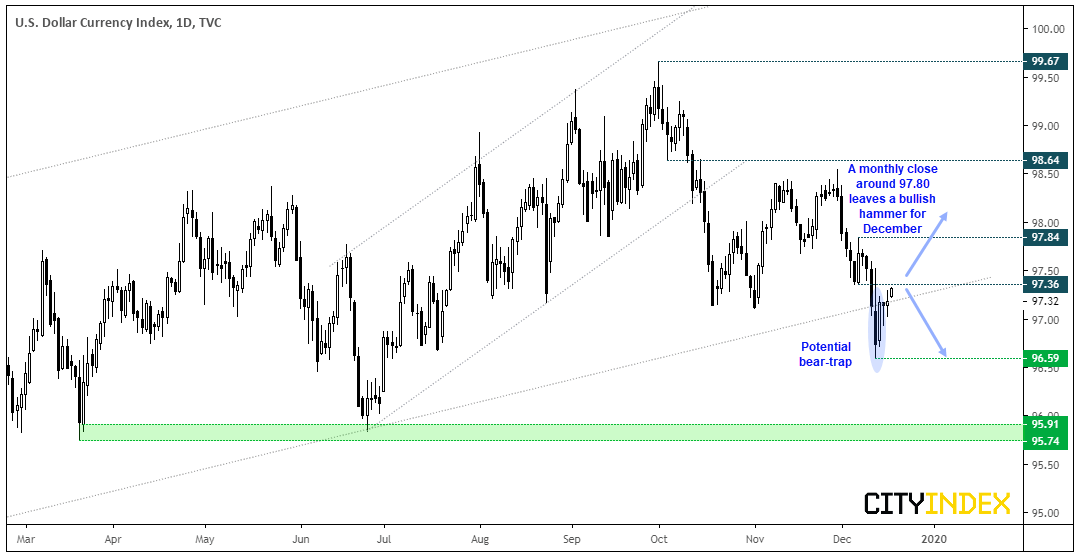

The difference between a bearish engulfing candle or bullish hammer on the monthly chart is to be decided over the remaining sessions for the year.

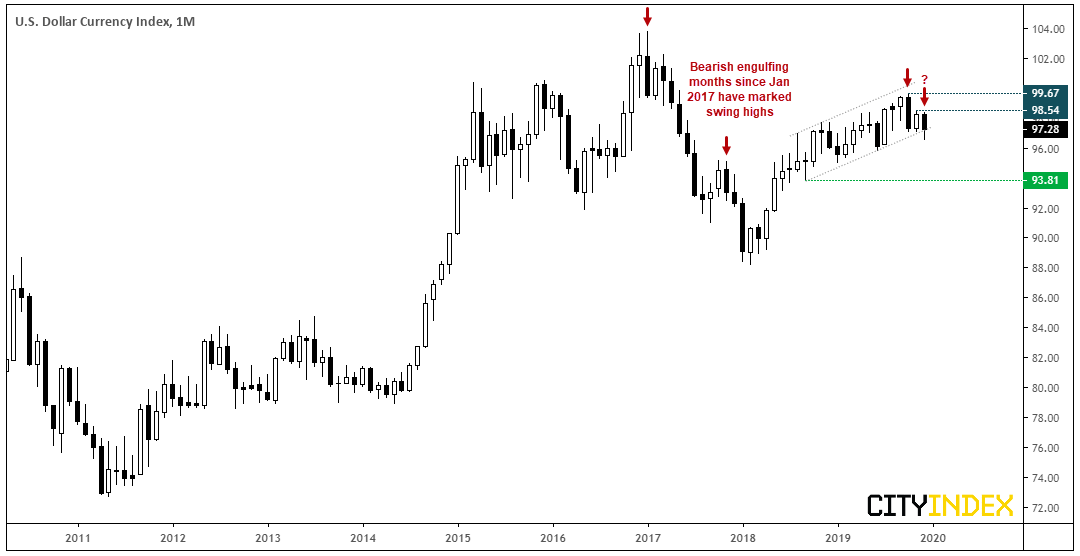

The US dollar is following its seasonal tendency of trading lower through the month of December. Currently around -1%, the USD index (DXY) is on track for a monthly bearish engulfing candle. If this is to occur following October’s bearish outside month (which was its worst month since Jan 2018), it adds weight to the potential that USD has topped out and could be headed lower next year. And this could be the case if the Fed continues to pump money into the money markets and / or launch (actual) QE4 in 2020. On a technical basis, it’s worth noting that the prior two bearish engulfing candles have marked tops on DXY.

However, if global growth fails to revive and the US outperforms the ROW as we saw this year, then we could indeed see a higher USD. Of course, this assumes that the Fed aren’t venturing into QE4 and step away from (not) QE. And then of course, there’s also the US presidential election to factor in. It’s arguable that Trump won’t want a higher USD as we’ll want decent growth figures through the campaign, and that a Democratic lead could also weigh on the dollar. So, there are clearly many moving parts to consider before we can declare whether we’re outright bullish or bearish on the greenback in 2020.

Its fine line between a bullish and bearish candle this month: On the daily chart there are signs of a minor rebound at the very least. Despite falling to a 5-month low and breaking its bullish channel on Thursday, a large bullish inside bar pulled it back towards the trendline and momentum is now starting to turn higher. If it can break above 97.36, the odds of a bear-trap increase and a break above 97.84 suggests its reverted back to its bullish trend. Assuming this occurs before month end, it would invalidate the potential bearish engulfing month and leave a bullish hammer in its wake for traders to mull over in January.

There’s not a huge amount of top tier data between now until the end of the year. Of course, some are worthy of a look such as initial jobless claims, final GDP, consumer sentiment and durable goods. But we may have to rely on outside events and / or month end flows to see the better dollar moves.