Earnings Guidance will be Watched Closely

With Columbus Day today in the US and the US bond markets closed, many market participants have taken the day as a holiday. In addition, Canada is closed for Thanksgiving, Therefore, barring any dramatic tweets or headlines, this afternoon is likely to be a slow one for the US. However, it is the beginning of earnings season this week, and the most important number to watch for the markets will be earnings guidance. (For a preview of earnings season see HERE.) Earnings guidance is important for the markets because it tells us what companies, not outside analysts, think their future financial “numbers” will look like, including sales, spending, and economic outlook.

Banks are most likely to lower guidance due to unexpected lower interest rates (unexpected in a sense that at the last Fed meeting, members were discussing when to halt the “mid-cycle adjustment”). However, with most of the world in a global slowdown, earnings guidance from companies such as Boeing, Caterpillar, ExxonMobil, and Microsoft, will be heavily scrutinized. If earnings guidance is revised lower for many companies, it may pull stock indices lower.

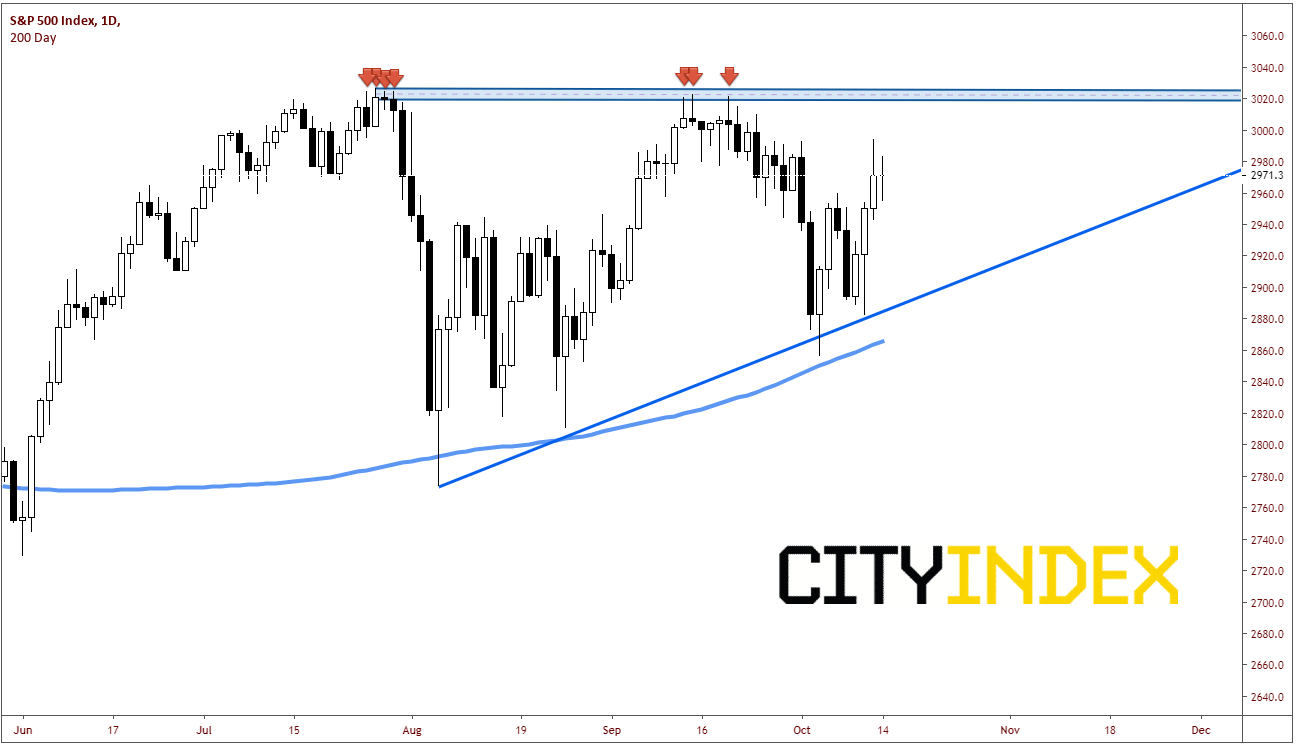

The S&P 500 is trading less than 100 handles from its all-time highs. Despite putting in three higher days in a row, the index is currently trading an inside day and a doji candle, a sign of indecision. Technically, there is strong resistance above at the highs between 3020 and 3027. Below, there is a rising trendline near 2900, as well as, the rising 200 Day Moving Average just below. Price has been putting in higher highs and higher lows since August 6th (hence the rising trendline). The price pattern appears to be an ascending triangle, and theoretically, should break out to the upside.

Source: Tradingview, City Index

However, IF earnings are guided lower, this may act as a catalyst to pull markets lower. And IF price breaks through the upward sloping trendline and the 200 Day Moving Average, the ascending triangle will be negated. On a weekly chart, we can see some of the downside targets that may be achieved:

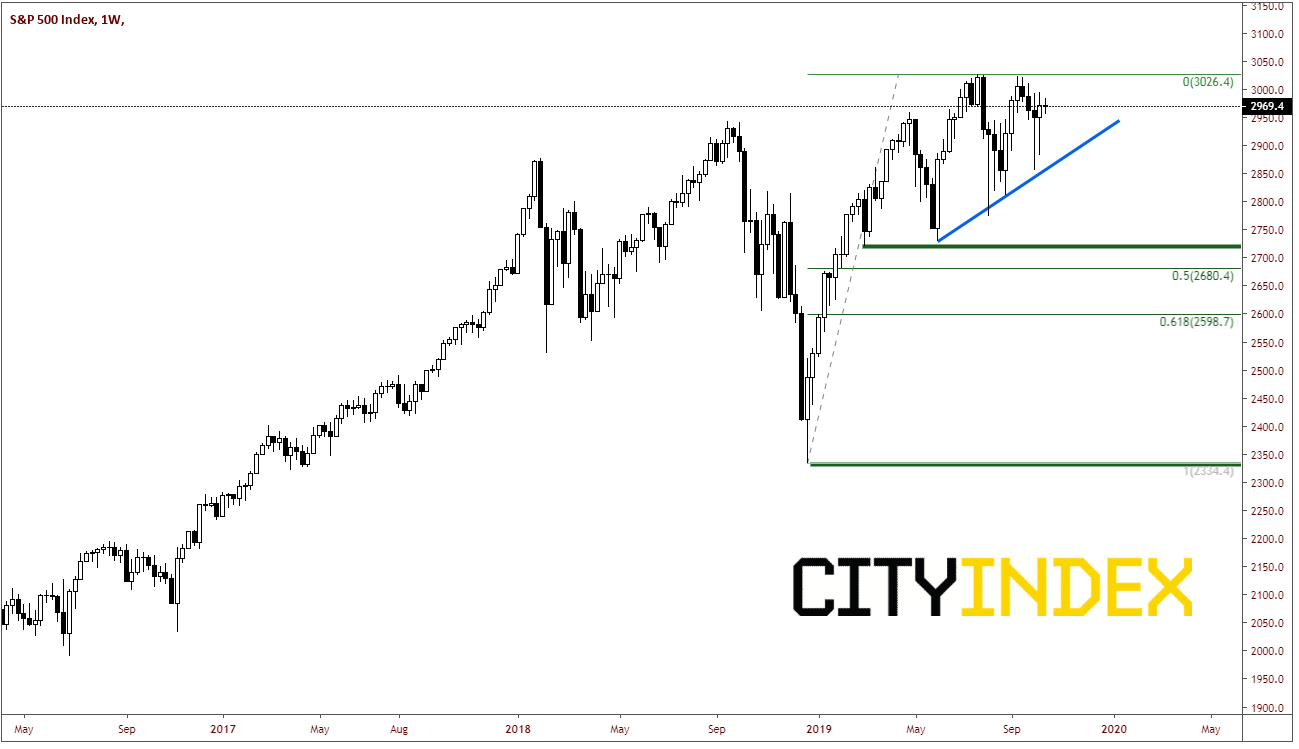

Source: Tradingview, City Index

There is horizontal support near 2720. Below that, we must look at Fibonacci retracement levels from the low on December 24th to the highs on July 29th for support. The 50% retracement of the move is 2680 and the 61.% retracement is bear 2600. Next level of support is the lows of December 24th at 2335.

Along with the obvious current themes of US-China trade wars and Brexit, earnings guidance must be watched as a catalyst for a move in stock indices. Just another thing to add to the radar, as traders need to be prepared for anything!!