Double Whammy for CAD/JPY

The CAD/JPY has taken a big hit this week due to both a weakening Canadian Dollar and a stronger Japanese Yen. The continued hit to Canadian data, this time in the form of weaker inflation data, and the dovish tone of the BOC this week have caused the Canadian Dollar to move lower. In addition, the flight to safety amid concerns of the coronavirus spreading around the global has given strength to the Japanese Yen. As a result, the CAD/JPY is down over 1% on the week so far.

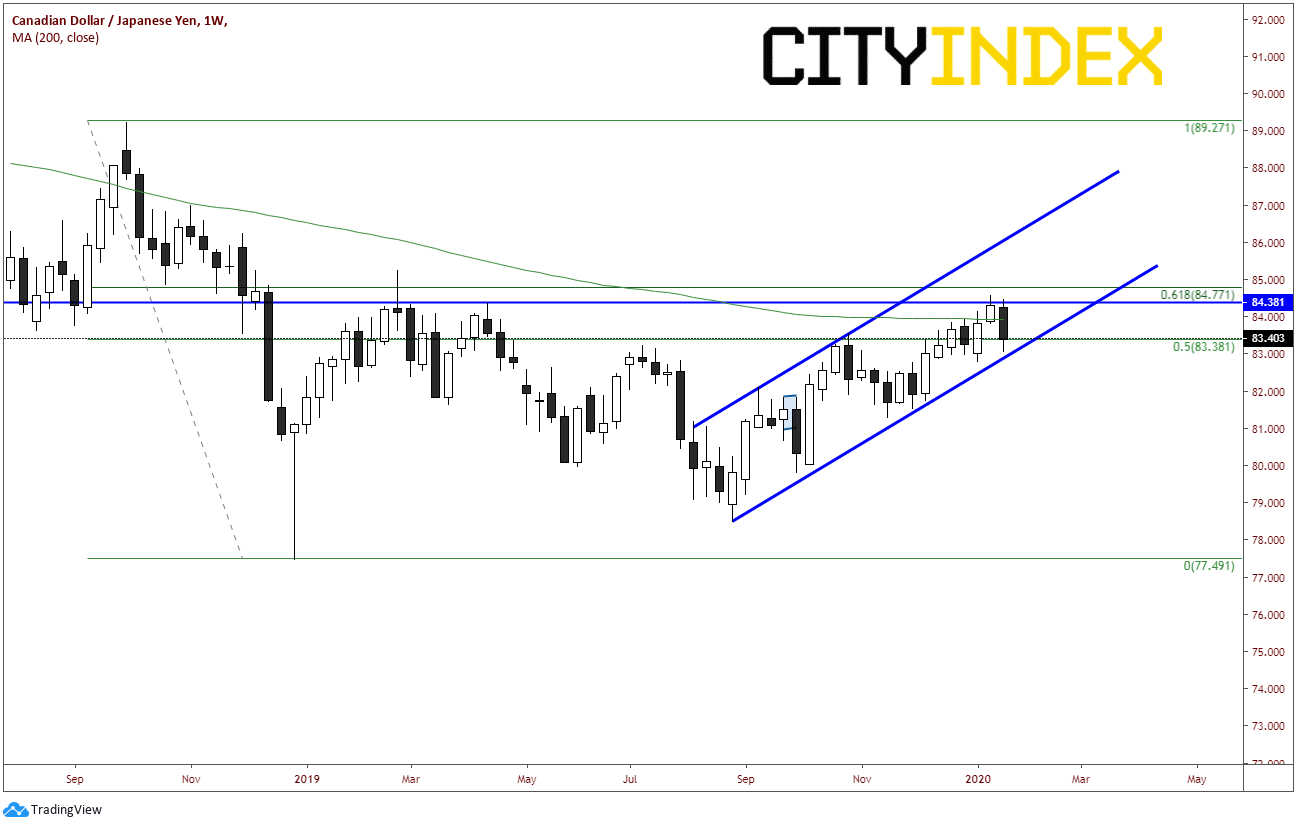

On a weekly chart, CAD/JPY has been in an upward sloping channel since the week of August 26th. Last week, the pair tested, and failed, horizontal resistance, the 200 Day Weekly Moving Average, and the 61.8% retracement from the highs on the week of October 1st, 2018 to the January 2nd, 2019 Yen flash crash lows near 84.40/84.80. In addition, price has gone down and tested the bottom trendline of the upward sloping channel near 83.00. The trendline is holding so far.

