to 314.00.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Cooper's stock price has just broken out to the upside of a short-term symmetrical triangle pattern that began to form in early-November. The RSI is above 50 and just crossed above a bearish trendline. The simple moving averages (SMA) are arranged in a mixed to bullish manner, as the 50-day SMA is above the 20-day SMA and the 20-day SMA is above the 200-day SMA. If the 20-day SMA crosses to the upside of the 50-day SMA it would be a bullish signal. It should also be noted that the 200-day SMA is currently angled downward, therefore traders on the long side should be cautious. Price is likely to continue to advance towards 347.00. If price can get over 347.00 then its next target would be 364.00. On the over hand, if price closes below the upper trendline of the symmetrical triangle pattern then price could pull back to the 324.00 support level. If price is unable to bounce off of 324.00 it would be a bearish signal that could send price back down to 314.00.

Source: GAIN Capital, TradingView

Latest market news

Today 04:24 AM

Yesterday 10:48 PM

Yesterday 02:00 PM