Dovish BOC Sends USD/CAD Soaring

The Bank of Canada met earlier today and left its benchmark interest rate unchanged at 1.75%, as expected. However, the dovish statement which accompanied the decision sent USD/CAD higher by nearly 100 pips as the Central Bank removed the description of interest rates as “appropriate”. The BOC also showed concerns about recent weak data and expressed concerns as to whether it was tied to the domestic economy or the world economy. In addition, they cut the near term GDP for 2020 to 1.6% from 1.8%, while raising the 2021 forecast to 2.0% from 1.8%. Combine this with release of the poor CPI data this morning and is was a recipe for disaster for the Canadian Dollar. (CPI MoM for December was 0.0% vs 0.1% expected. Core CPI YoY was 1.7% vs 1.9% expected).

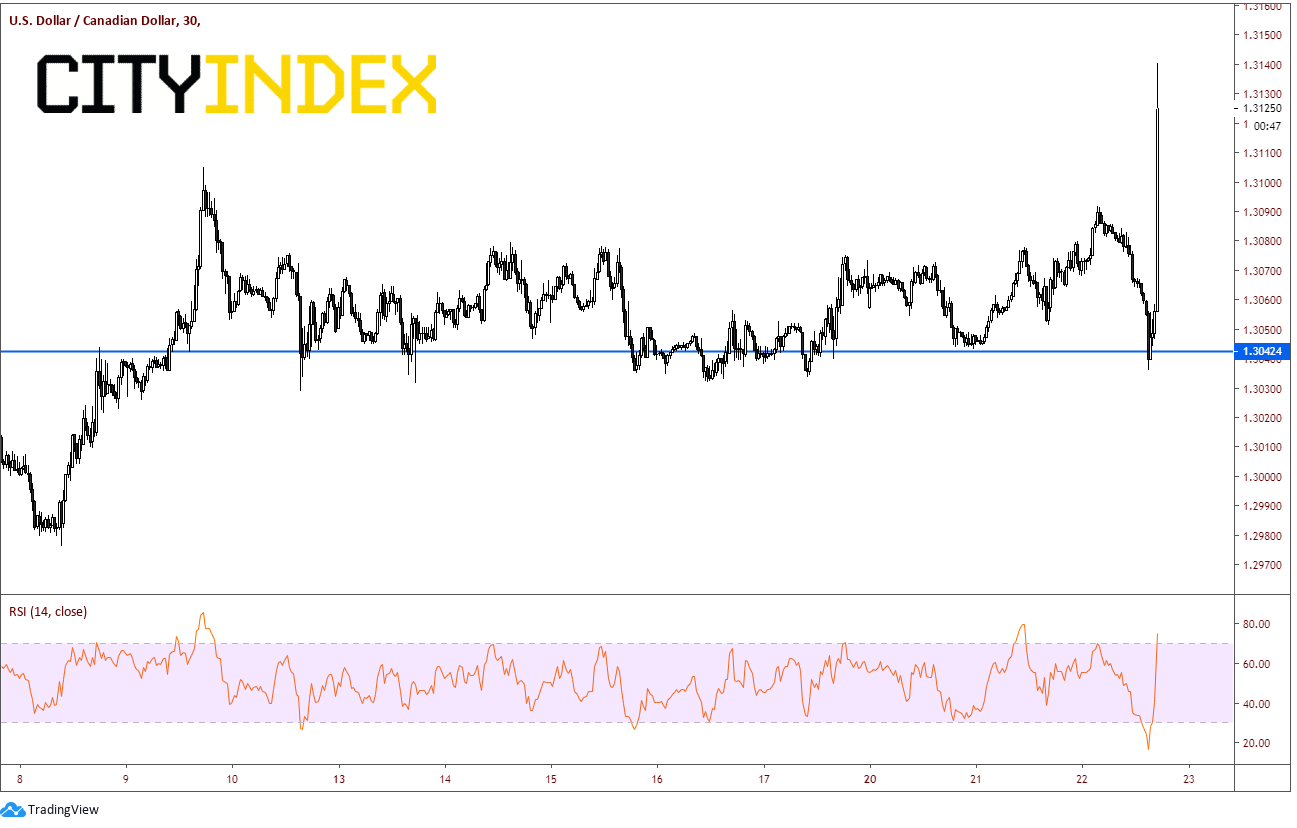

Upon release of the statement, USD/CAD pairs took off like a bat out of hell. The possibility of this move was discussed yesterday in our BOC preview.

Source: Tradingview, City Index

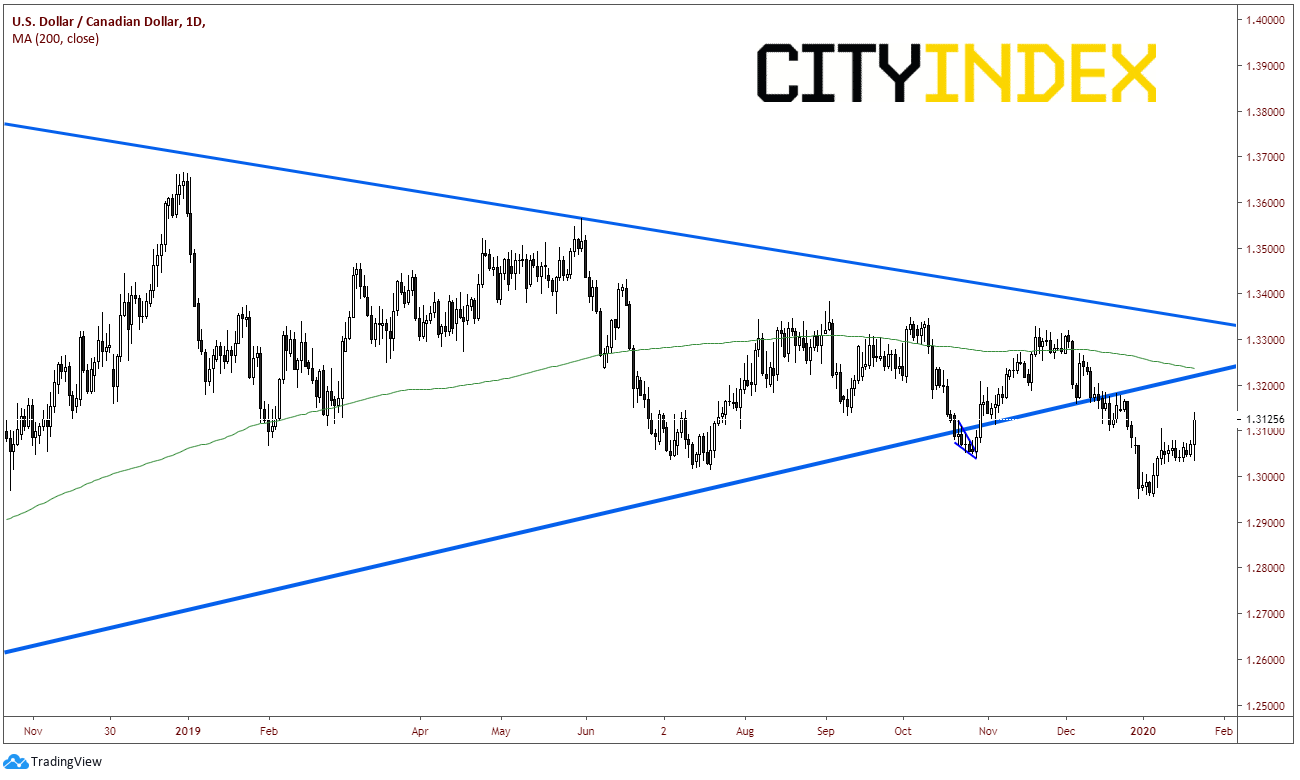

Previously the BOC had been quite neutral, one of the few Central Banks to remain so. USD/CAD had recently broke lower out of its long-term symmetrical triangle on a daily timeframe. With the move higher today, the pair is looking to test the underside of bottom trendline and the 200 Day Moving Average, which converge near 1.3220. A break above here would indicate a false breakdown and could lead to a test of the upper trendline near 1.3330.

Source: Tradingview, City Index

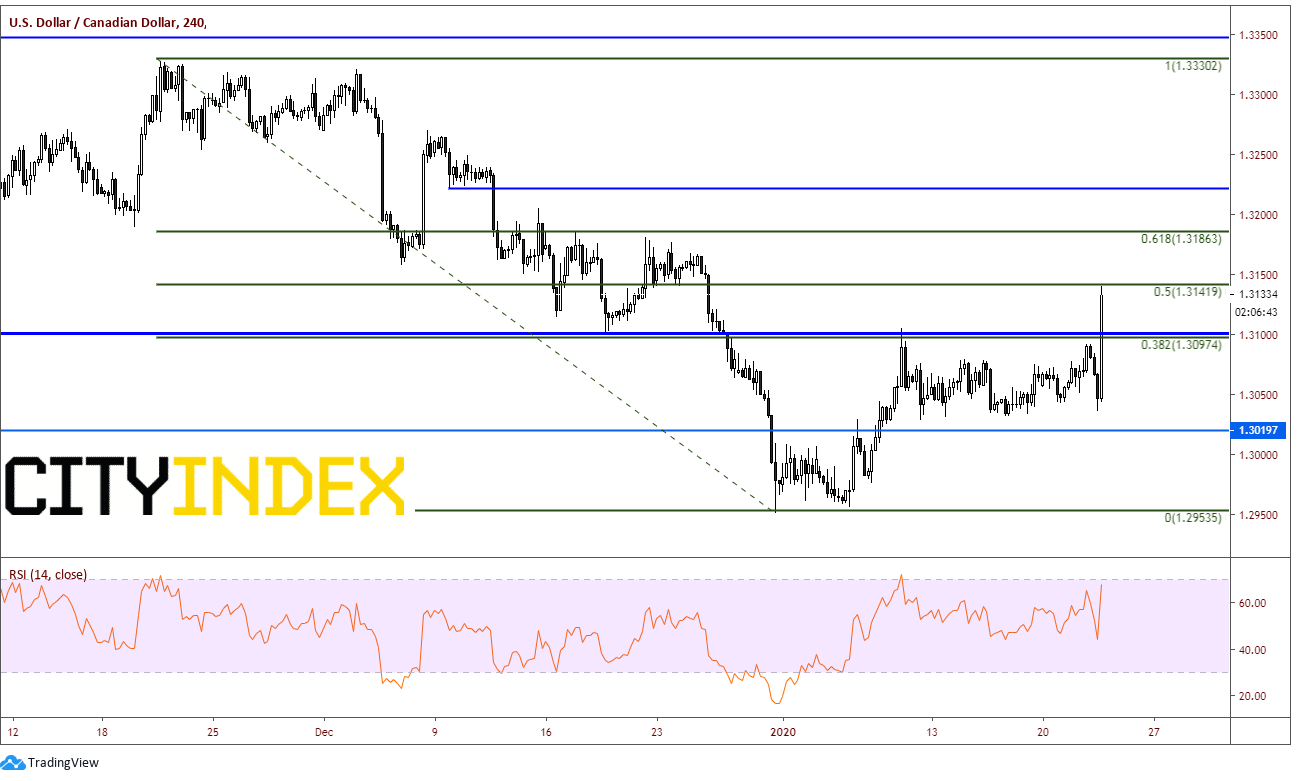

On a 240-minute timeframe, the pair moved to the 50% retracement level from the highs on November 19th, 2019 to the lows on December 31st at 1.3142. Resistance crosses above at the 61.8% retracement level of the same time period near 1.3186. There is also horizontal resistance near 1.3230, which confluences with the previously mentioned 200-day moving average and the long-term trendline. Support now is at previous highs near 1.3100, as well as horizontal support near 1.3020, before returning to the December 31st lows at 1.2954.

Source: Tradingview, City Index

On Friday Retail Sales for November will be released. 0.4% is expected for the headline vs -1.2% last. In addition, next week we will see GDP and PPI. The Bank of Canada doesn’t meet again until March 4th. If the data over the next 1 ½ months continues to remain weak, the BOC may be ready to cut rates (if not before then!).