Source: Tradingview, City Index

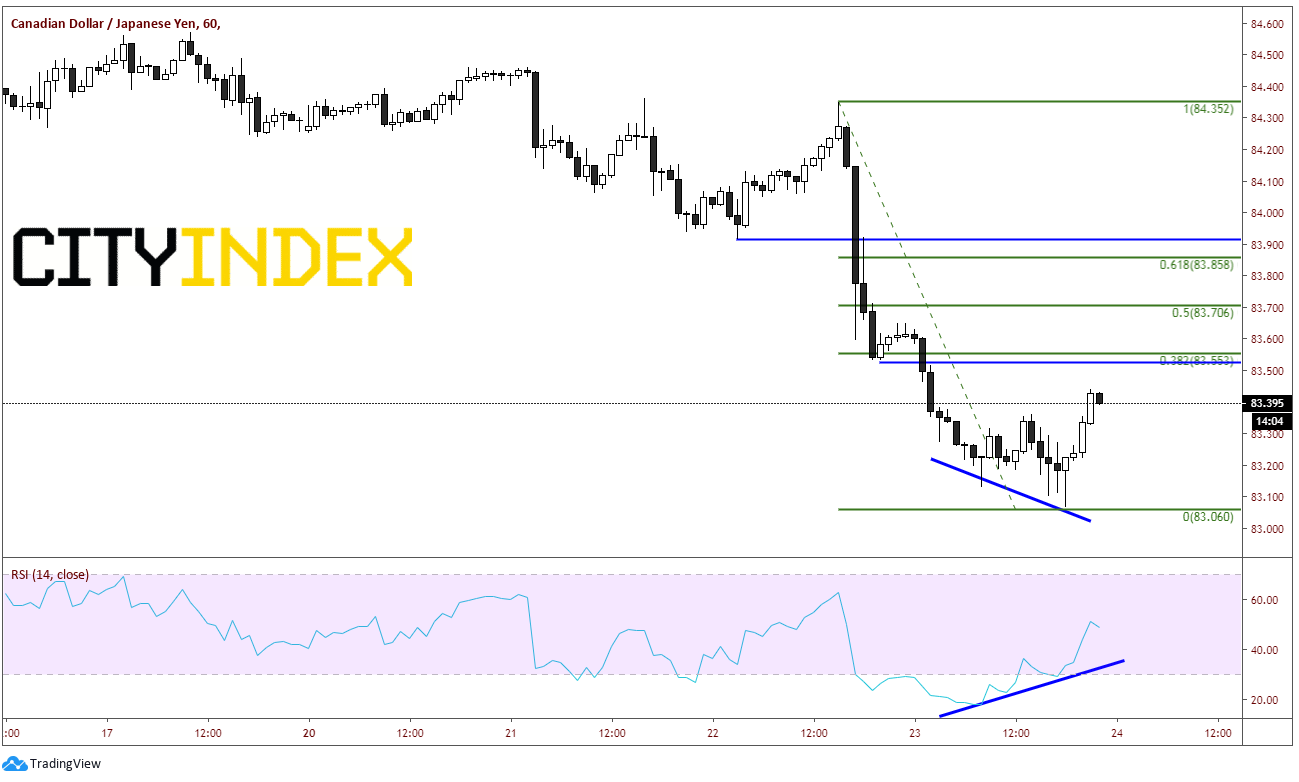

On a short-term 60-minute chart, we can see how much of the weekly move came after yesterday’s dovish BOC rate decision meeting. As CAD/JPY traded lower to near the weekly channel line, price began to diverge with the RSI, and the pair put in a hammer candlestick formation off the low. This was a sign the pair may be ready for a bounce. So far, CAD/JPY bounced slightly but hasn’t been able to take out the horizontal resistance or 38.2% retracement level from the highs before the BOC to today’s hammer how, which is hear 83.50. The 50% retracement level comes across at 83.70, and horizontal resistance and the 61.8% retracement level is neat 83.85/83.90. Support comes in at the day’s lows and the weekly rising channel trendline near 84.00/83.05.

Source: Tradingview, City Index

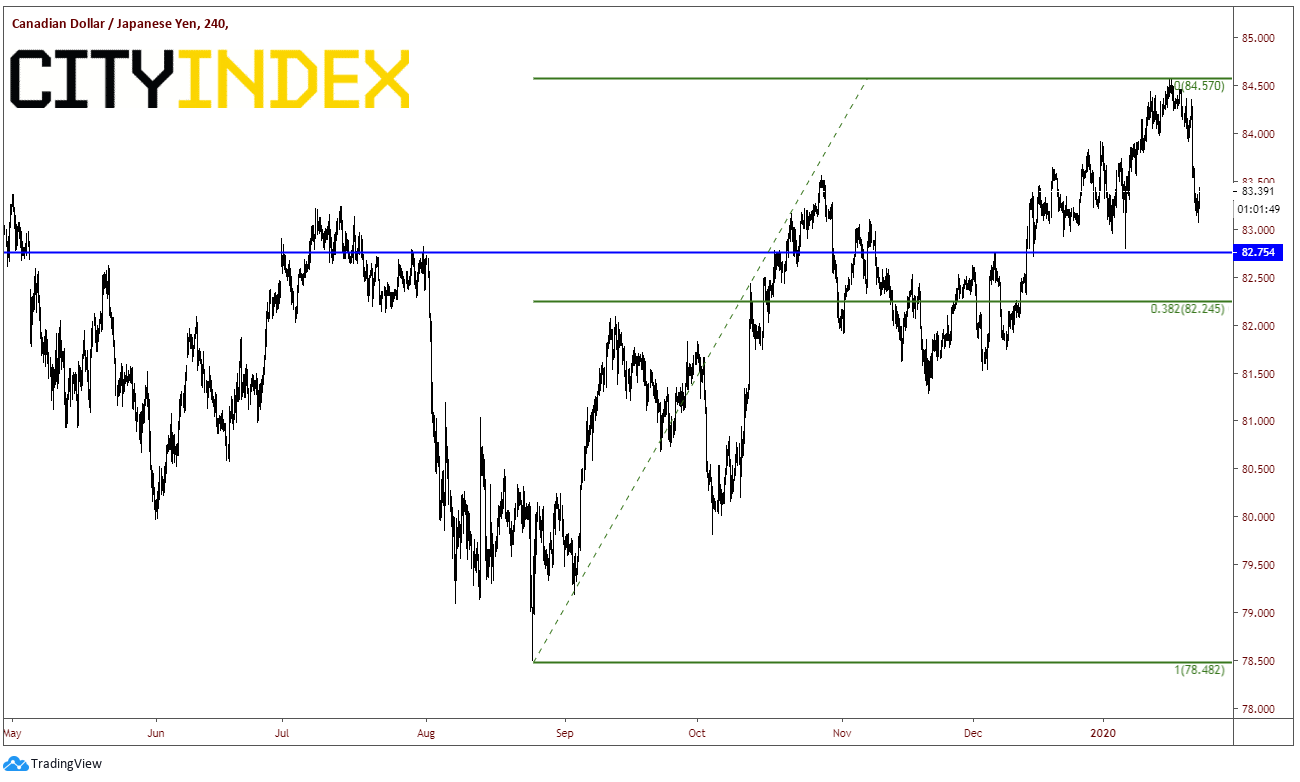

Below that, horizontal support comes in at 82.75 on a 240-minute timeframe, and they the 38.2% retracement level from the August 23rd, 2019 lows to the January 17th highs near 82.25.

Source: Tradingview, City Index

If there continues to be more verified cases of the coronavirus the Yen may continue to strengthen. In addition, on Friday Canadian Retail Sales for November will be released. Expectations for the headline number are 0.4% vs -1.2% last. If the Canadian data is worse than expected, the Canadian Dollar may continue to weaken. This could be a dangerous combination for the CAD/JPY.