Earnings Play: Air Products and Chemicals

On Wednesday, before market, Air Products and Chemicals (APD) is expected to report fourth quarter EPS of $2.17 compared to $2.27 last year on revenue of approximately $2.3 billion, in line with the year before. The company is a global supplier of industrial gases and its expected move based on front-month options is 4.6%. The last time the company reported earnings the stock declined 0.8%.

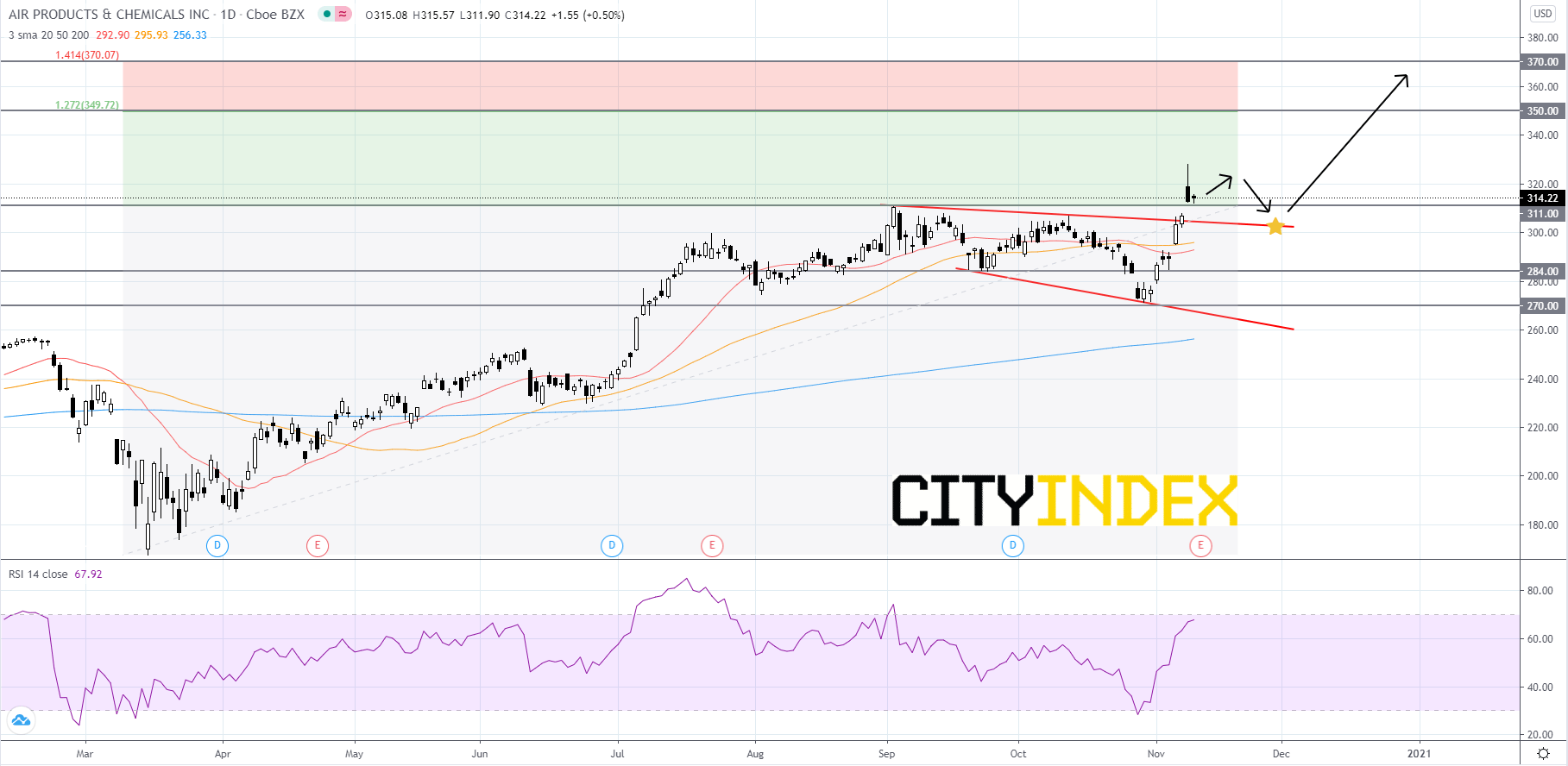

Looking at a daily chart, on Monday, APD's stock price broke out to the upside of a descending broadening wedge pattern and made a new record high of 327.89. The RSI is currently sitting just below overbought territory at 68. As long as price can stay over the upper trendline of the descending broadening wedge pattern, the short-term bias should remain bullish. If price continues to advance then its first Fibonacci target is 350.00, followed by 370.00. If price slips then trades should look to the upper trendline for support. If price falls below the upper trendline, then price could bounce off of the 284.00 support level. If price fails to be supported at 284.00 then its last line of defense is 270.00. If price falls below 270.00 it would be a bearish signal that could send the stock falling further.

Source: GAIN Capital, TradingView

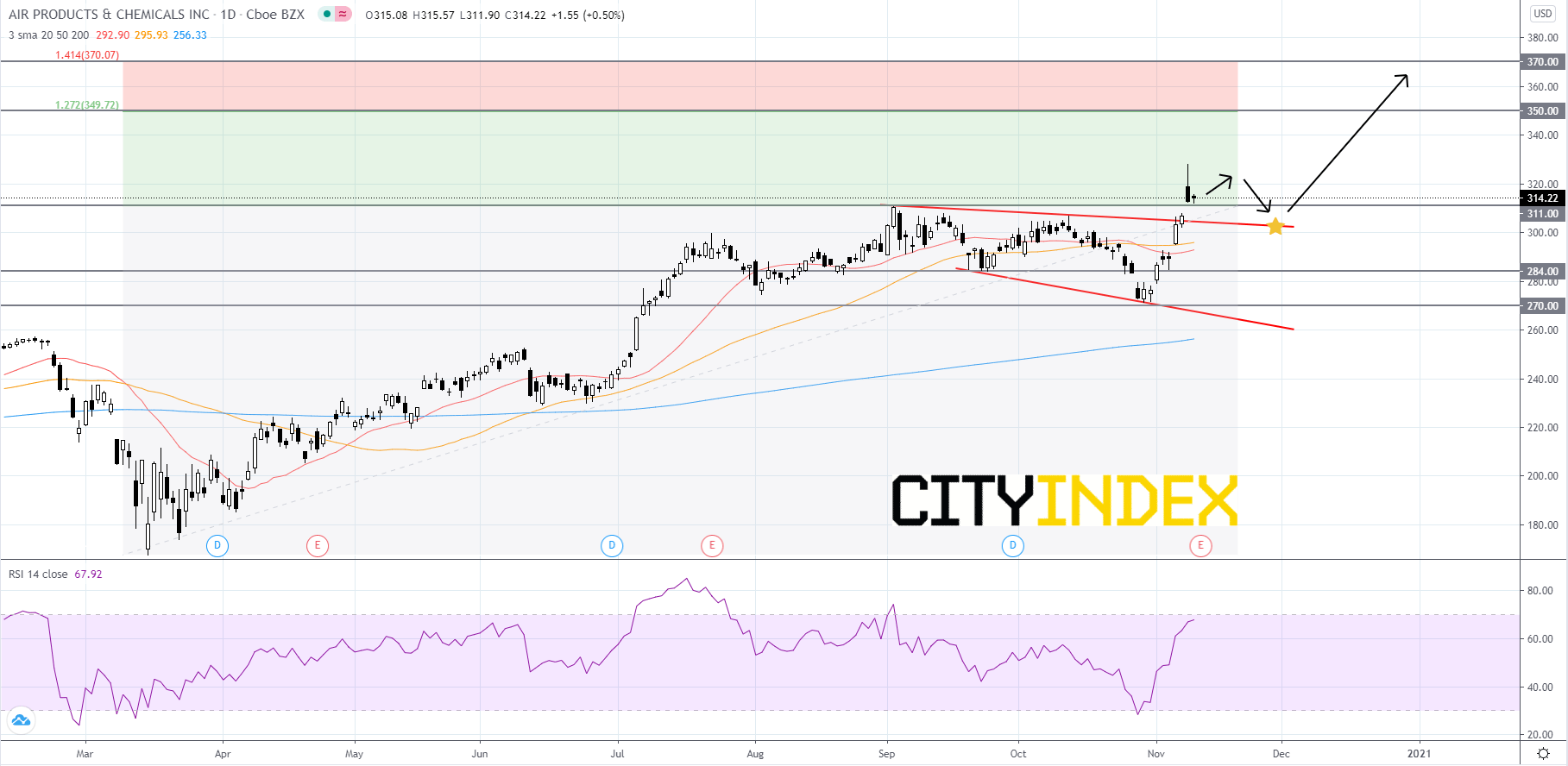

Looking at a daily chart, on Monday, APD's stock price broke out to the upside of a descending broadening wedge pattern and made a new record high of 327.89. The RSI is currently sitting just below overbought territory at 68. As long as price can stay over the upper trendline of the descending broadening wedge pattern, the short-term bias should remain bullish. If price continues to advance then its first Fibonacci target is 350.00, followed by 370.00. If price slips then trades should look to the upper trendline for support. If price falls below the upper trendline, then price could bounce off of the 284.00 support level. If price fails to be supported at 284.00 then its last line of defense is 270.00. If price falls below 270.00 it would be a bearish signal that could send the stock falling further.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM