Today it’s on, but yesterday it was off.

The so-called ‘Trump trade’, responsible for ‘reflating’ the dollar, U.S. Treasury yields, and triggering a string of U.S. stock market records, needs no further introduction. Trouble is, wheels keep falling off the wagon.

Remember the oil sector rally? Well, it looks like it’s hiding. Or it might be over for all intents and purposes. The S&P 500′s energy sector under performs the index right now, leaving it down some 5% since December 31st 2016.

That’s in step with a similar slippage of Nymex crude oil futures, tracking a frustrating lack of significant inventory depletion (underscored by the EIA’s latest update on Wednesday). True, shale oil boomed before Trump. But the speed at which oversupply worries have eclipsed hopes of refuelled American demand is telling.

One leg down, several to go too, perhaps. For instance, another Trumpflation sector, financials is still gaining, albeit marginally. It’s S&P 500 sector index is up just 0.4% this year. It rallied hard into 2016 year end but then drifted lower.

Some sort of finreg reform remains on the cards after one of Trump’s well-publicised all-day briefings with bulge-bracket head honchos last week.

(The latest such powwow on Thursday is lifting airline stocks.)

But finreg reform plans are still sketchy, to say the least.

There’s more Trump behind the latest bid-up phase across the board for stocks on Thursday. That includes the 20K-plus Dow Jones Industrial Average, which Trump has claimed as his own.

The largely symbolic index of handpicked stocks is having one of its best days since mid-December, having only managed a handful of sessions to date when it’s risen more than 0.5%.

The one running right now coincides with a set of more emollient comments from the President and his lieutenants. On Thursday, Trump finally sent a letter to China’s President Xi Jinping, having not spoken directly to the premier since taking office. Now, Trump “looks forward to working with President Xi to develop a constructive relationship that benefits both the United States and China,” the letter said.

It contrasts with the animosity colouring many communications to and about supposed ‘currency manipulator’ China for months.

All this comes ahead of a closely eyed meeting between Trump and Japan’s Prime Minister Shinzo Abe on Friday. Hopes are running high after a Japanese official said Abe would propose new cabinet level U.S.-Japan talks on trade, security and macroeconomic issues, including currencies.

Such talks might smooth over a lot of ground which the new U.S. administration has indicated is contentious, even with one its more favoured trading partners.

Traders are also pointing to reports of a meeting between the President and the CEO of motorbike maker Harley Davidson, Matt Levatich.

Citing a potential cut of the current 35% corporate tax rate to 20%, Levatich said Harley stood “to benefit from the potential border adjustment to the tax code, which is being debated on Capitol Hill and would exempt U.S. corporate revenues from tax, but at the same prevent companies from deducting the cost of imported goods and services.”

Great for U.S. megacorps, though why are we having to get our updates on policy progress in snippets from tough-to-corroborate news reports?

Like those of Harley’s CEO, investors’ best hopes will ‘run on empty’ ignoring the risk that most of the ‘Trump-flation’ policy agenda is up in the air.

U.S. stocks are up in the air too, at least for today. Though the fiscal renaissance + tax cuts that could keep them aloft for the longer term are still hot air.

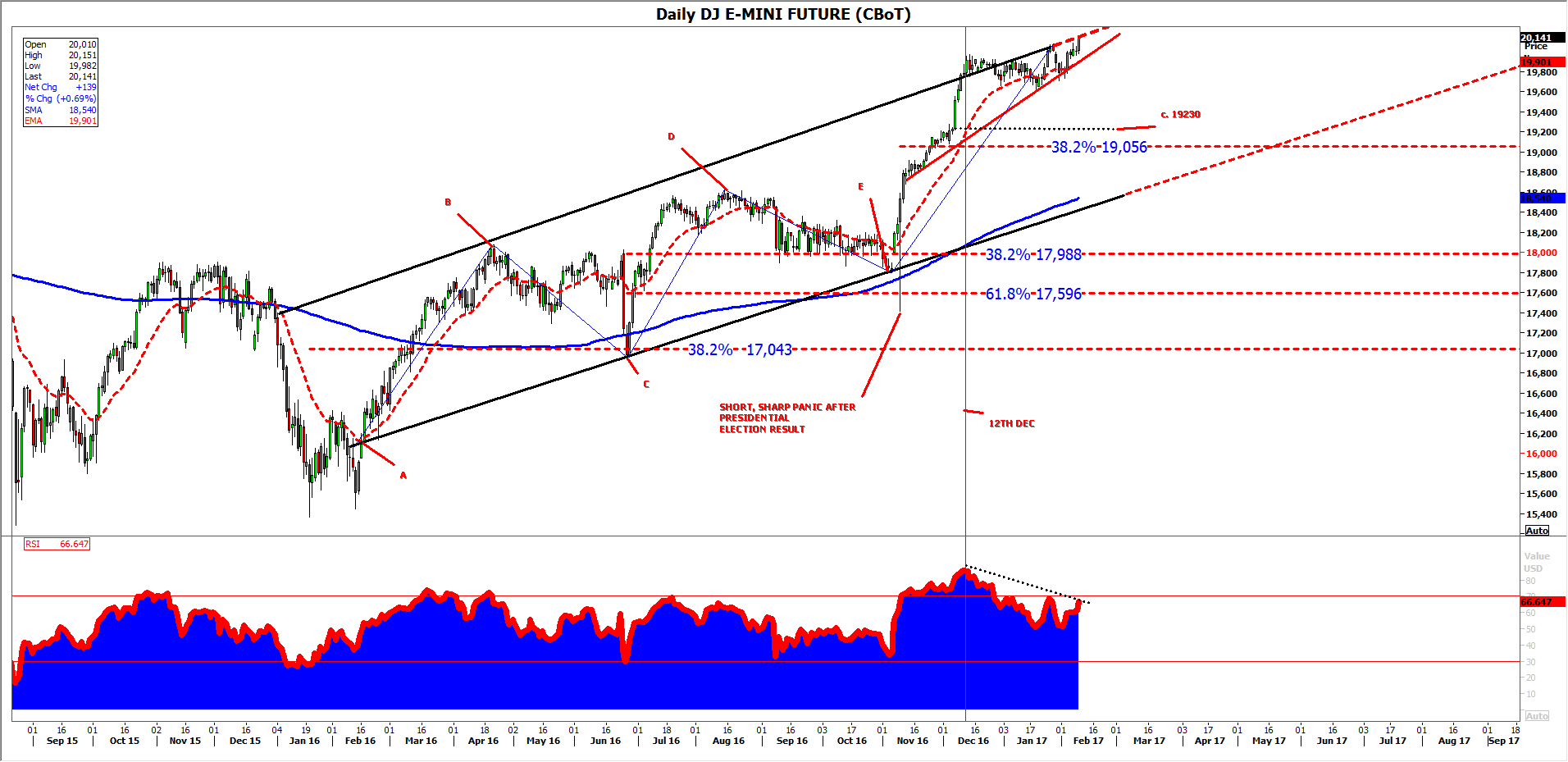

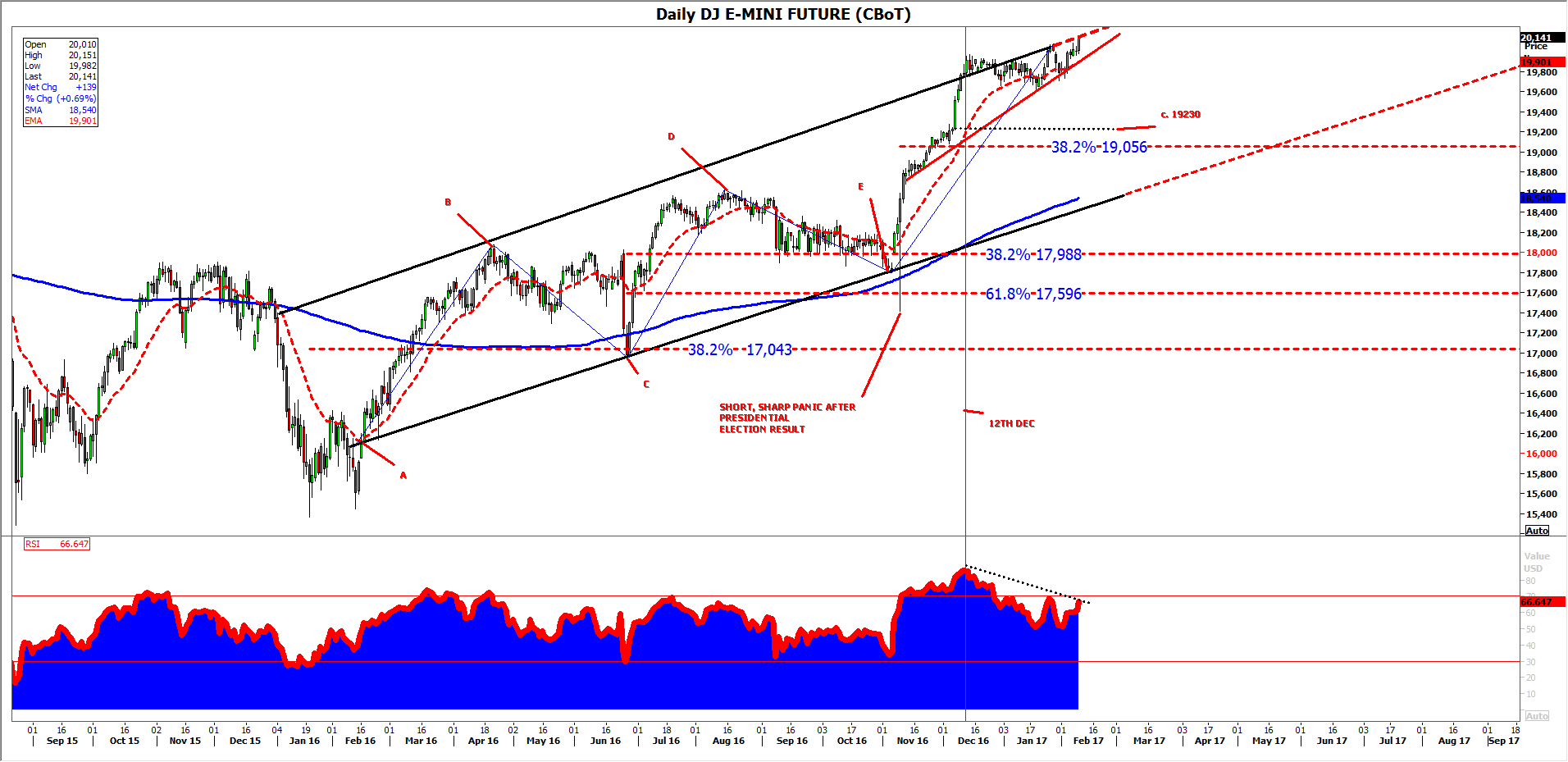

Technically speaking, our familiar Dow chart shows its advance since January last year continues.

The rise began on the back of unequivocal improvement in America’s economy, particularly the labour market.

It continues on the back of the unequivocal sustained strength of America’s economy, particularly the labour market.

The Dow is still setting new highs. Potentially bearish divergence is still visible to the naked eye (RSI).

The market is still strongly supported despite the momentum signal by its clear trend within the channel (red line) since November.

The structure is triangulating though. The upper bound of Dow’s standard deviation over the last year is helping to form a rising wedge.

So long as the channel continues to be respected, that bearish wedge will remain valid.

Combined with divergence the breakout which typically follows is likelier to head lower instead of higher.

DAILY CHART: DOW JONES FUTURE

Source: Thomson Reuters, City Index / please click image to enlarge