Earnings play: Cintas

On Tuesday, before market, Cintas (CTAS), a designer and manufacturer of corporate uniforms, reported second quarter EPS of $2.62, up from $2.27 last year on revenue of $1.8 billion, in line with the year before.

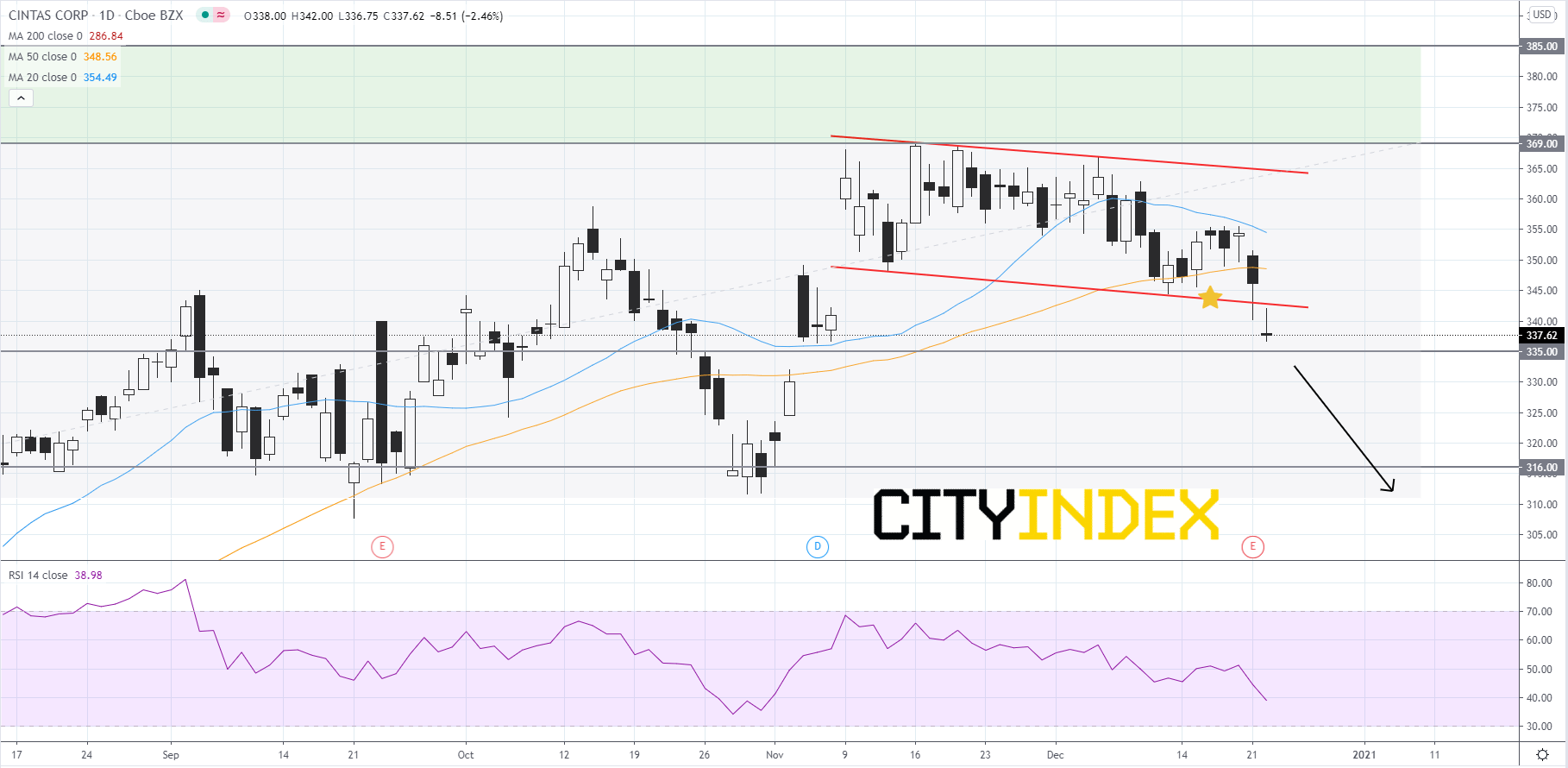

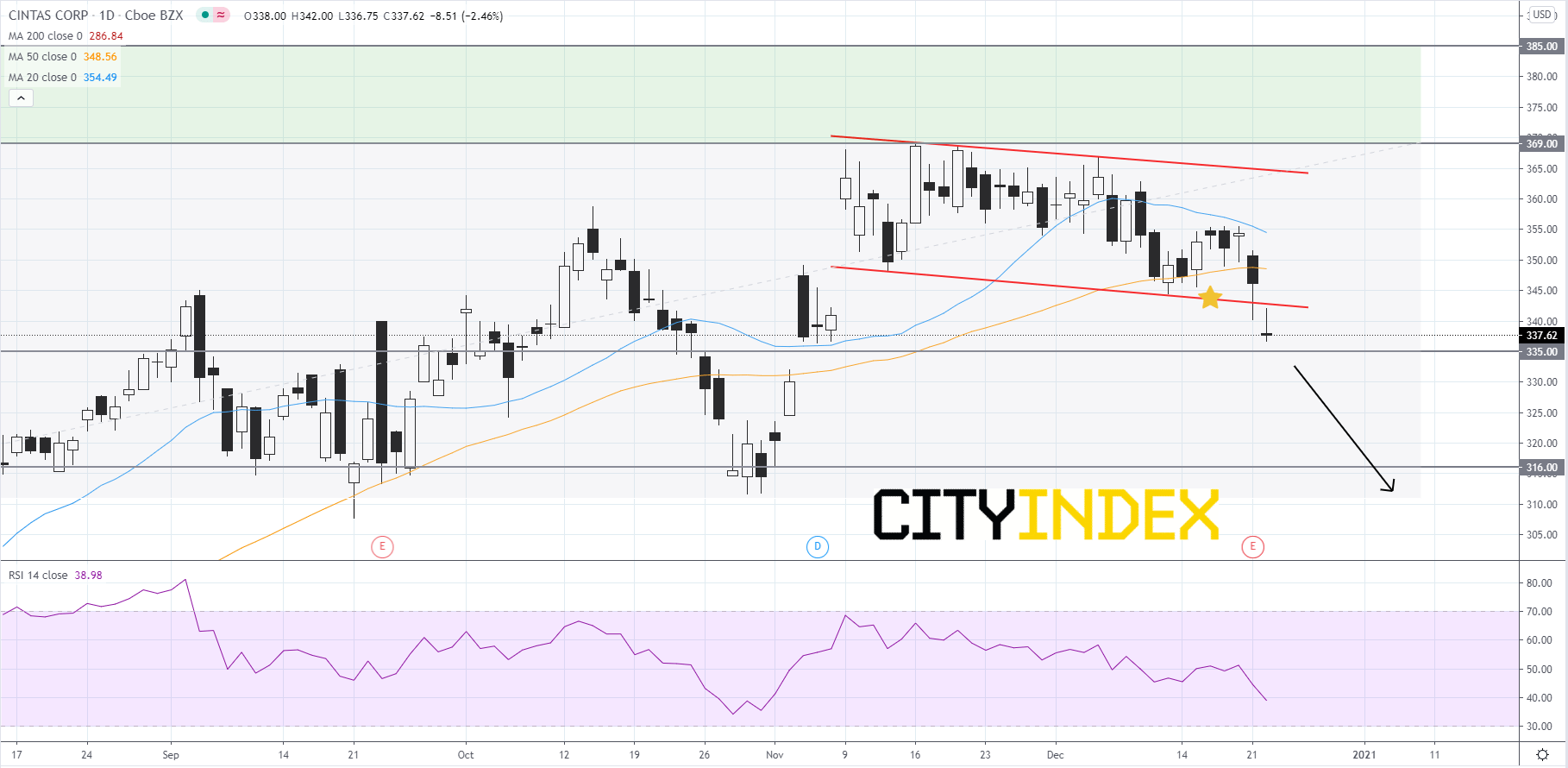

Technically speaking, on a daily chart, Cintas' stock price broke out to the downside of a short-term bearish channel after price gapped down at the open. The RSI is below 40 and pointing downward. The simple moving averages (SMAs) are arranged in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. If the 20-day SMA crosses to the downside of the 50-day SMA, it would be a bearish signal. Price will likely break below 335.00 and continue falling towards 316.00. If price finds support at 316.00, it could consolidate and attempt to bounce. However, if price fails to find support at 316.00, it could slip further. On the other hand, if price gets above the lower trendline of the pattern then it could attempt to reach for the record high of approximately 369.00. If price can manage to get over 369.00, then its first Fibonacci target would be 385.00.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Cintas' stock price broke out to the downside of a short-term bearish channel after price gapped down at the open. The RSI is below 40 and pointing downward. The simple moving averages (SMAs) are arranged in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. If the 20-day SMA crosses to the downside of the 50-day SMA, it would be a bearish signal. Price will likely break below 335.00 and continue falling towards 316.00. If price finds support at 316.00, it could consolidate and attempt to bounce. However, if price fails to find support at 316.00, it could slip further. On the other hand, if price gets above the lower trendline of the pattern then it could attempt to reach for the record high of approximately 369.00. If price can manage to get over 369.00, then its first Fibonacci target would be 385.00.

Source: GAIN Capital, TradingView