Earnings Play: Chevron

On Friday, before market, Chevron (CVX) is anticipated to report second quarter LPS of $0.90 compared to an EPS of $2.27 a year ago on revenue of approximately $20.7B vs. $38.9B last year. Chevron is an energy company with exploration, production, and refining operations worldwide, and on July 30th, the company announced a four-year agreement with Algonquin Power & Utilities (AQN) to co-develop renewable power projects globally to provide electricity to Chevron's strategic assets.

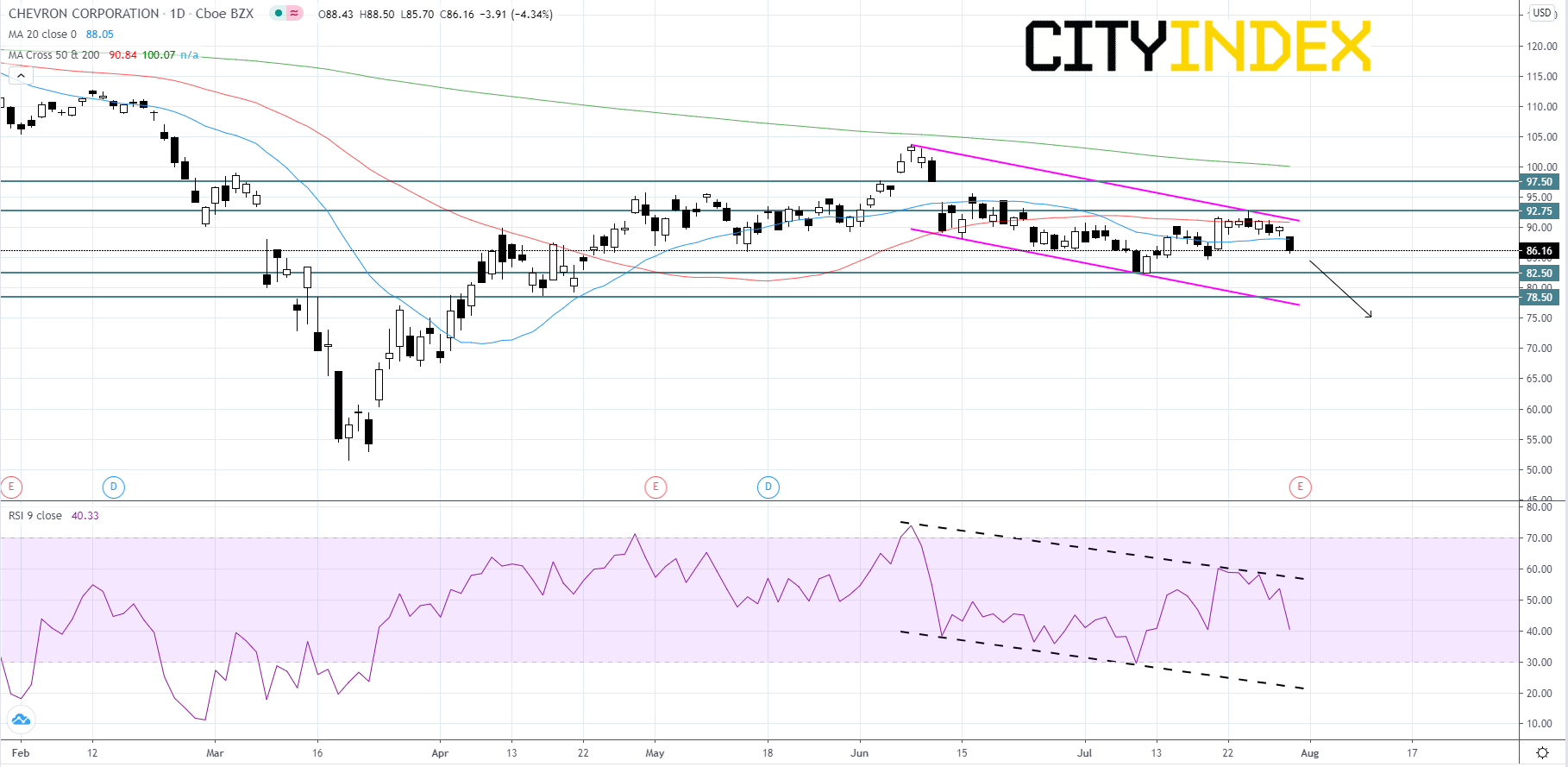

Looking at a daily chart, Chevron's stock price appears to be forming a downward channel that began developing in early-June after price peeked at just over $100.00. The RSI also appears to be forming a downward channel. The price of crude oil broke below its 20-day moving average today and touched its 50-day moving average for the first time in this rally that began in late-April. Also, the rising infection rate of COVID-19 globally could spur another series of travel bans and country lockdowns, adding to the bearish sentiment on energy markets. Chevron's stock price will likely continue to descend to its $82.50 support level. If price breaks below $82.50, it will probably continue falling to $78.50. If price can manage to rebound and get above its upper trend line, we could see a push to $92.75 or even $97.50. However, if the socioeconomic situation continues to worsen, it is more likely that energy companies will fall with the price of oil for the second time this year.

Source: GAIN Capital, TradingView

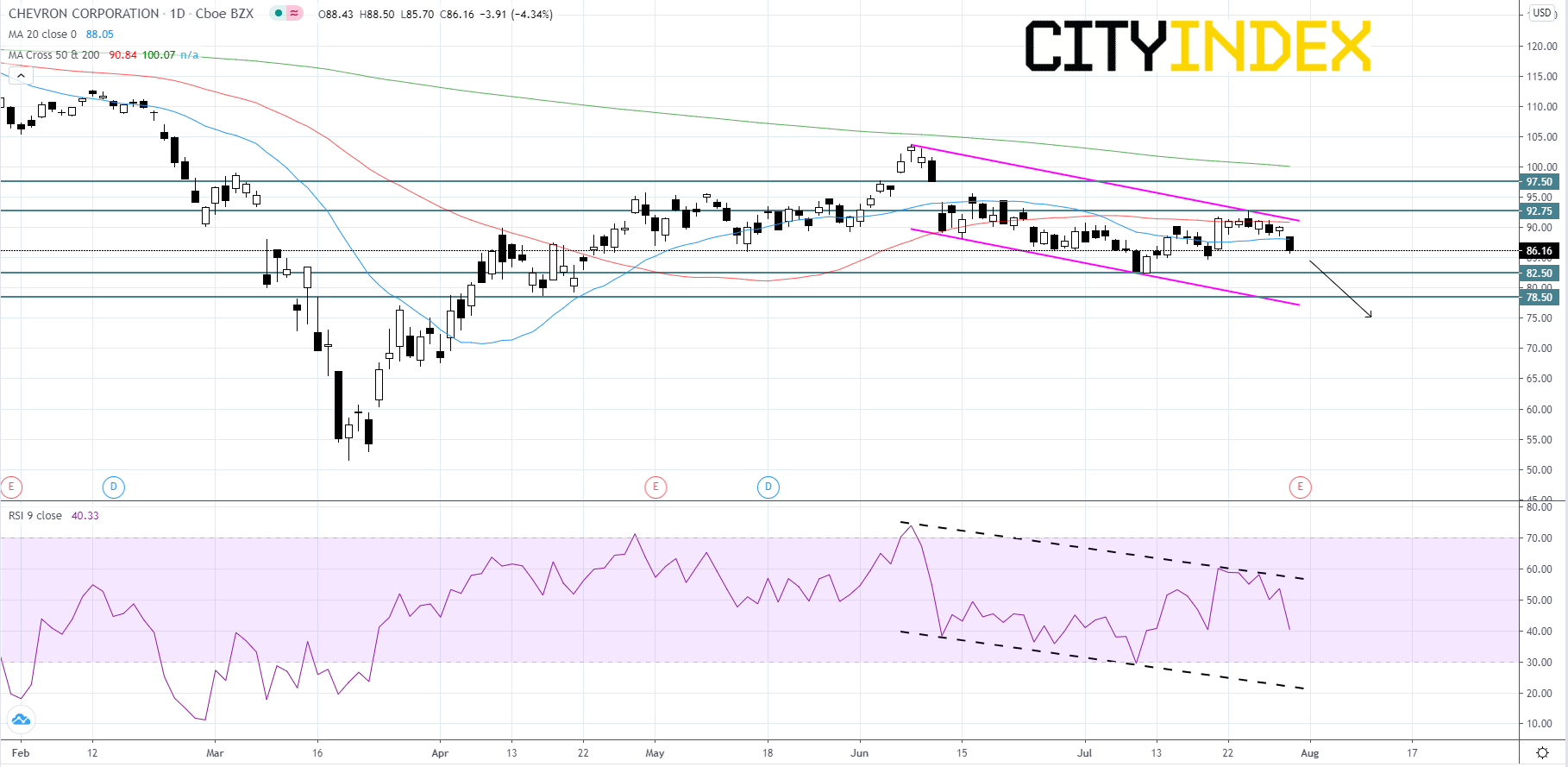

Looking at a daily chart, Chevron's stock price appears to be forming a downward channel that began developing in early-June after price peeked at just over $100.00. The RSI also appears to be forming a downward channel. The price of crude oil broke below its 20-day moving average today and touched its 50-day moving average for the first time in this rally that began in late-April. Also, the rising infection rate of COVID-19 globally could spur another series of travel bans and country lockdowns, adding to the bearish sentiment on energy markets. Chevron's stock price will likely continue to descend to its $82.50 support level. If price breaks below $82.50, it will probably continue falling to $78.50. If price can manage to rebound and get above its upper trend line, we could see a push to $92.75 or even $97.50. However, if the socioeconomic situation continues to worsen, it is more likely that energy companies will fall with the price of oil for the second time this year.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM