Draghi Carney Lash at Bernanke 8217 s Taper

Both Draghi and Carney unleashed carnage in their own currencies as they warned against the growth repercussions of rapid rise in market interest rates. Said […]

Both Draghi and Carney unleashed carnage in their own currencies as they warned against the growth repercussions of rapid rise in market interest rates. Said […]

Both Draghi and Carney unleashed carnage in their own currencies as they warned against the growth repercussions of rapid rise in market interest rates. Said otherwise, both central bankers are concerned at their economies’ inability to handle soaring borrowing costs, stemming from Fed Chairman Bernanke’s candid assessment in suggesting that reducing asset purchases will begin this year.

ECB Finally Embarks on Forward Guidance

As central banks run out of tools (zero interest rates), the dependence on words and semantics increases. And as ECB rates linger at zero, the ECB finally issues forward guidance, borrowed a phrase long used by the Fed in stating: “monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates to remain at present or lower levels for an extended period of time.”

Draghi described the step on forward guidance as “unprecedented”.

Why so Dovish?

Draghi’s usual reference to low inflation was highlighted via “subdued monetary dynamics” as well “broad-based weakness in aggregate demand”. But the decision to resort to forward guidance in ensuring rates remain low is the verbal equivalent of announcing Outright Monetary Transactions, whose goal was to rein in soaring Spanish and Italian bond yields.

As important as it is for the ECB to stimulate the macroeconomy, Draghi’s chief priority remains stabilizing sovereign borrowing costs, with particularly Italy’s €2.0 trillion sovereign bond market. Draghi had little choice to contain advancing yields stemming from Bernanke’s tapering comments and Portugal’s political instability. Portugal’s 10-year yields hit the 8.0% level for the first time since 7 months, posting 7 straight weekly advances-the longest in 3 years.

Carney Makes his Mark

GBPUSD fell more than 2 cents, posting its biggest decline in 18 months after the Bank of England introduced a change under its new governor Carney by releasing a statement on the economy, accompanying the usual announcement on interest rates and asset purchases. The statement was unusually dovish, indicating: 1) economic slack expected to continue for some time; 2) rising market rates weigh on outlook; 3) inflation should fall back further out.

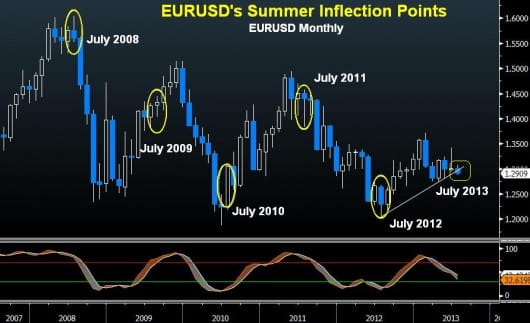

The statement aimed at alleviating the run-up in yields, emerging from improving economic data as well as similar moves in global bond yields. While we expect EURGBP to extend advances to 0.88, the path to 1.2770s in EURUSD, suggests 1.45 is a viable target by year-end.