A double blow for the AUDUSD this morning as the FOMC delivered what at first glance appears a “hawkish cut”, followed by a mixed Australian labour force report for August.

As expected, this morning, the FOMC lowered the federal funds target range by 25bp to 1.75-2%. The statement affirmed that the Fed would “act as appropriate to sustain the expansion” and offered little else in the way of guidance for future rate cuts.

The lack of guidance and the all-important dot plots that showed only 7 of 17 members forecast another rate by year-end were less dovish than hoped. However, the likely makeup of the vote is important. Of the 7 members who voted for another rate cut in 2019, three are likely to be key voting members and Fed leaders Powell, Clarida and Williams.

Hence assuming there is no significant easing of U.S.- China trade tensions and the growth outlook remains uncertain into year-end, it is highly likely the Fed will cut rates again either in October or December, cemented by a vote of 7-3 or even 8-2.

Locally this morning’s Australian labour force report showed employment growth of +35k vs market consensus of +10k and the participation rate reached a new high of 66.2%. The key narrative though was the rise in the unemployment rate to 5.3%, joined by a rise in the underemployment rate to 8.6% confirming spare capacity remains in the labour market.

Spare labour market capacity and rising unemployment is a key concern of the RBA. Furthermore, it acts to keep wage growth stagnant and limits the ability of inflation to return to the 2-3% target band. Enough reasons then for the RBA to cut rates again this year, most likely in November.

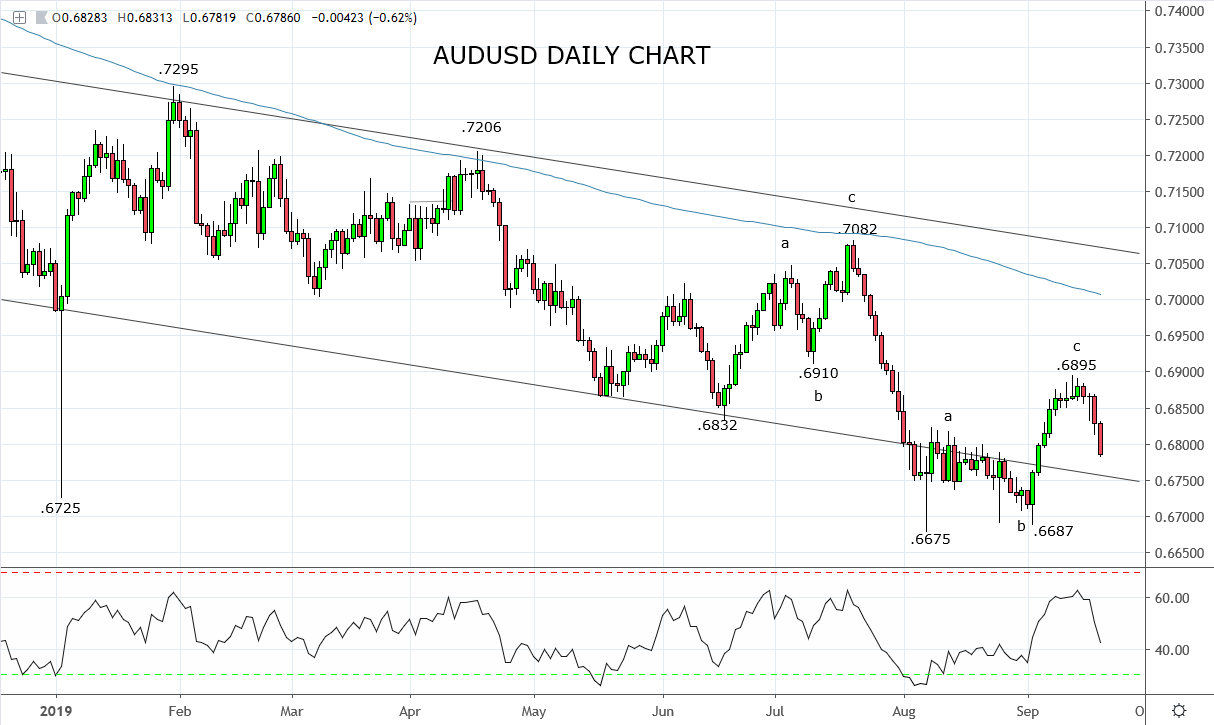

Today’s developments have resulted in the AUDUSD convincingly breaking below the pivotal support at .6820/00, that comes from the half a dozen daily highs the AUDUSD traded to during August.

The decline from the recent .6895 high has now become more impulsive in appearance, and this tilts the odds in favour of lower prices. In the short term, I would expect sellers on bounces to emerge near the .6820/30 resistance zone and on the downside support at .6685/75 remains strong.

Source Tradingview. The figures stated are as of the 19th of September 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.