Earnings Play: Campbell Soup

On Wednesday, before market, Campbell Soup (CPB) is expected to report first quarter EPS of $0.78, in line with last year on revenue of approximately $2.3 billion vs. $2.2 billion a year earlier. The company manufactures branded food products and on December 1st, GENYOUth and Campbell's Chuncky announced the Chuncky Million Meals Challenge Madden NFL 21 tournament, which will be played in EA Sports Madden NFL 21 and provide 100 million meals to school-aged children during the Covid-19 pandemic.

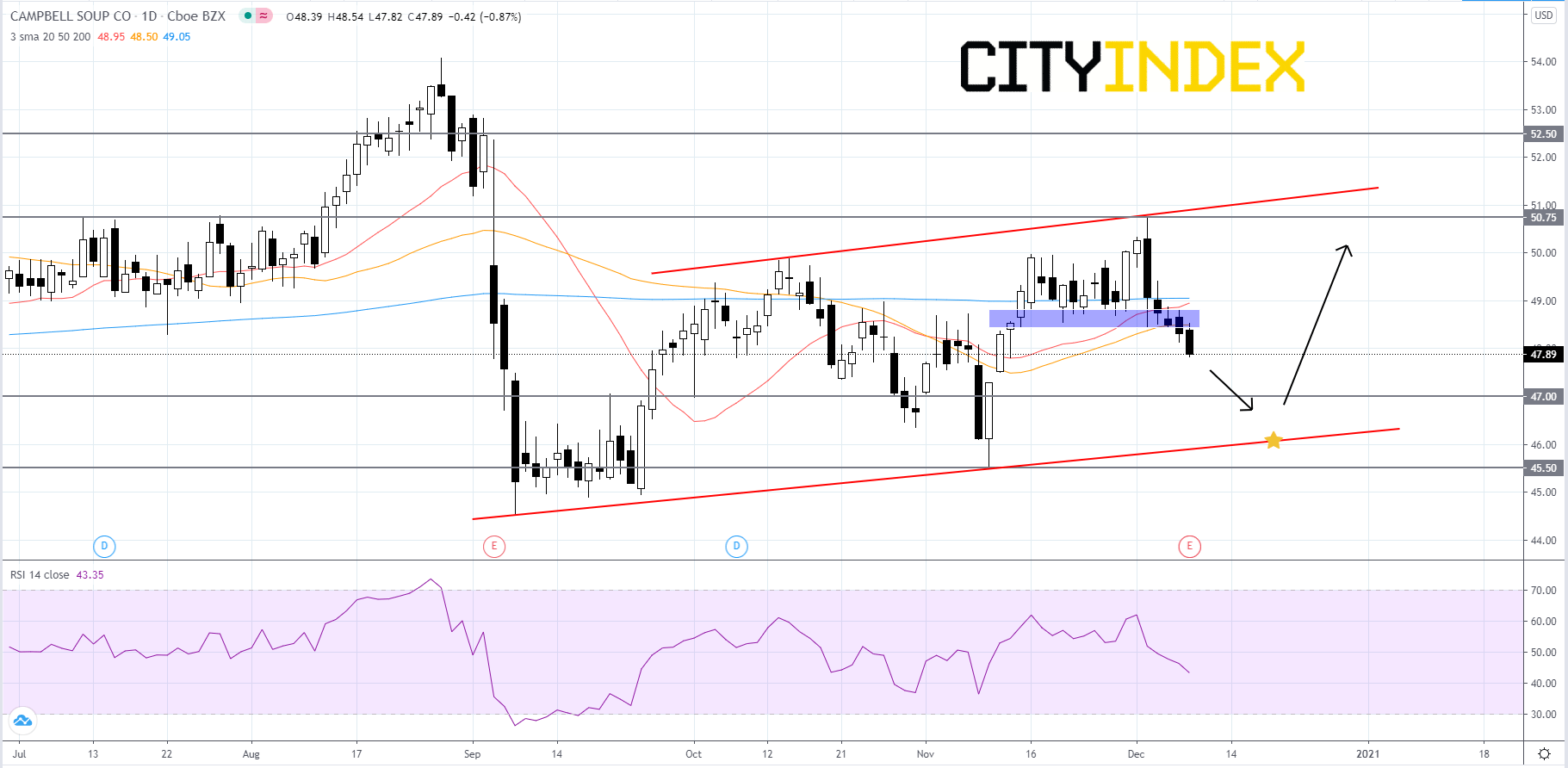

Technically speaking, on a daily chart, Campbell's stock price is currently falling within an intermediate-term bullish channel that began to form in early-September. The RSI is below 50 and headed downward. The simple moving averages are arranged in a mixed manner, the 20-day is above the 50-day SMA and the 20-day is just below the 200-day SMA, which is moving sideways. Price will likely fall towards the lower trendline of channel as a result of price breaking below a short-term support zone (purple rectangle). If price can halt at the lower trendline or possibly the 47.00 support level, then traders should look for consolidation followed by a rally back towards 50.75. If price gets above 50.75 and the upper trendline then 52.50 would be the next target. On the other hand, if price fails to be supported at the lower trendline and slips past 45.50, then price could tumble further.

Source: GAIN Capital, TradingView

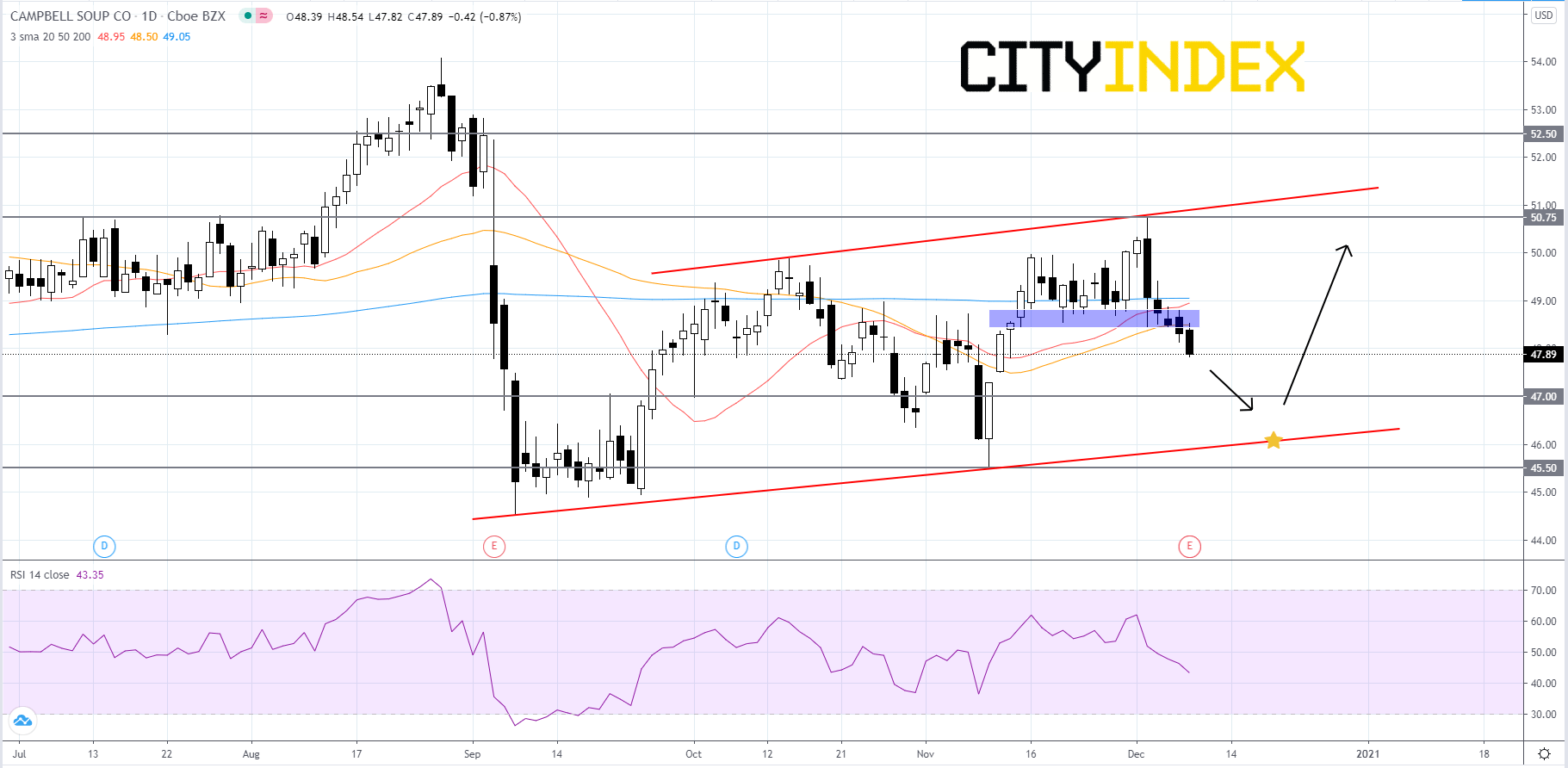

Technically speaking, on a daily chart, Campbell's stock price is currently falling within an intermediate-term bullish channel that began to form in early-September. The RSI is below 50 and headed downward. The simple moving averages are arranged in a mixed manner, the 20-day is above the 50-day SMA and the 20-day is just below the 200-day SMA, which is moving sideways. Price will likely fall towards the lower trendline of channel as a result of price breaking below a short-term support zone (purple rectangle). If price can halt at the lower trendline or possibly the 47.00 support level, then traders should look for consolidation followed by a rally back towards 50.75. If price gets above 50.75 and the upper trendline then 52.50 would be the next target. On the other hand, if price fails to be supported at the lower trendline and slips past 45.50, then price could tumble further.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM