Earnings play: Broadcom

On Thursday, after market, Broadcom (AVGO) is anticipated to release fourth quarter EPS of $6.24 compared to $5.39 last year on revenue of approximately $6.4 billion vs. $5.8 billion in the previous year. The company develops a range of semiconductors and its current analyst consensus rating is 27 buys, 5 holds and 1 sell, according to Bloomberg.

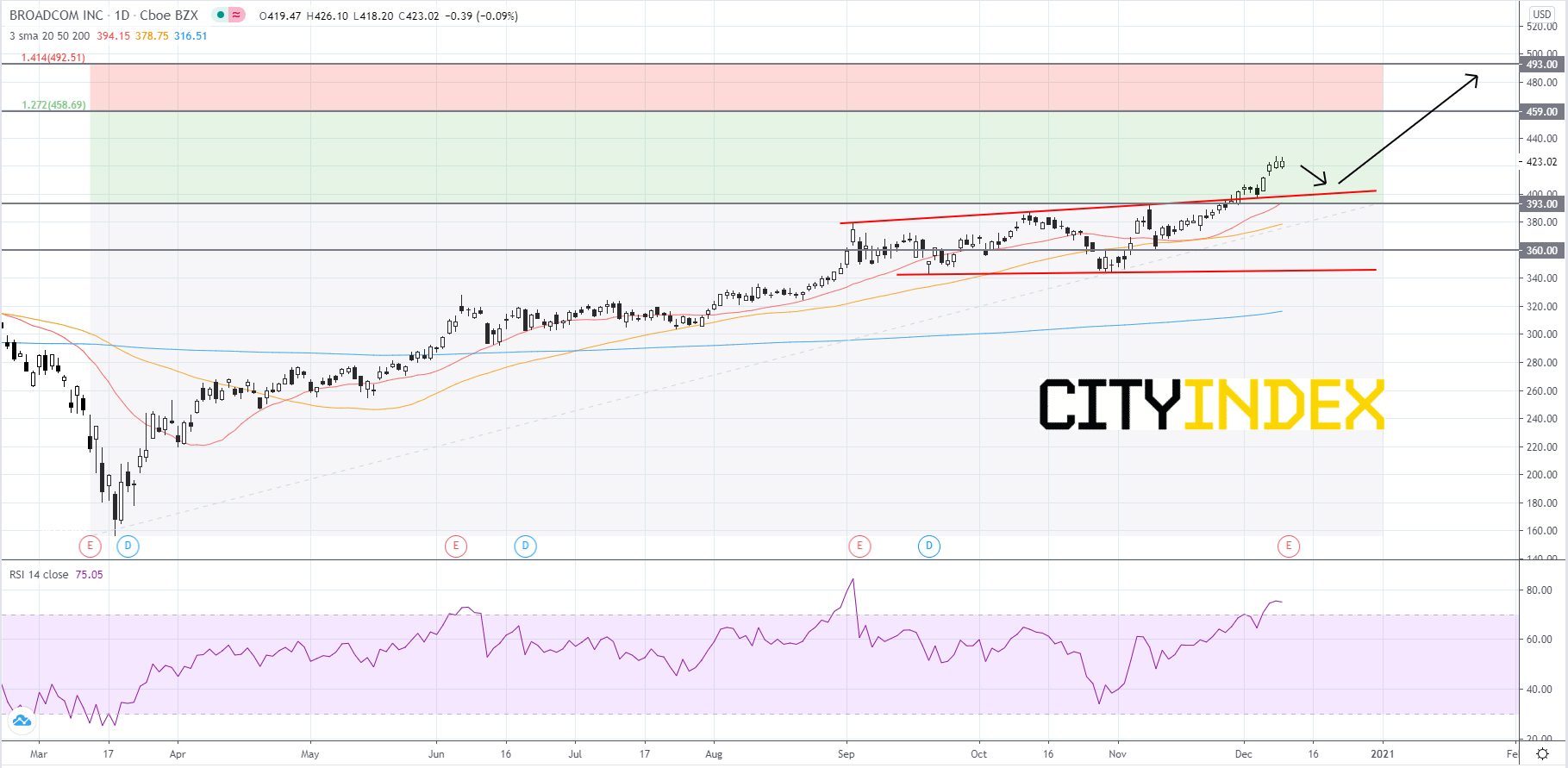

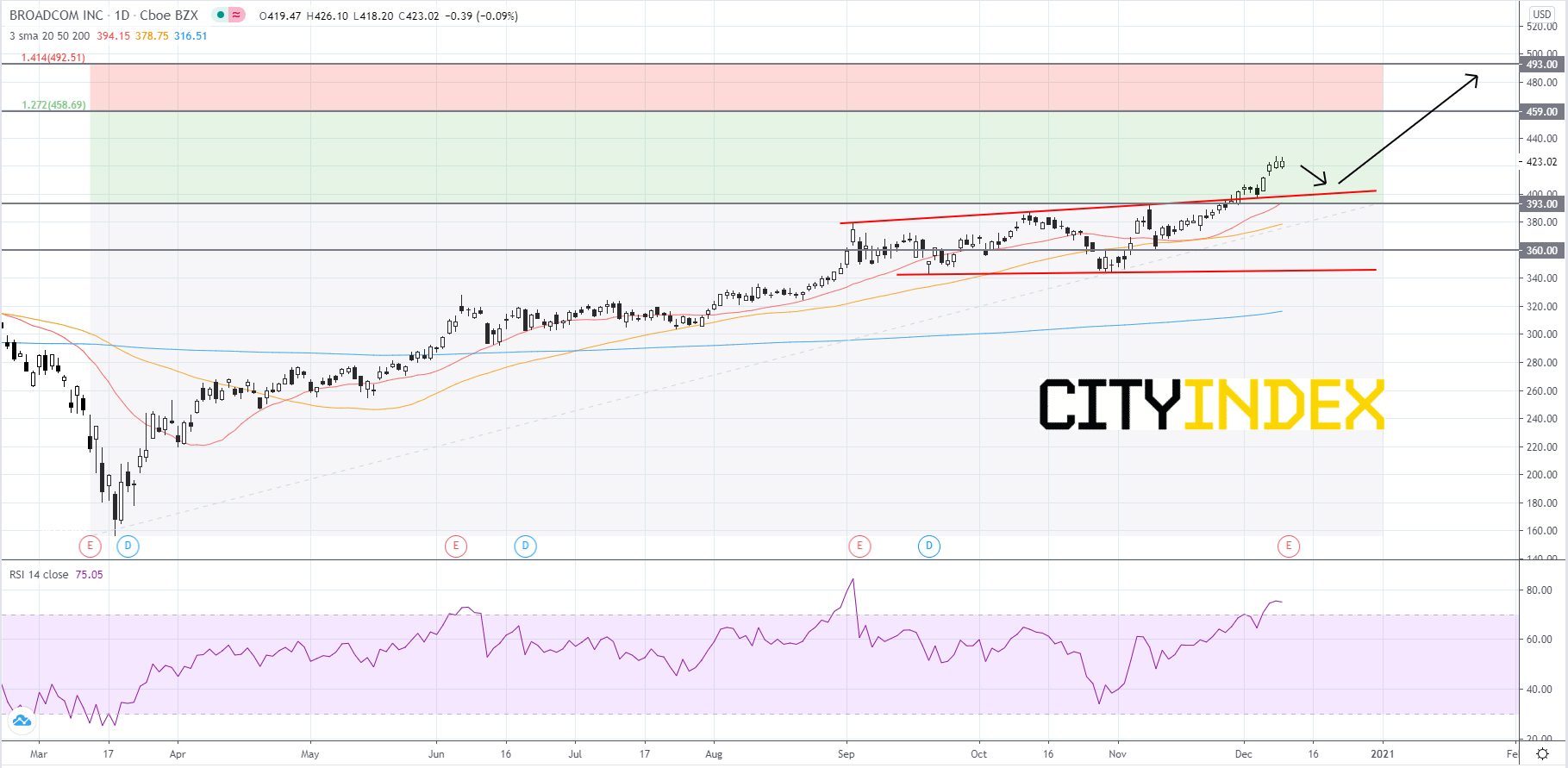

Looking at a daily chart, on November 30th, Broadcom's stock price broke out to the upside of an ascending broadening wedge pattern that began to form in early-September. The RSI shows bullish momentum and is currently holding in overbought territory over 70. The simple moving averages (SMAs) are arranged in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Given the overbought reading on the RSI, price could potentially pull back to the upper trendline of the pattern before continuing to advance. As long as Broadcom's closing price can stay above the upper trendline then price will likely rise towards the first Fibonacci target of 459.00. If price can get above 459.00, then traders should look to the second Fibonacci target of 493.00. On the other hand, if price slips below the upper trendline, then traders should look for support around the last peak of 393.00. If price fails to bounce off of 393.00 then price could slip to 360.00.

Source: GAIN Capital, TradingView

Looking at a daily chart, on November 30th, Broadcom's stock price broke out to the upside of an ascending broadening wedge pattern that began to form in early-September. The RSI shows bullish momentum and is currently holding in overbought territory over 70. The simple moving averages (SMAs) are arranged in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Given the overbought reading on the RSI, price could potentially pull back to the upper trendline of the pattern before continuing to advance. As long as Broadcom's closing price can stay above the upper trendline then price will likely rise towards the first Fibonacci target of 459.00. If price can get above 459.00, then traders should look to the second Fibonacci target of 493.00. On the other hand, if price slips below the upper trendline, then traders should look for support around the last peak of 393.00. If price fails to bounce off of 393.00 then price could slip to 360.00.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM