Earnings Play: Cisco Systems

On Thursday, after market, Cisco Systems (CSCO) is anticipated to release first quarter EPS of $0.71 compared to $0.84 a year ago on revenue of approximately $11.9 billion vs. $13.2 billion last year. The company is a leading global supplier of network hardware and software, and its expected move based on front-month options is 5.6%. The last time the company reported earnings the stock dropped 11.2%.

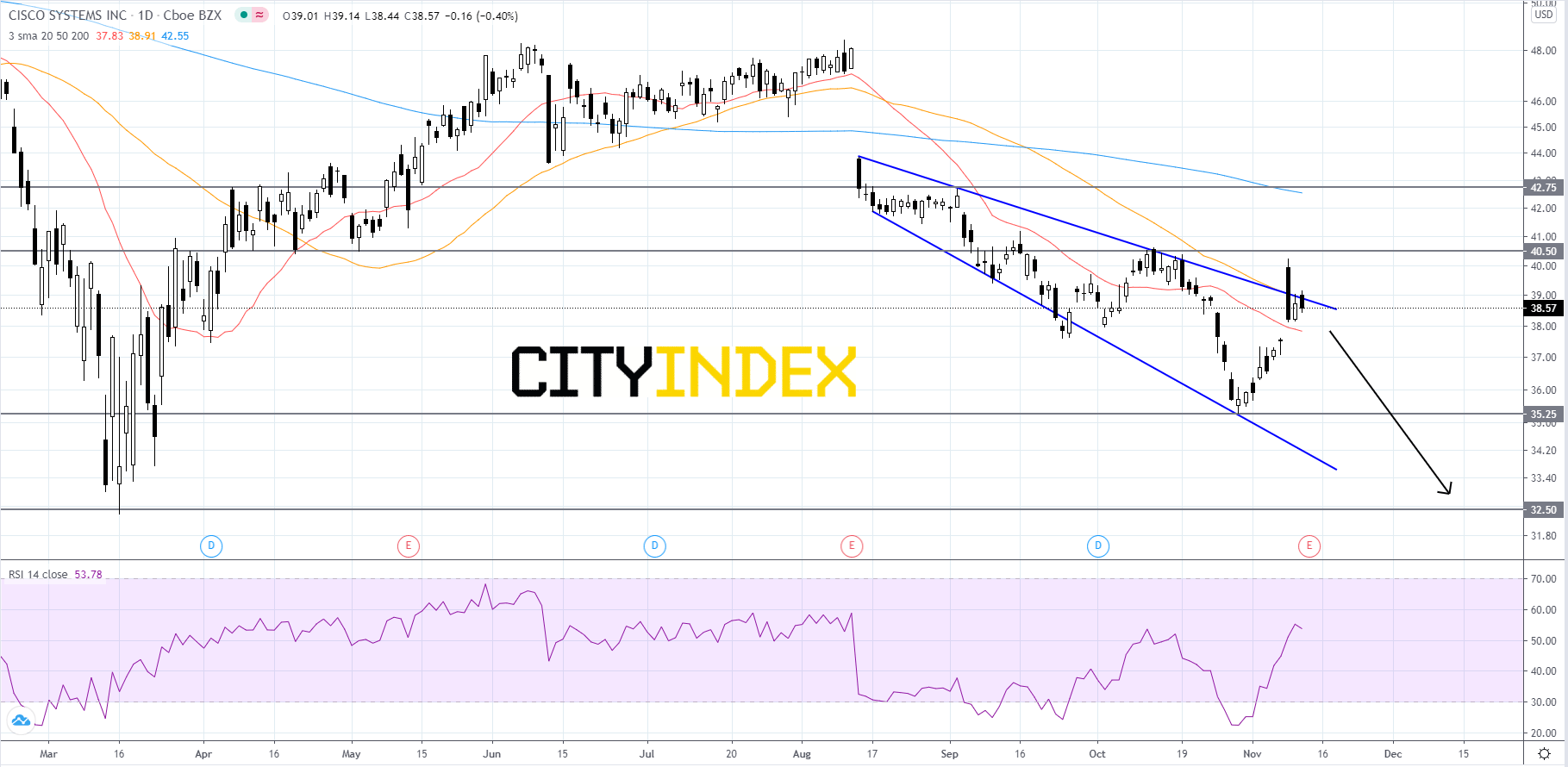

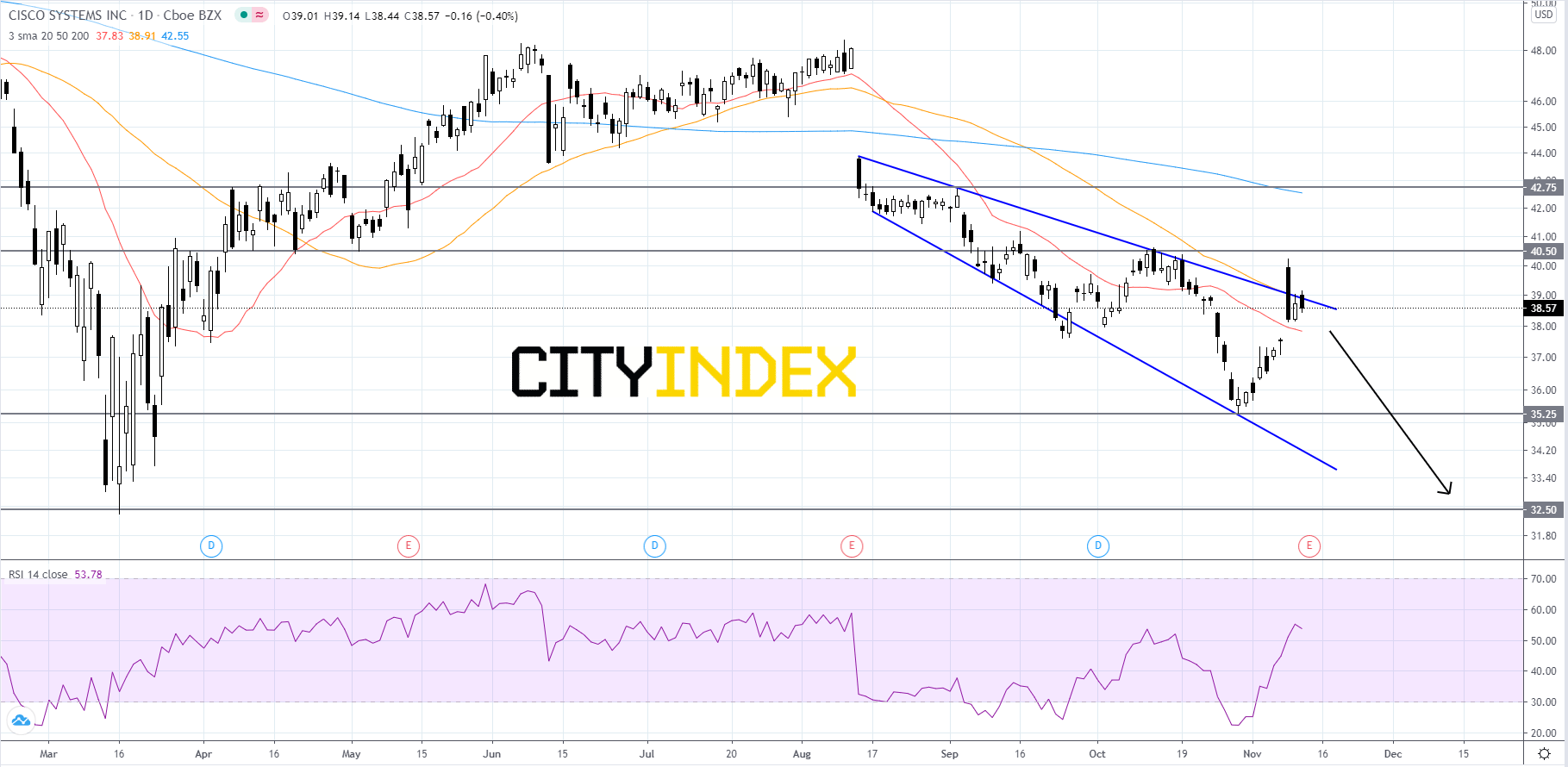

Looking at a daily chart, in logarithmic scale, Cisco's stock price has been falling inside of a descending broadening wedge pattern that began to form in mid-August after the company last reported earnings. The RSI is currently sitting at roughly 54 and appears to be pointing down. The simple moving averages (SMA) are set-up in a bearish manner, with the 200-day SMA above the 50-SMA and the 50-day SMA above the 20-day SMA. Price will likely hold below the upper trendline of the pattern and sell off towards the 35.25 support level. If price reaches 35.25 it will probably find brief support. If price falls below 35.25, then it will likely decline further to 32.50. On the other hand, if price can breakout and close above the upper trendline it would be a bullish signal that could send price up to the first resistance level of 40.50. If price can breakout to the upside of 40.50. then it could reach for 42.75.

Source: GAIN Capital, TradingView

Looking at a daily chart, in logarithmic scale, Cisco's stock price has been falling inside of a descending broadening wedge pattern that began to form in mid-August after the company last reported earnings. The RSI is currently sitting at roughly 54 and appears to be pointing down. The simple moving averages (SMA) are set-up in a bearish manner, with the 200-day SMA above the 50-SMA and the 50-day SMA above the 20-day SMA. Price will likely hold below the upper trendline of the pattern and sell off towards the 35.25 support level. If price reaches 35.25 it will probably find brief support. If price falls below 35.25, then it will likely decline further to 32.50. On the other hand, if price can breakout and close above the upper trendline it would be a bullish signal that could send price up to the first resistance level of 40.50. If price can breakout to the upside of 40.50. then it could reach for 42.75.

Source: GAIN Capital, TradingView

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM