Earnings Play: Albemarle

On Wednesday, after market, Albemarle (ALB) is anticipated to release 1Q EPS of $0.78 compared to $1.23 the prior year on revenue of approximately $758.5M vs. $832.1M last year. On April 20th, the company announced that J. Kent Masters was elected Chief Executive Officer, President and Chairman, effective immediately.

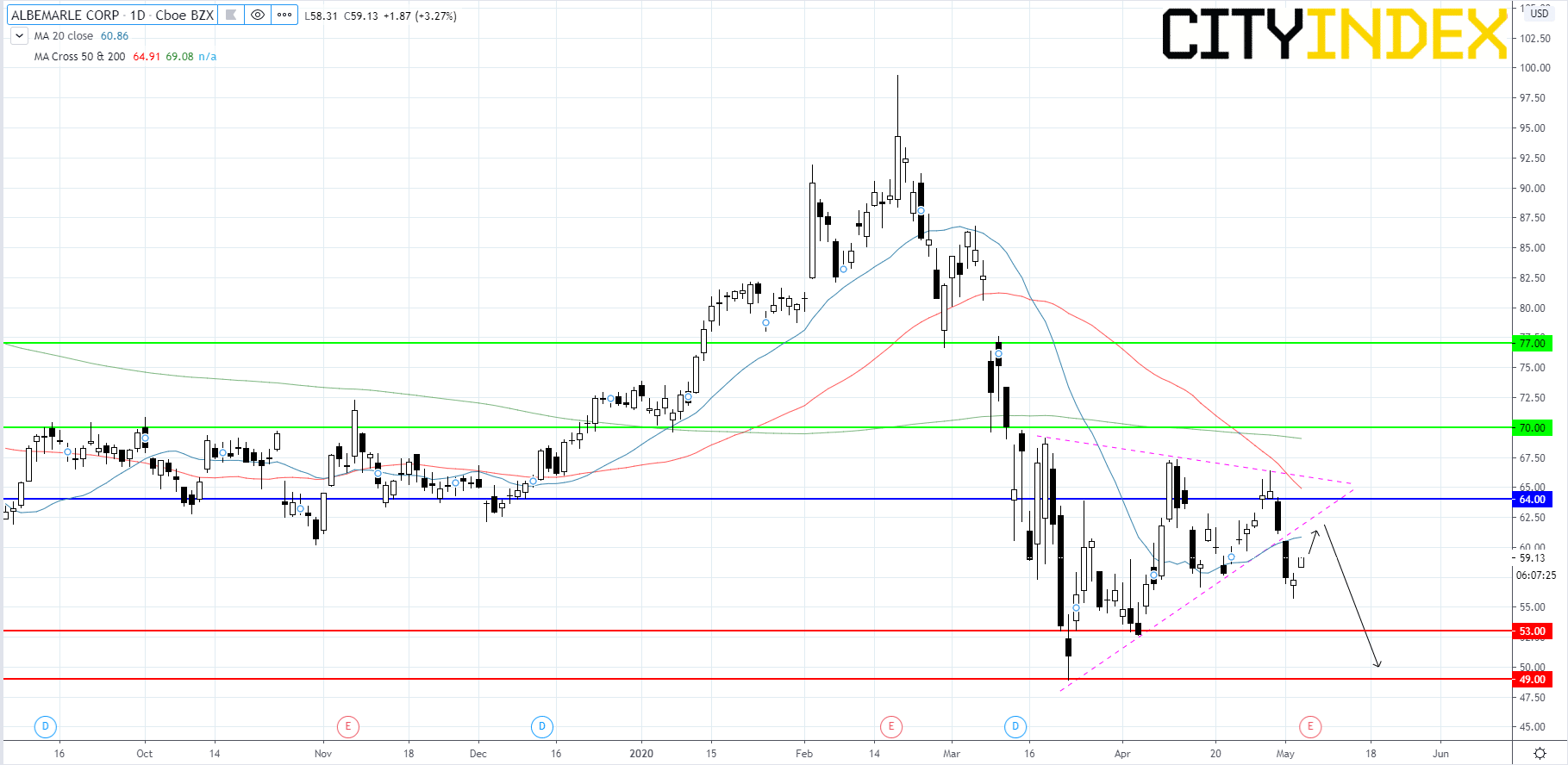

Looking at a daily chart, Albemarle's stock price recently broke out to the downside of a symmetrical triangle pattern that price began to form back in mid-March. In late April, after price hit resistance at the upper trend line, price broke down gapping below the lower trend line and 20 day moving average. We expect price to find new resistance under the lower trend line below $64.00. If price stays under pressure we may see price fall back to $53.00 and possibly retrace to the 2020 lows at $49.00.

Source: GAIN Capital, TradingView

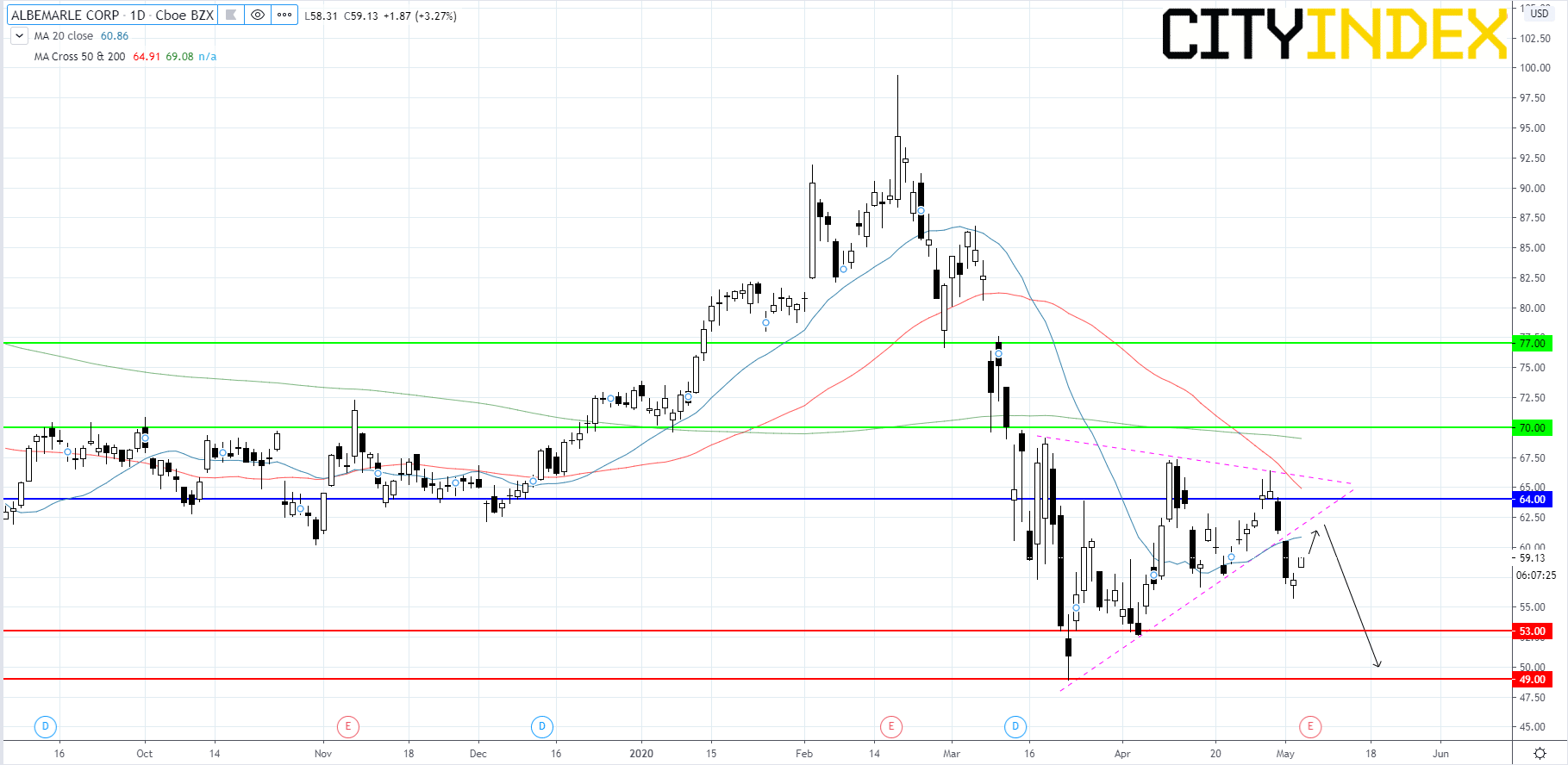

Looking at a daily chart, Albemarle's stock price recently broke out to the downside of a symmetrical triangle pattern that price began to form back in mid-March. In late April, after price hit resistance at the upper trend line, price broke down gapping below the lower trend line and 20 day moving average. We expect price to find new resistance under the lower trend line below $64.00. If price stays under pressure we may see price fall back to $53.00 and possibly retrace to the 2020 lows at $49.00.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM