Earnings Play: Applied Materials

Today, after market, Applied Materials (AMAT) is expected to report fourth quarter EPS of $1.17 compared to $0.80 last year on revenue of approximately $4.6 billion vs. $3.8 billion in the year before. The company is a global leader in materials engineering solutions for the semiconductor industry and its current analyst consensus rating is 22 buys, 5 holds and 0 sells, according to Bloomberg.

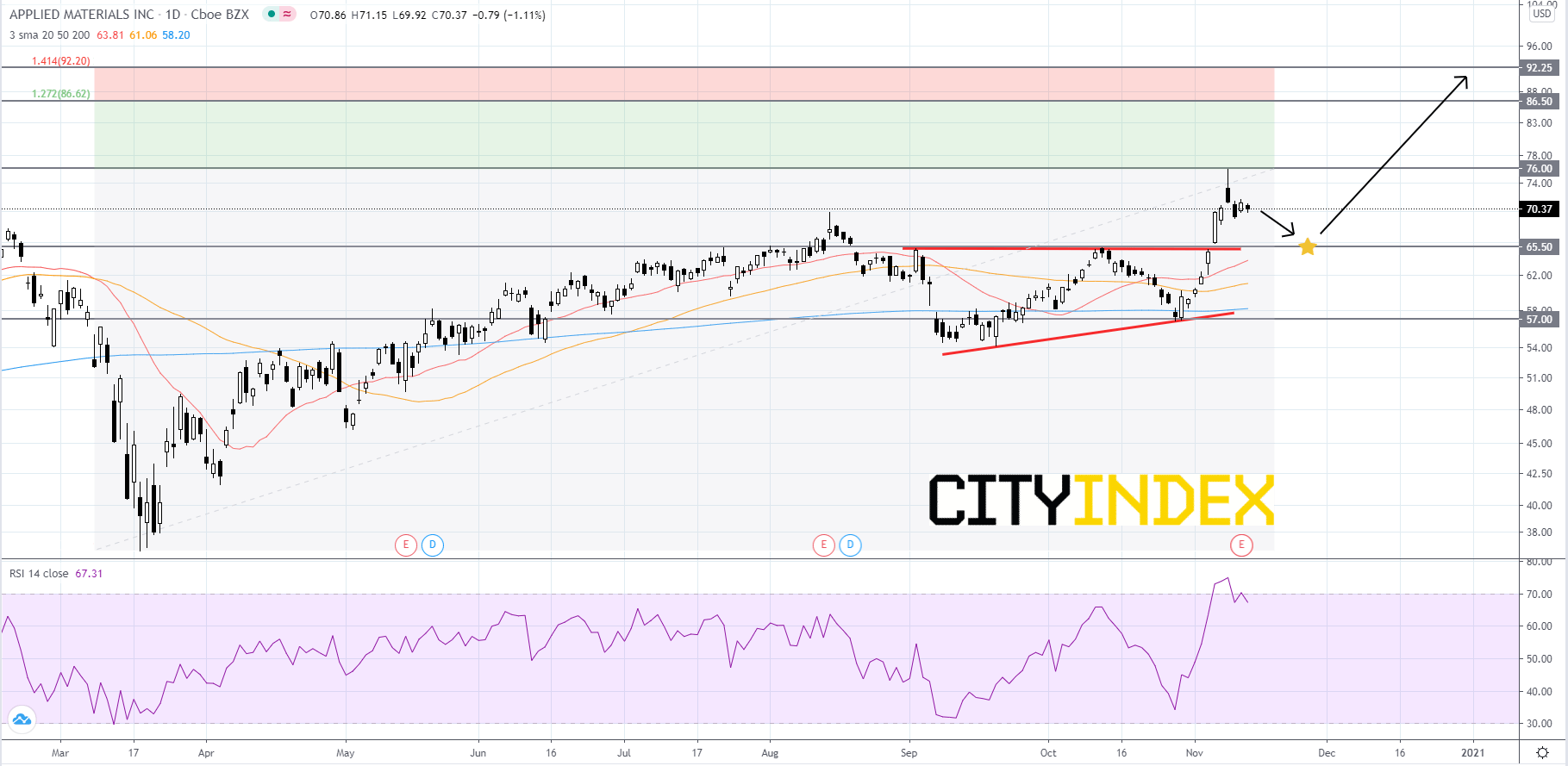

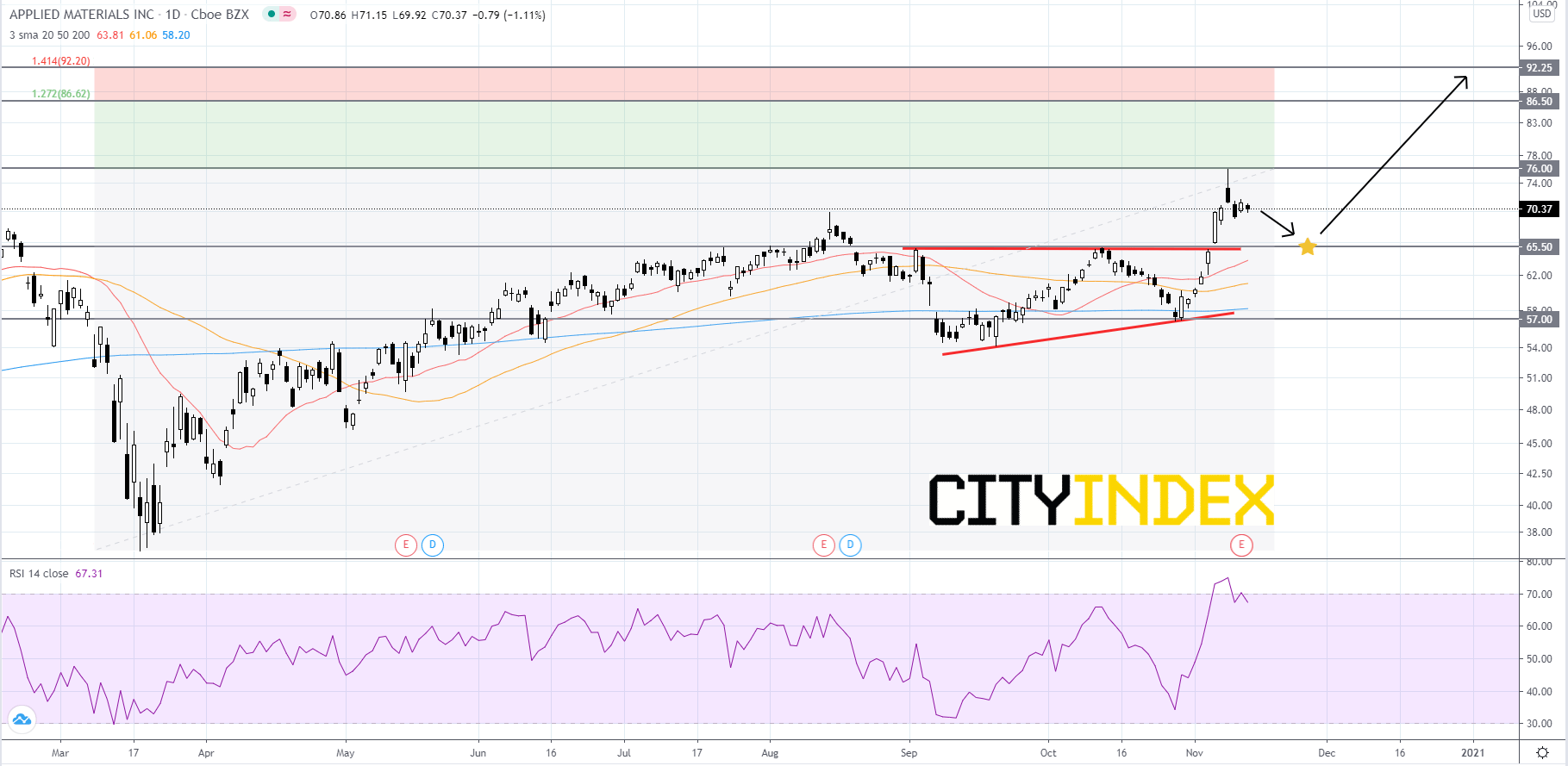

Looking at a daily chart, in logarithmic scale, Applied Material's stock price made a new record high of 75.93 on Monday, November 9th. Last week, price broke out to the upside of what appears to be an ascending triangle pattern that price was holding within since the beginning of September. The RSI is over 65 and retreating from overbought territory. The simple moving averages (SMA) are set-up in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Price will probably pullback to its breakout level around 65.50 where it will likely find support. If price is supported by 65.50, then traders should look for a retest of the all-time high around 76.00. If price can breakout above 76.00, then the next targets would be 86.50 followed by 92.25. However, if price closes below the 65.50 level, it would be a negative signal. If price falls further then a rebound could occur around 57.00. If price gets below 57.00 it would be a bearish signal, as price would be under its 200-day SMA.

Source: GAIN Capital, TradingView

Looking at a daily chart, in logarithmic scale, Applied Material's stock price made a new record high of 75.93 on Monday, November 9th. Last week, price broke out to the upside of what appears to be an ascending triangle pattern that price was holding within since the beginning of September. The RSI is over 65 and retreating from overbought territory. The simple moving averages (SMA) are set-up in a bullish manner, with the 20-day SMA above the 50-day SMA and the 50-day SMA above the 200-day SMA. Price will probably pullback to its breakout level around 65.50 where it will likely find support. If price is supported by 65.50, then traders should look for a retest of the all-time high around 76.00. If price can breakout above 76.00, then the next targets would be 86.50 followed by 92.25. However, if price closes below the 65.50 level, it would be a negative signal. If price falls further then a rebound could occur around 57.00. If price gets below 57.00 it would be a bearish signal, as price would be under its 200-day SMA.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM