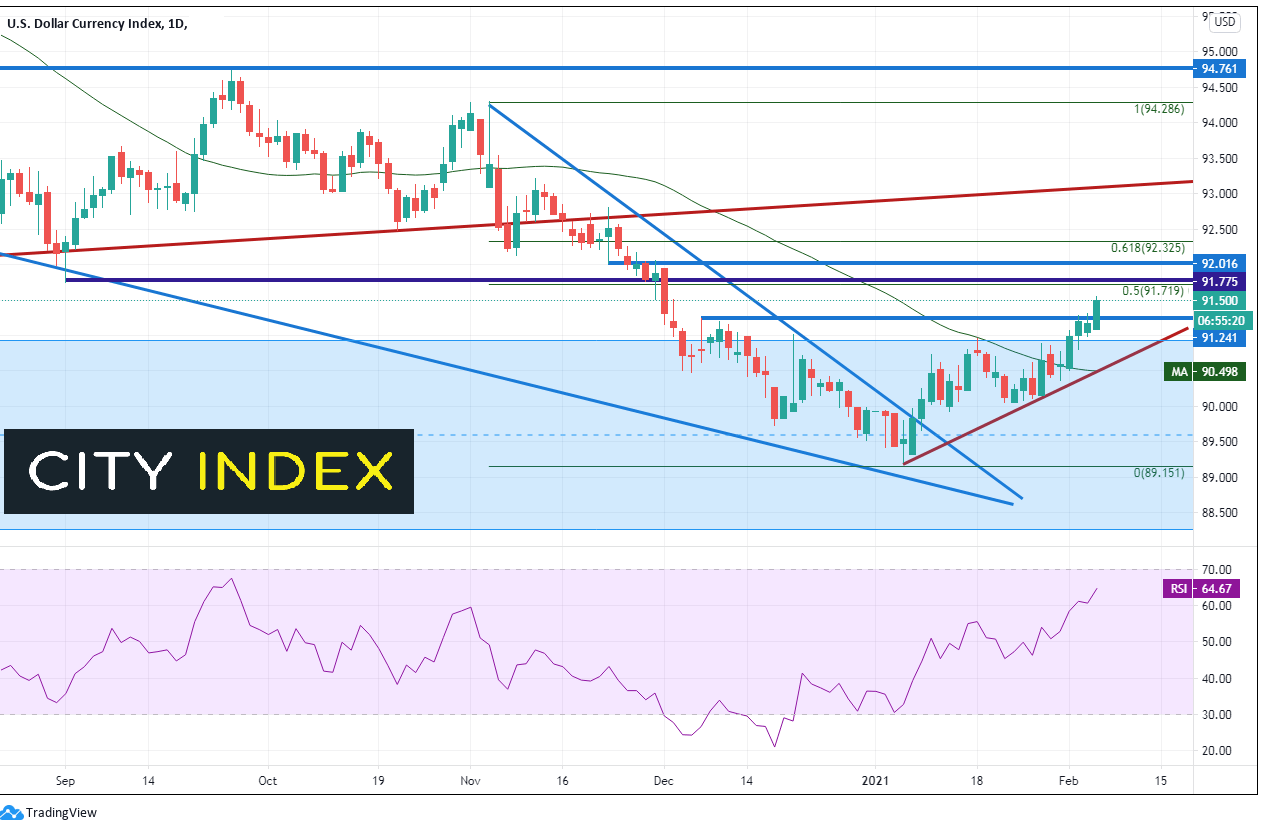

DXY continues higher! Where to next?

Earlier, we wrote that the DXY was holding key resistance near 91.50 and had pulled back after the BOE said they did not intend to give the impression to the markets that they would take interest rates negative. That didn’t last very long!! The US Dollar Index later broke higher(and XAU/USD pushed lower through the 1800 level!). Where can the DXY go from here?

On a daily timeframe the US Dollar Index moved out of the support zone on February 1st (light blue area). However, today the DXY moved above prior highs from December 7th, 2020 at 91.24. Resistance above is now at previous lows from September 1st at 91.73 . If price moves above there, the next resistance level is near 92.00. In addition to the psychological round number resistance, 92.00 is also the lows from November 23rd, 2020, as well as, the 50% Fibonacci retracement level from the highs of November 4th, 2020 to the lows of January 6th. Watch for bears to enter the market near this level! Above there, resistance is the at 61.8% Fibonacci retracement level from the previously mentioned timeframe, near 92.32. Support is back at the intraday breakout level of 91.24 where bulls will be looking to re-enter long positions and continue the move higher. Support below there is at 91.02.

Source: Tradingview, City Index

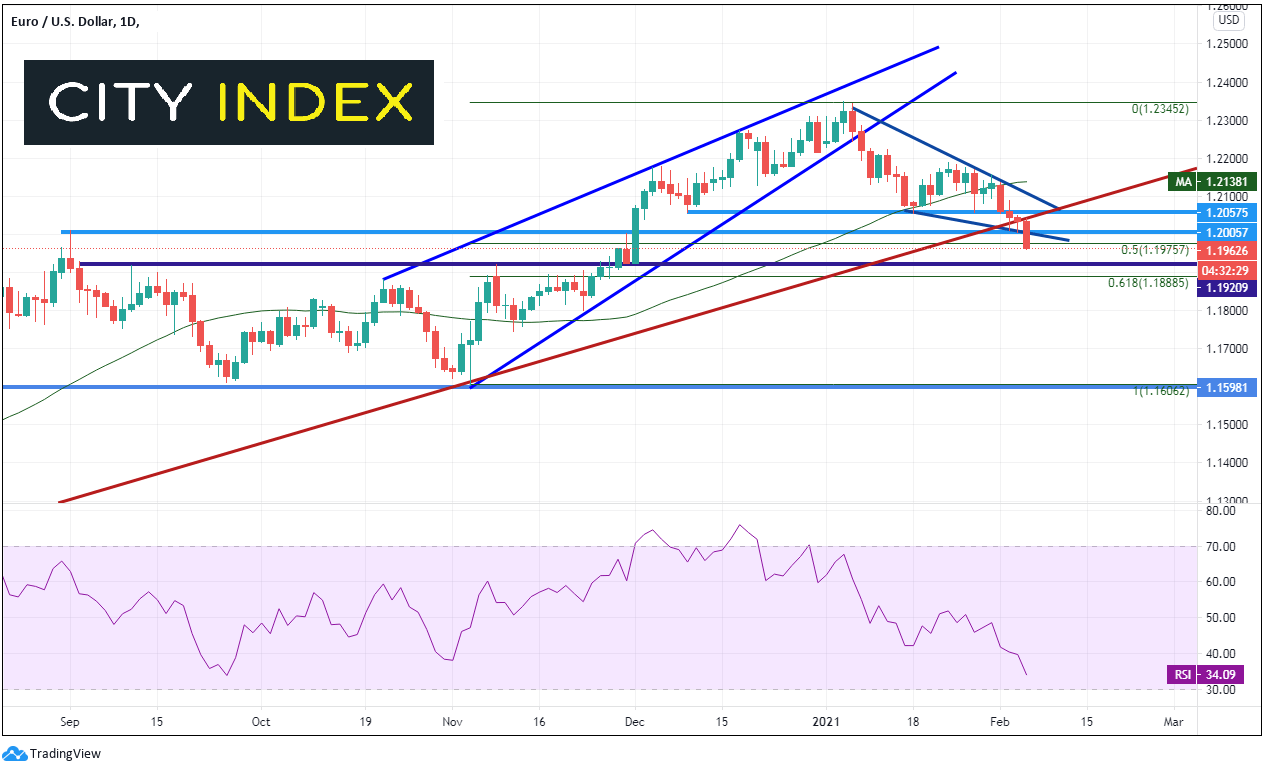

The Euro makes up 58% of the DXY. Therefore, a breakout higher in the US Dollar index is likely to affect EUR/USD the most. With today’s move in DXY, EUR/USD fell below some key support. The most notable support level was a weekly trendline dating back to May 2020 (red). Price also fell below previous resistance at 1.2011, a downward sloping trendline and psychological support at 1.2000 and the 50% retracement level from the lows of November 4th, 2020 to the January 6th highs at 1.1975. These levels all act as resistance now, where bears will be looking to enter the market to continue pushing the pair lower. Horizontal support below sits at 1.1920 and the 61.8% Fibonacci retracement level of the previously mentioned timeframe, near 1.1885.

Source: Tradingview, City Index

As the DXY has broken out today above 91.24, the index can quickly move towards 92.00. The main beneficiary from such a move would be EUR/USD. Watch for bears to continue to push the pair lower if it can bounce to the 1.1975/1.2000 level.

Learn more about forex trading opportunities.