Earnings Play: Apple

On Thursday, after market, Apple (AAPL) is anticipated to report fourth quarter EPS of $0.70 compared to $0.76 a year ago on revenue of approximately $63.5 billion vs. $64.0 billion last year. The company develops consumer electronics and its current analyst consensus rating is 27 buys, 13 holds and 4 sells, according to Bloomberg.

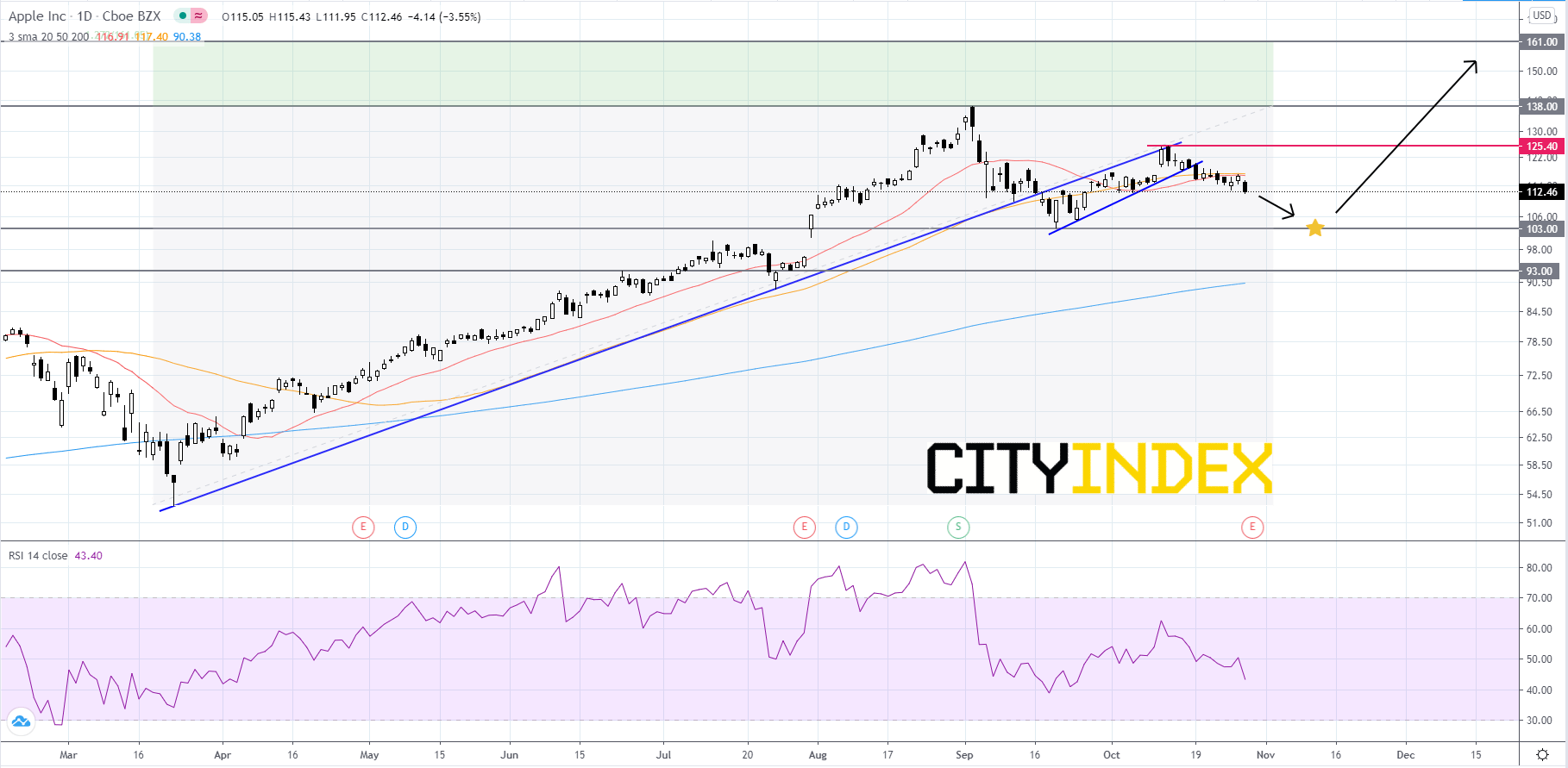

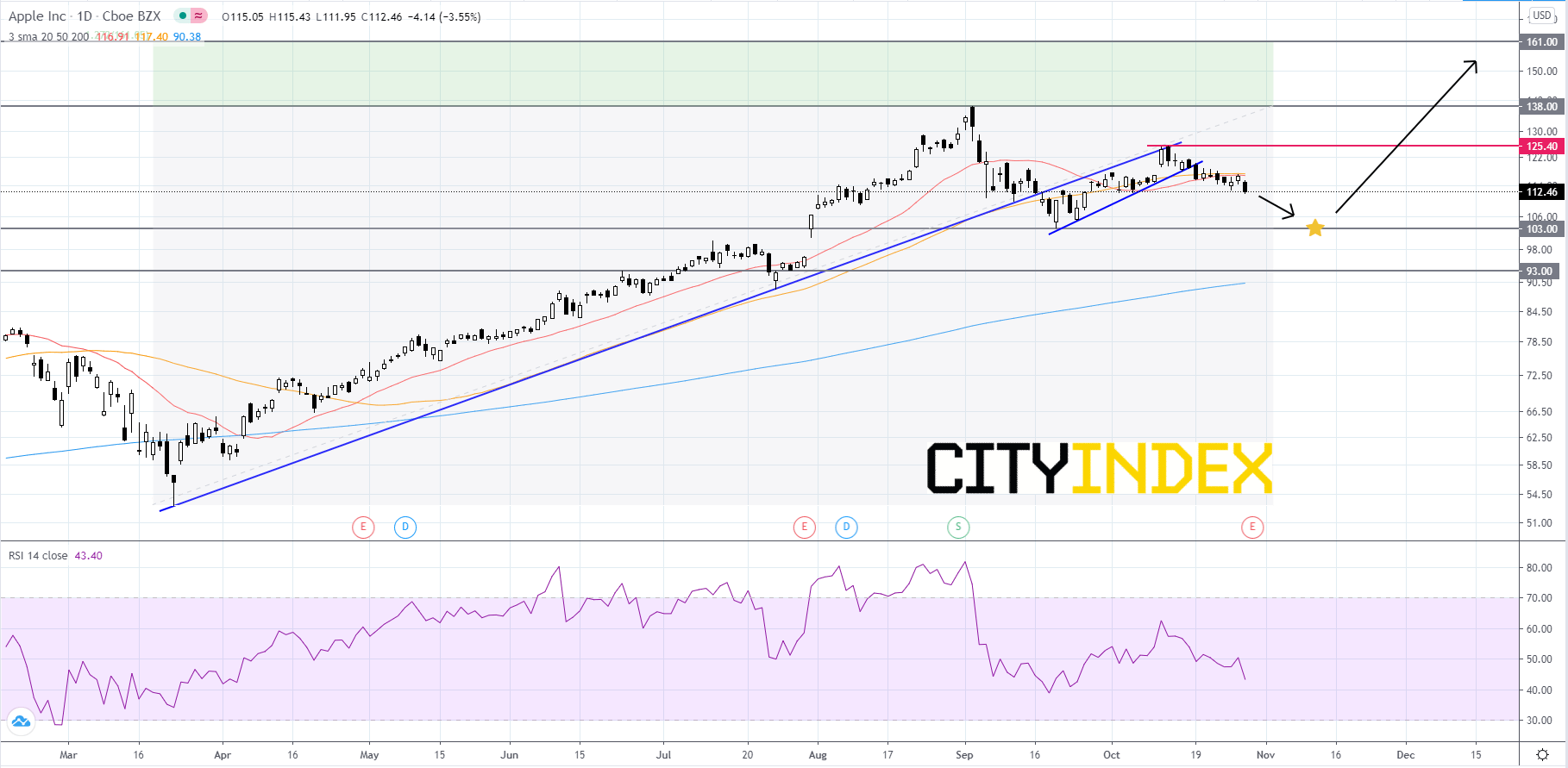

Looking at a daily chart, Apple's stock price recent broke out to the downside of a short-term bullish trendline that price was rising above since mid-September. At the same time Apple's price was holding under an intermediate-term bullish trendline that began to form back in mid-March. The RSI is currently around 43 and confirming price action with a lower high made in mid-October compared to the last peak in early-September. Apple's stock price will probably continue to fade until it reaches its key support level at 103.00. Price will likely rebound off of 103.00 and retest the last peak of 125.40. If price can get above 125.40 then the next target is the record high of about 138.00. If price can get above 138.00, then the first Fibonacci target is 161.00. On the other hand, if Apple breaks out and closes below its 103.00 support it would be a bearish signal that could send price down to 93.00 and possibly lower.

Are we witnessing the beginning of the end for Apple or is this a great time to dip buy?

Source: GAIN Capital, TradingView

Looking at a daily chart, Apple's stock price recent broke out to the downside of a short-term bullish trendline that price was rising above since mid-September. At the same time Apple's price was holding under an intermediate-term bullish trendline that began to form back in mid-March. The RSI is currently around 43 and confirming price action with a lower high made in mid-October compared to the last peak in early-September. Apple's stock price will probably continue to fade until it reaches its key support level at 103.00. Price will likely rebound off of 103.00 and retest the last peak of 125.40. If price can get above 125.40 then the next target is the record high of about 138.00. If price can get above 138.00, then the first Fibonacci target is 161.00. On the other hand, if Apple breaks out and closes below its 103.00 support it would be a bearish signal that could send price down to 93.00 and possibly lower.

Are we witnessing the beginning of the end for Apple or is this a great time to dip buy?

Source: GAIN Capital, TradingView

Latest market news

Today 10:37 AM