Earnings Play: Canopy Growth Corporation

On Monday, before market, Canopy Growth Corporation (CGC) is anticipated to release third quarter revenue of approximately $119.1 million vs. $76.6 million last year. The company cultivates and sells medicinal and recreational cannabis, and on November 4th, ABC News reported that 5 states passed marijuana legalization measures.

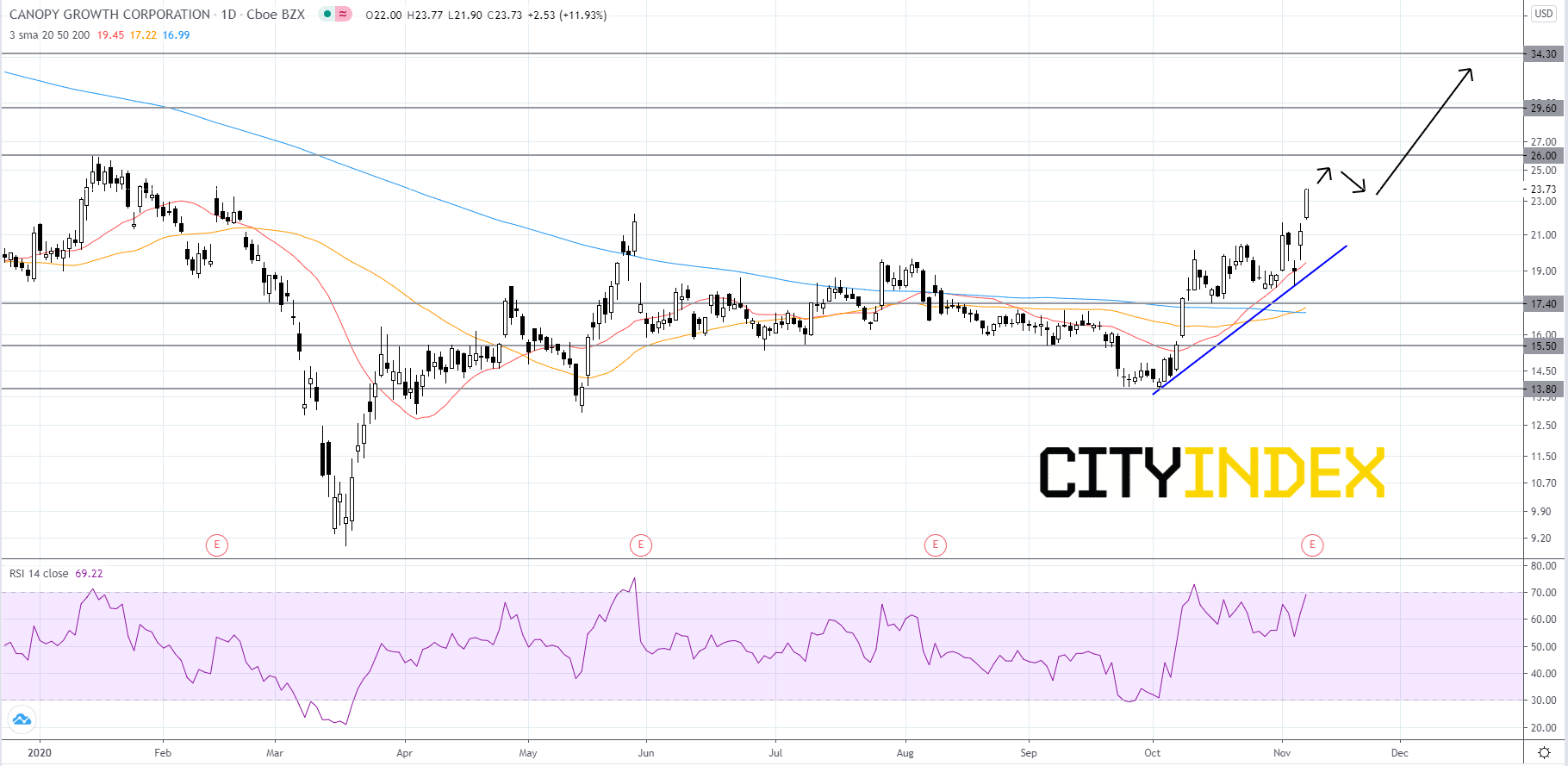

Looking at a daily chart, in logarithmic scale, Canopy's stock price has been in a short-term uptrend since the beginning of October. The RSI is bullish and currently just below overbought territory. The simple moving averages (SMA) have just turned bullish, as the 20-day SMA is above the 50-day SMA, and the 50-day SMA is above the 200-day SMA. On the chart traders can see that after the election on November 3rd Canopy's stock price became very volatile and has gapped at each market open since. Price will likely continue to rise towards the 2020 high of $26.00. At around $26.00 the stock will probably sell off a bit as speculators take some profits, and price will likely pull back to the 20-day SMA around the bullish trendline. If price can manage to hold above the bullish trendline then it could be a chance for late comers to jump on for a retest of $26.00. If price breaks out to the upside of 26.00, then its next targets would be $29.60 and 34.30, levels last reached in 2019. On the flip side, if Canopy pulls back to the bullish trendline and breaks below it, then a rebound could occur at around 17.40. If price cant hold at 17.40 then it could dip to 15.50, which would be a bearish signal as price be below the 200-day SMA. If price cant find footing on 15.50, then it will likely decline further to 13.80.

Source: GAIN Capital, TradingView

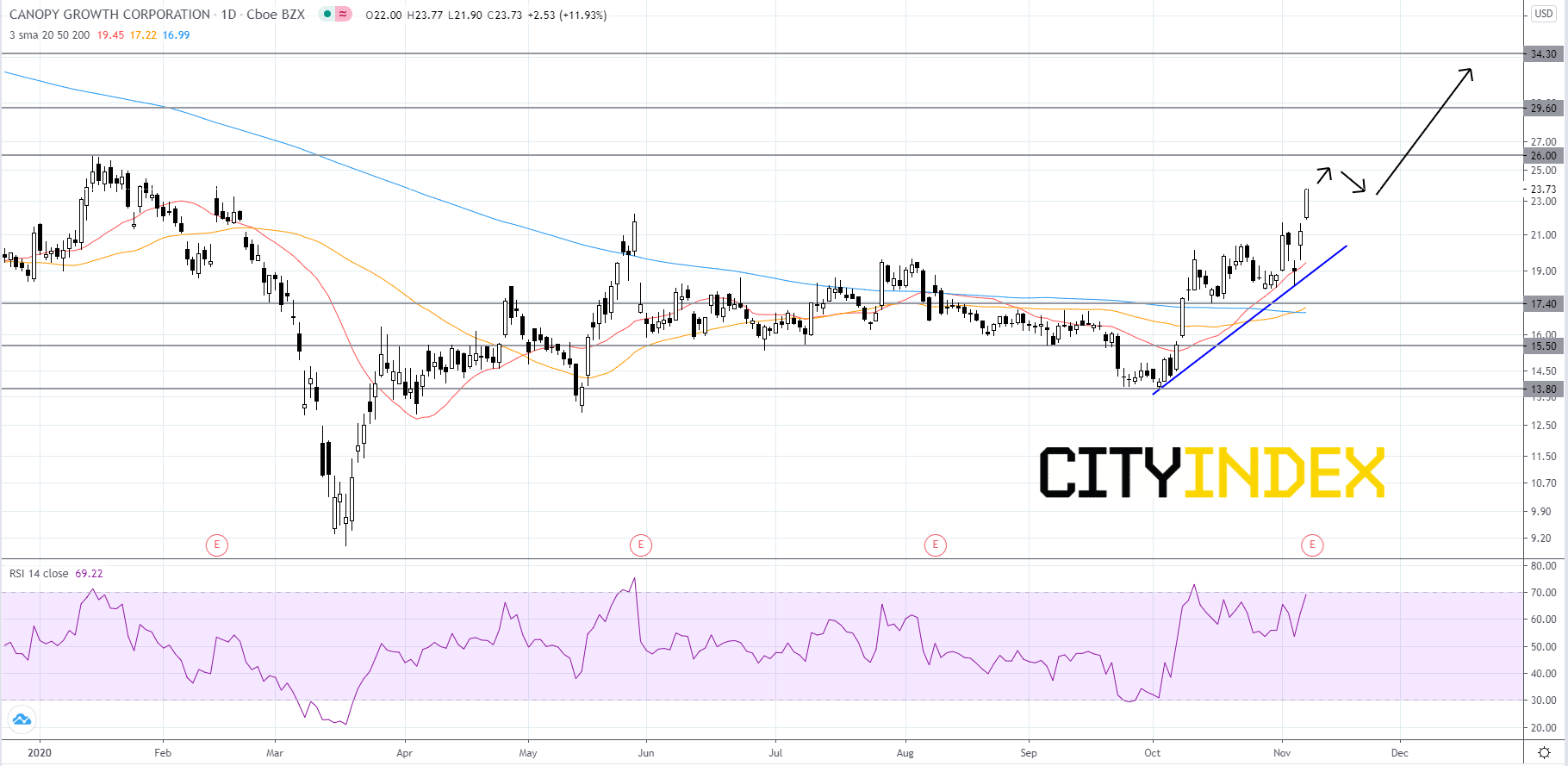

Looking at a daily chart, in logarithmic scale, Canopy's stock price has been in a short-term uptrend since the beginning of October. The RSI is bullish and currently just below overbought territory. The simple moving averages (SMA) have just turned bullish, as the 20-day SMA is above the 50-day SMA, and the 50-day SMA is above the 200-day SMA. On the chart traders can see that after the election on November 3rd Canopy's stock price became very volatile and has gapped at each market open since. Price will likely continue to rise towards the 2020 high of $26.00. At around $26.00 the stock will probably sell off a bit as speculators take some profits, and price will likely pull back to the 20-day SMA around the bullish trendline. If price can manage to hold above the bullish trendline then it could be a chance for late comers to jump on for a retest of $26.00. If price breaks out to the upside of 26.00, then its next targets would be $29.60 and 34.30, levels last reached in 2019. On the flip side, if Canopy pulls back to the bullish trendline and breaks below it, then a rebound could occur at around 17.40. If price cant hold at 17.40 then it could dip to 15.50, which would be a bearish signal as price be below the 200-day SMA. If price cant find footing on 15.50, then it will likely decline further to 13.80.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM