Earnings Play: Autozone

On Tuesday, before market after Memorial Day weekend, Autozone (AZO) is anticipated to announce 3Q EPS of $13.12 compared to $15.99 the prior year on sales of approximately $2.6B vs. $2.8B last year. The company's current analyst consensus rating is 12 buys, 9 holds and 1 sell, according to Bloomberg.

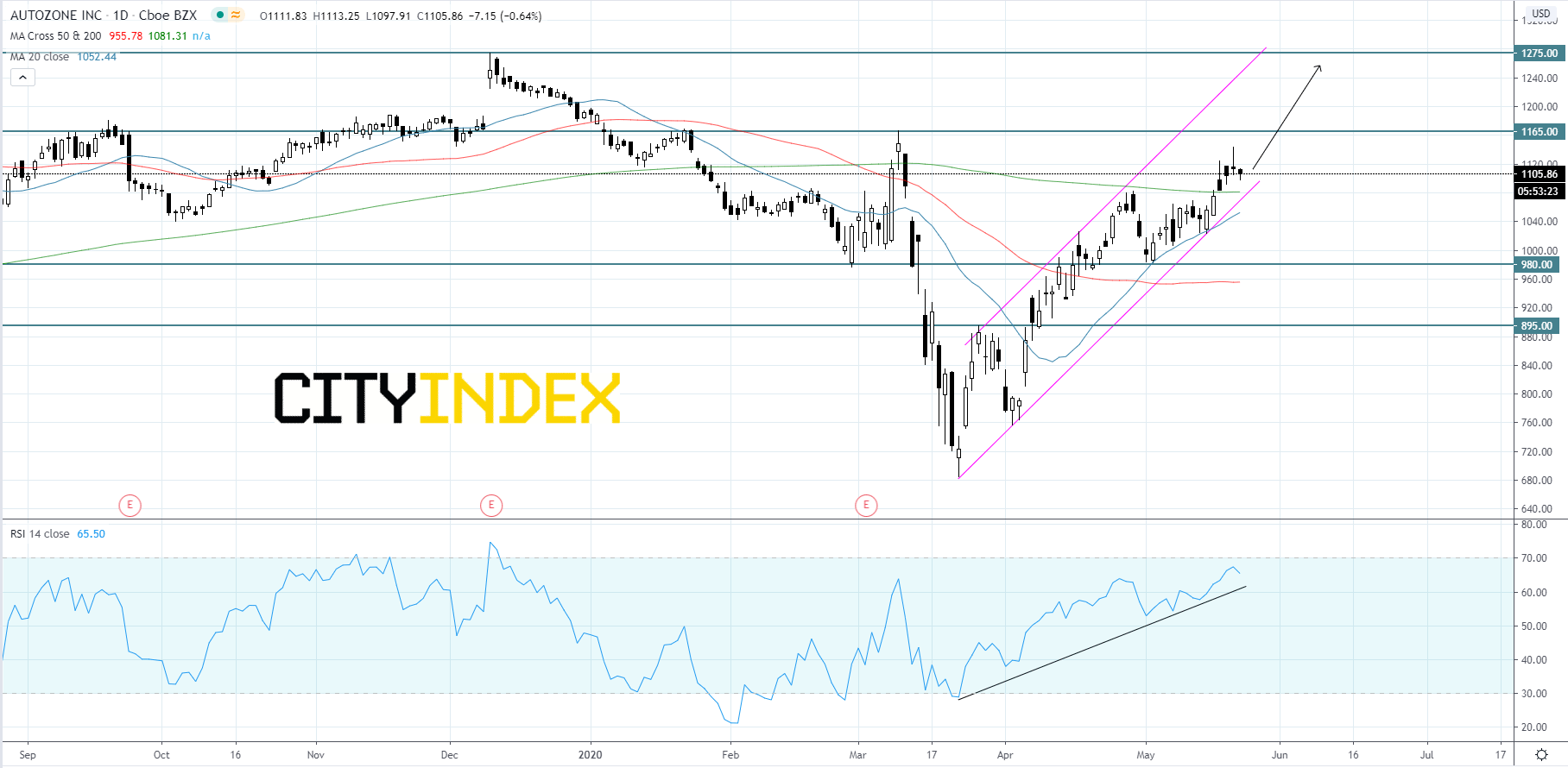

From a chartist's point of view, Autozone's stock price has been increasing inside of a rising channel that began to form in late-March. Price has upward momentum and just broke to the upside of the 200-day moving average, both bullish signals. The RSI has been holding above a rising trend line and currently sitting over 60. Price appears to be pulling back for a moment where it will most likely find support on the lower trend line before bouncing towards $1165.00 resistance. If price can get above $1165.00 then we could even see a retest of the record highs at $1275.00. If price breaks below the lower trend line and the 200-day moving average we could see price stumble back to the $980.00 support and maybe even down to the $895.00 support.

Source: GAIN Capital, TradingView

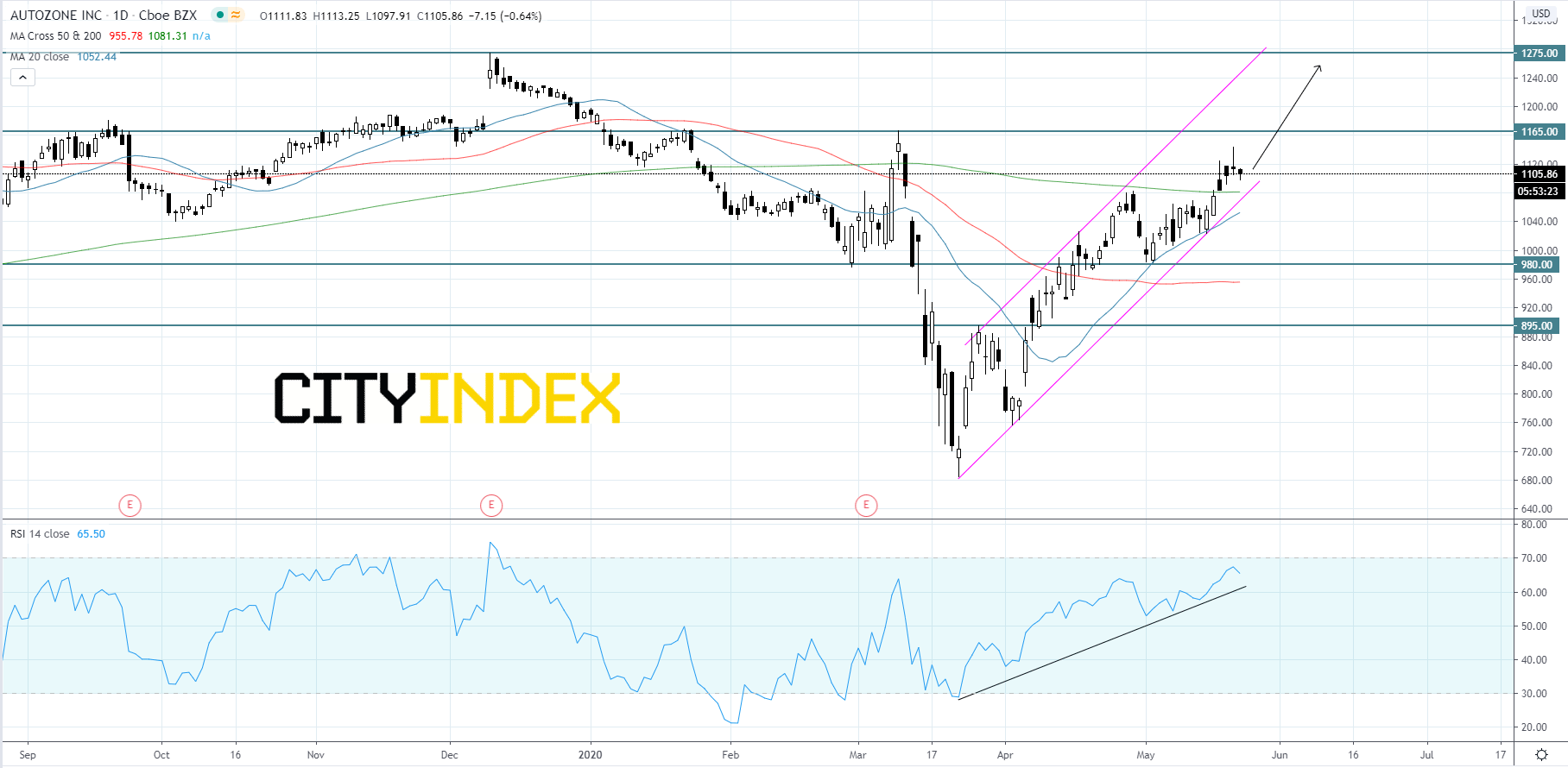

From a chartist's point of view, Autozone's stock price has been increasing inside of a rising channel that began to form in late-March. Price has upward momentum and just broke to the upside of the 200-day moving average, both bullish signals. The RSI has been holding above a rising trend line and currently sitting over 60. Price appears to be pulling back for a moment where it will most likely find support on the lower trend line before bouncing towards $1165.00 resistance. If price can get above $1165.00 then we could even see a retest of the record highs at $1275.00. If price breaks below the lower trend line and the 200-day moving average we could see price stumble back to the $980.00 support and maybe even down to the $895.00 support.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM