Earnings Play: Bed Bath & Beyond

On Wednesday, after market, Bed Bath & Beyond (BBBY) is expected to report first quarter LPS of $1.22 compared to an EPS of $0.12 a year ago on revenue of approximately $1.4B vs. $2.6B last year. The company operates a home furnishing retail chain and its current analyst consensus rating is 4 buys, 12 holds and 3 sells, according to Bloomberg.

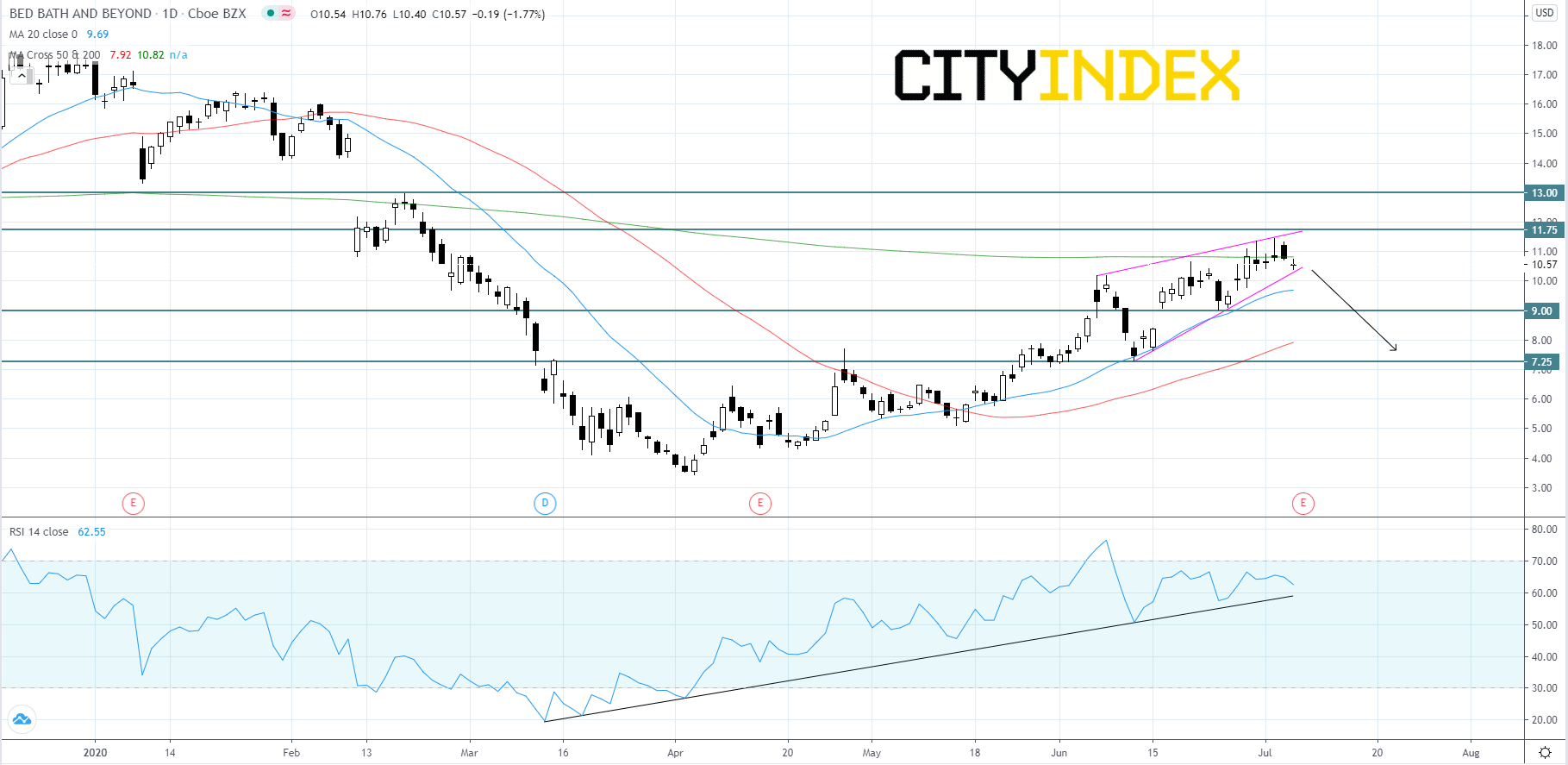

Looking at a daily chart, Bed Bath & Beyond's stock price is currently rising within a short-term ascending wedge pattern. The ascending wedge pattern is usually categorized as having a bearish bias. The RSI is currently above 60 and has been holding above a bullish trend line since mid-March. In the last 2-3 weeks it appears the RSI has been losing momentum after spiking into overbought territory (>70) in early-June. Price can potentially fall below the lower trend line and break down to the $9.00 support level. If price does not find strong support on the $9.00 level it will most likely continue to meander down to the $7.25 level. If price manages to hold within the ascending wedge pattern, we could see price reach for the $11.75 resistance level. If price can hit $11.75, there is a possibility that price could run back up to $13.00.

Source: GAIN Capital, TradingView

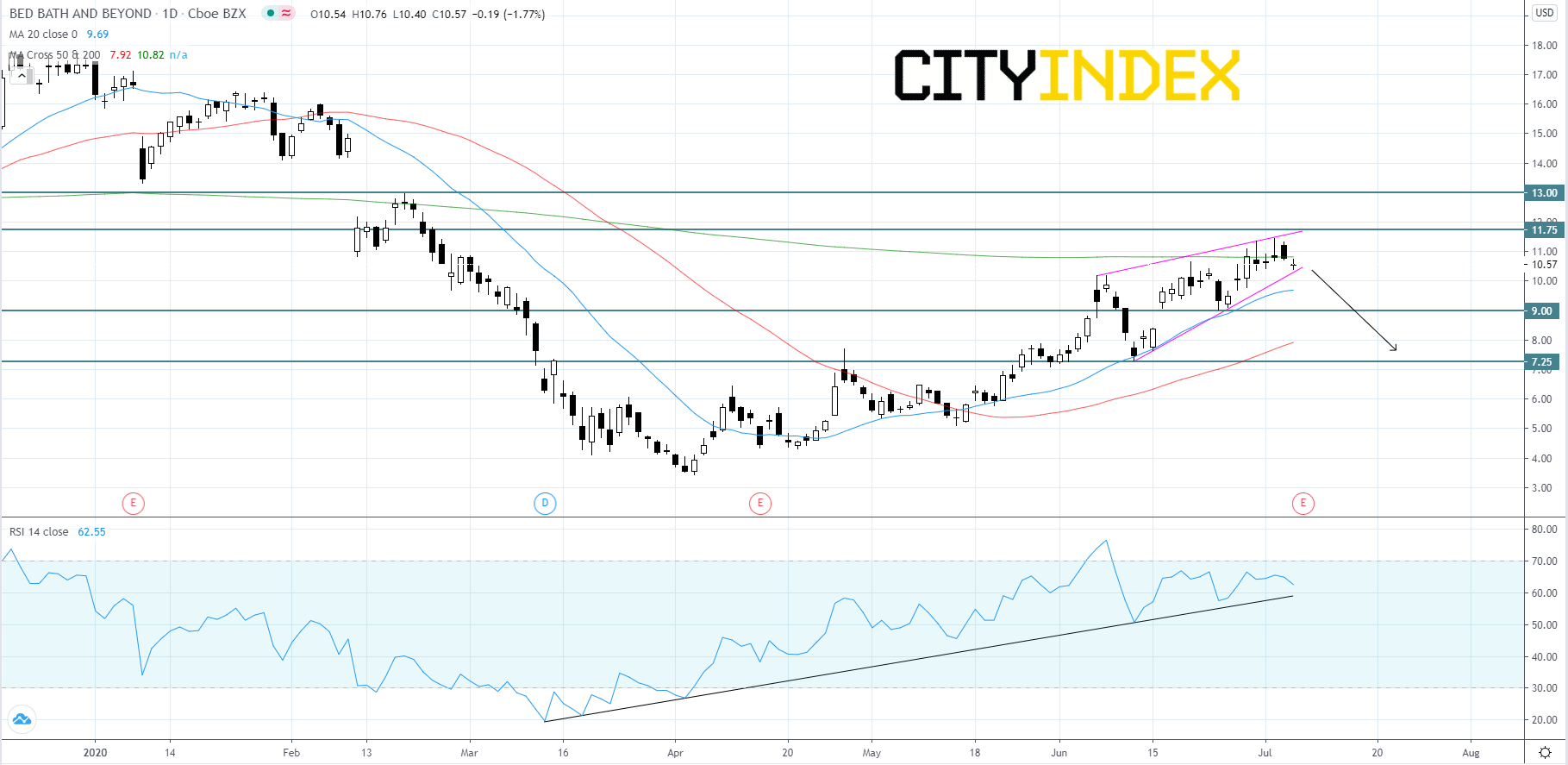

Looking at a daily chart, Bed Bath & Beyond's stock price is currently rising within a short-term ascending wedge pattern. The ascending wedge pattern is usually categorized as having a bearish bias. The RSI is currently above 60 and has been holding above a bullish trend line since mid-March. In the last 2-3 weeks it appears the RSI has been losing momentum after spiking into overbought territory (>70) in early-June. Price can potentially fall below the lower trend line and break down to the $9.00 support level. If price does not find strong support on the $9.00 level it will most likely continue to meander down to the $7.25 level. If price manages to hold within the ascending wedge pattern, we could see price reach for the $11.75 resistance level. If price can hit $11.75, there is a possibility that price could run back up to $13.00.

Source: GAIN Capital, TradingView

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM