Canary row

If Dow Transports are the canaries in the Trump-trade coal mine, their song may be deceptive right now as they’re outperforming their larger cousins.

There’s some logic to the notion that the Dow Jones Transportation Average’s role of leading indicator will be enhanced whilst the ‘reflation trade’ still has legs. Although the fundamental underpinnings of equity and fixed income yield reflation have been widely criticised as nebulous, rising demand for transportation and distribution services would indeed go hand in hand with the potential economic boom on which ‘Trumpflation’ is predicated. Backing that view, it’s notable that DJTA, the gauge of twenty of America’s largest logistics, railroad, airline and distribution stocks, is having its best week so far this month. It is up some 3% from Monday lows despite trading 40 points lower on the day, as I write. Its more widely followed cousin, the Dow Jones Industrial Average, is up about 1%.

The DJ tag team

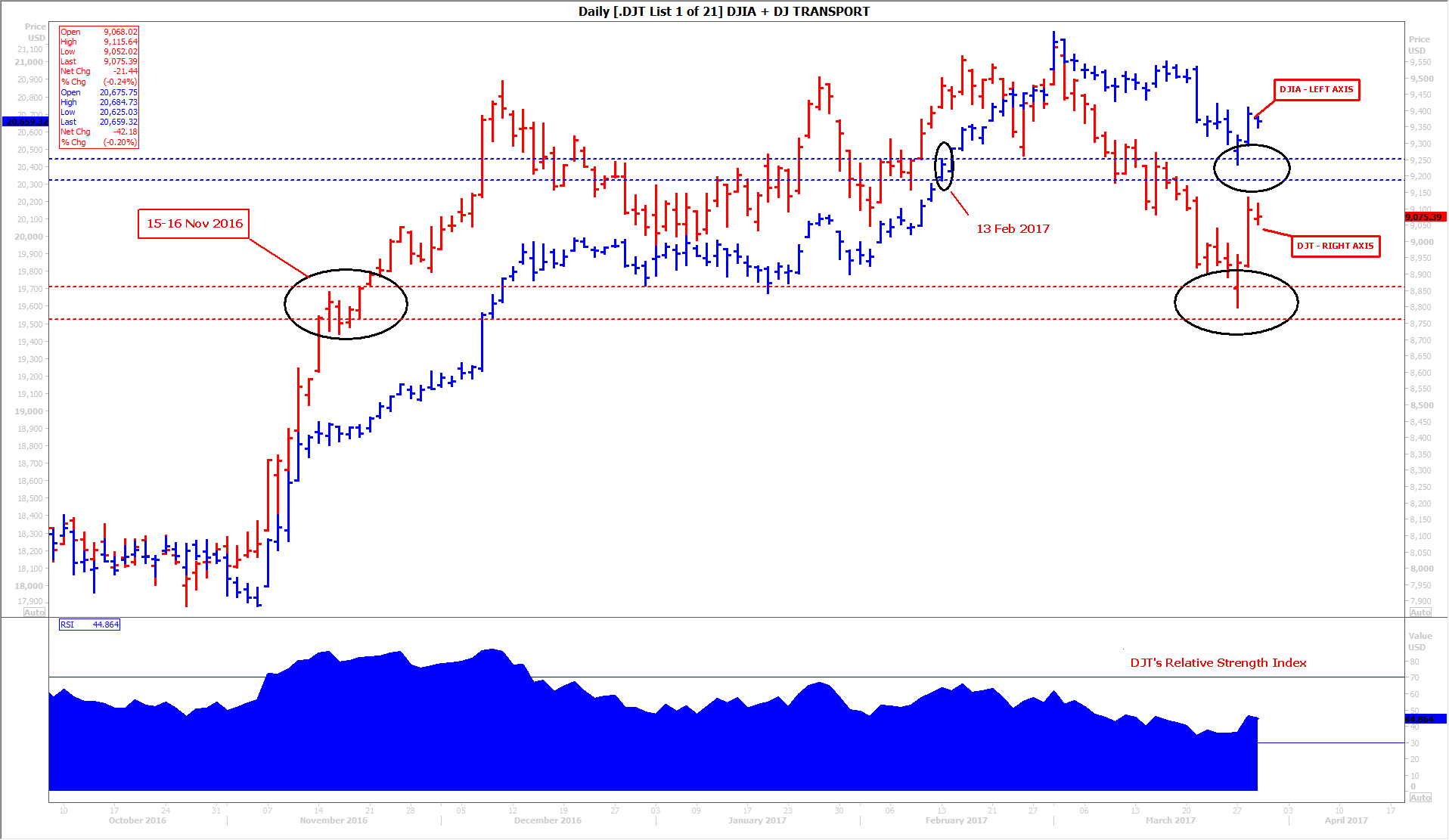

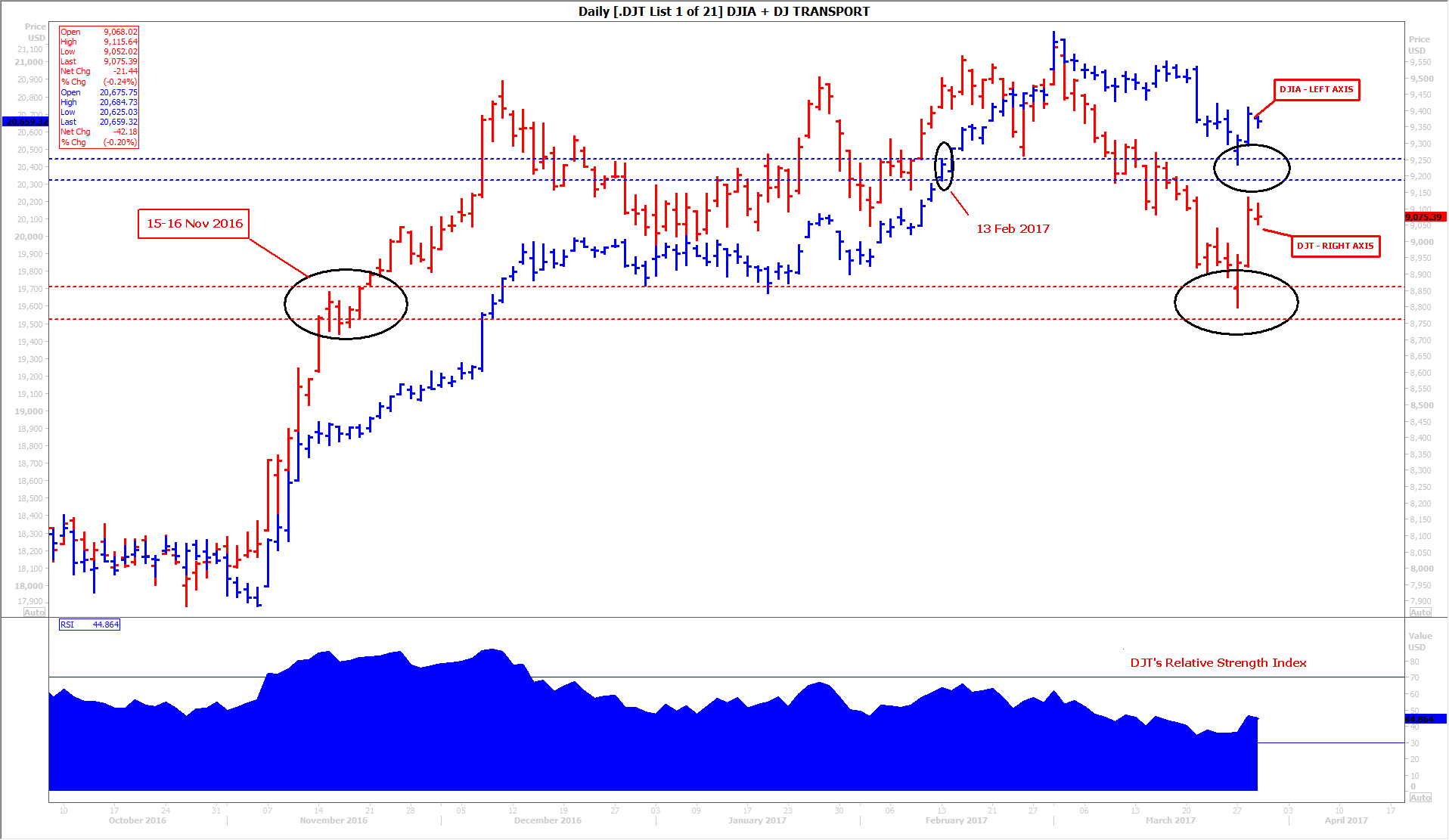

Still—the older and broader tenet of Dow Theory—that DJTA must promptly confirm DJIA highs and lows for a prevailing move to be sustained—is intact. The implication right now is that DJTA is going a step further and actually leading the Dow, suggesting DJIA could even extend this week’s rebound. Having found support at previous resistance levels, both DJIA and DJTA steadied earlier in the week, after careering lower last Friday and on Monday, in the wake of the Trump administration’s failed healthcare push. The Dow steadied at levels established in February whilst Transports found a floor at a consolidation zone eked out in mid-November. The supports have proved to be solid nonetheless: so far, so good.

CSX backslide

The main cautionary element at play is that Transports are echoing the relatively small cohort of DJIA stocks that powered it to recent milestones. It was CSX Corp, the railroad-to-real-estate giant that accounted for the bulk of DJTA’s Trump-trade gains. CSX rallied 53% between 8th November and 1st March, against DJTA’s 15% rise. And CSX is still 31% higher since January, dwarfing rises of no more than 5% by DJTA/DJIA in the year to date. In theory then, narrow participation leaves Transports just as exposed to risk of a broad pullback as DJIA, particularly with CSX down more than 4% over the last month, and other key components, FedEx and UPS, slipping by similar amounts. With U.S. shares again on a mild retreat as I write, investor caution since last week’s correction remains evident. The continuing recoil of previous leaders does little to encourage the early return of an outright bull case.

DAILY CHART: DOW TRANSPORTATION AVERAGE AND DOW JONES INDUSTRIAL AVERAGE

Source: Thomson Reuters and City Index / Please click image to enlarge