Earnings Play: CarMax

On Friday, before market, CarMax (KMX) is anticipated to release first quarter EPS of $0.04 compared to $1.59 a year ago on revenue of approximately $2.7B vs. $5.4B last year. The company operates a car and light truck retail chain, and its current analyst consensus rating is 14 buys, 2 holds and 1 sell, according to Bloomberg.

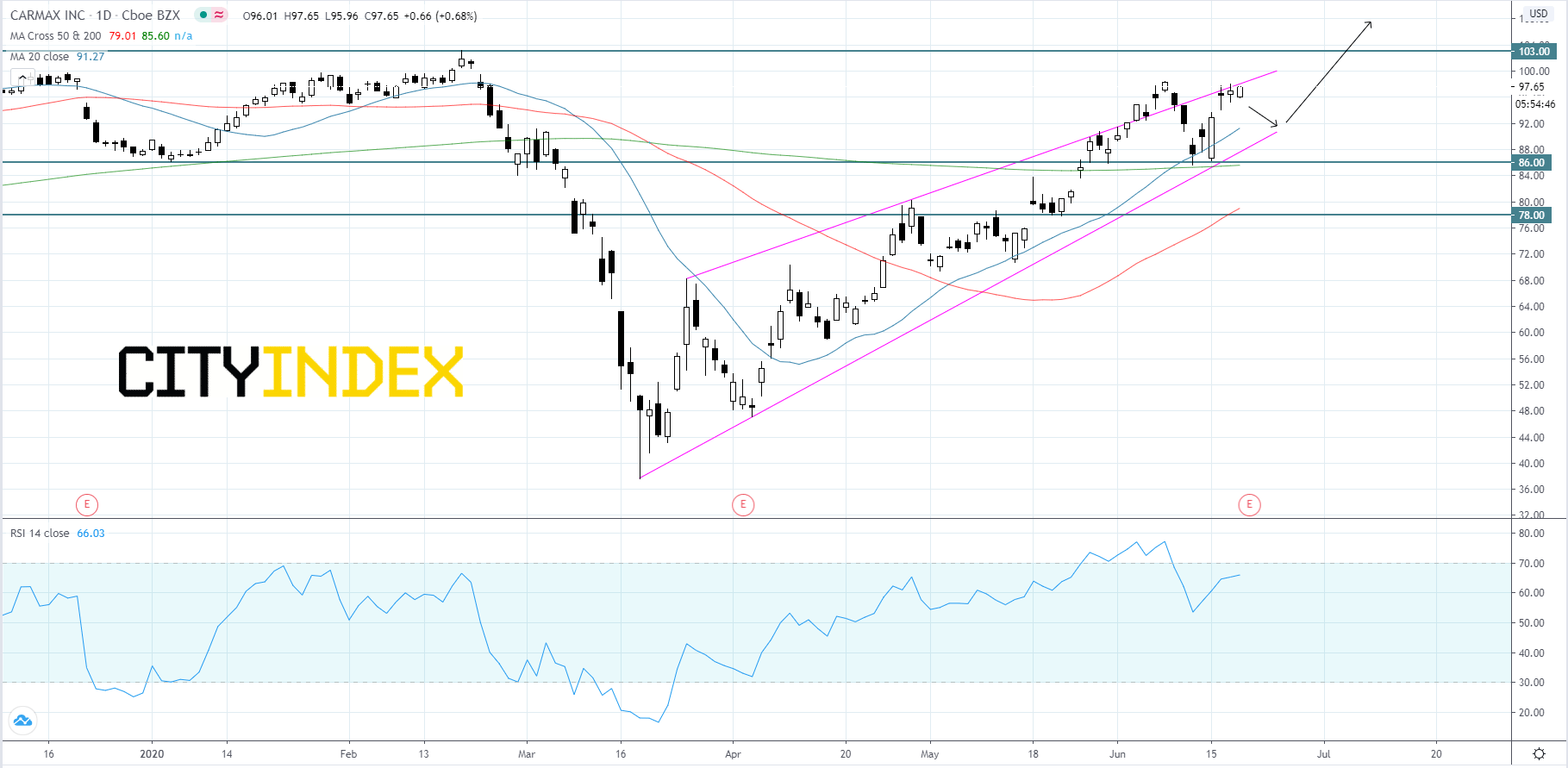

From a chartist's point of view, on a daily chart, CarMax's stock price has been rising inside of an ascending wedge pattern that began to form in mid-March. Price has been holding against the upper trend line for the last three trading days making higher lows, a bullish signal. The RSI has been rising since late-March and is currently holding above 60 after a slight pull back from overbought territory last week. Price is anticipated to continue advancing towards the record high at $103.00 and the uptrend to continue. If price breaks below the lower trend line then price will likely make its way back down to the $86.00 level on the 200-day moving average. If price cannot find support at the $86.00 level then we could see the beginning of a bearish market structure forming, which could send price back down to $78.00.

Source: GAIN Capital, TradingView

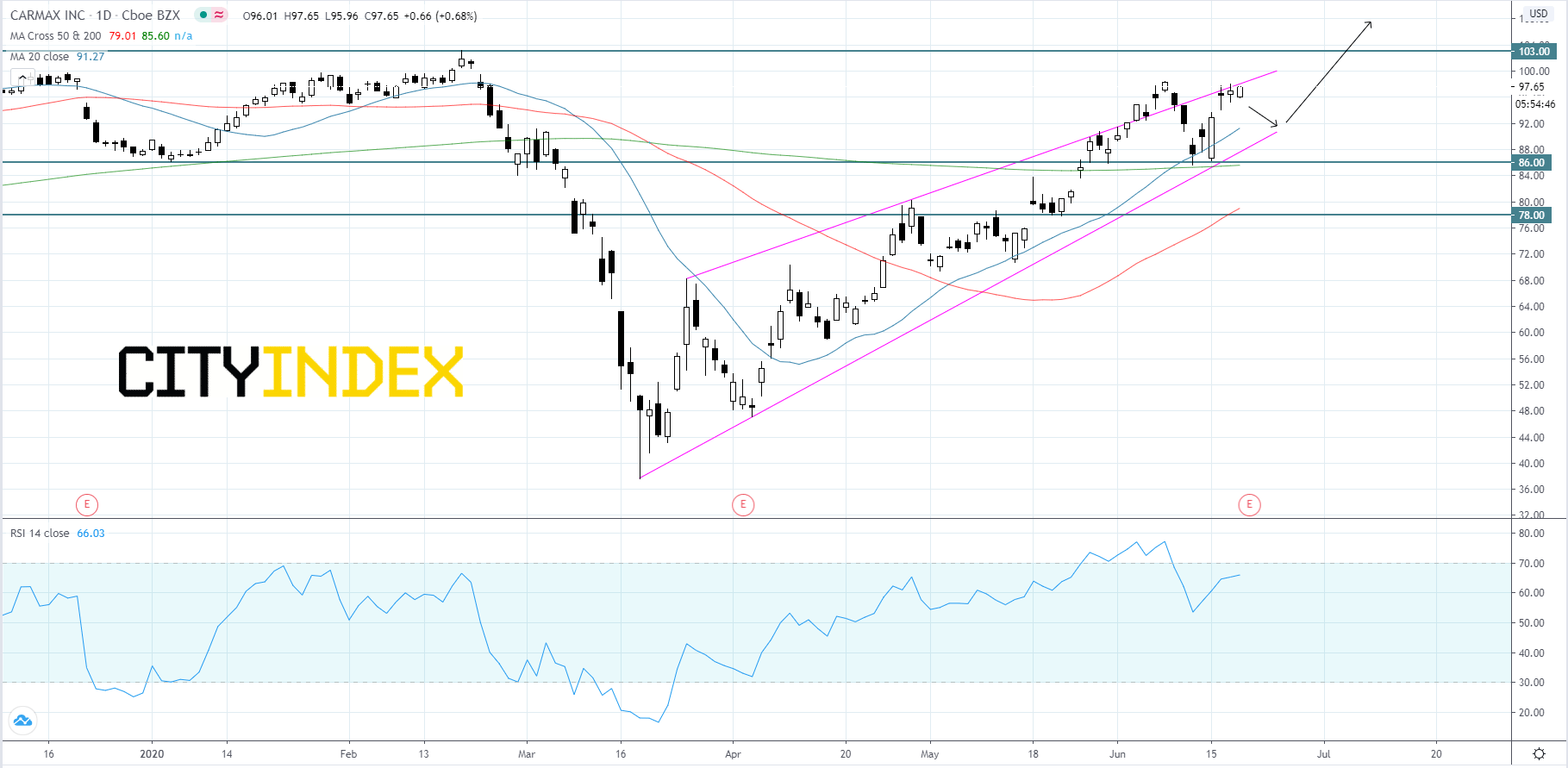

From a chartist's point of view, on a daily chart, CarMax's stock price has been rising inside of an ascending wedge pattern that began to form in mid-March. Price has been holding against the upper trend line for the last three trading days making higher lows, a bullish signal. The RSI has been rising since late-March and is currently holding above 60 after a slight pull back from overbought territory last week. Price is anticipated to continue advancing towards the record high at $103.00 and the uptrend to continue. If price breaks below the lower trend line then price will likely make its way back down to the $86.00 level on the 200-day moving average. If price cannot find support at the $86.00 level then we could see the beginning of a bearish market structure forming, which could send price back down to $78.00.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM