Don’t Fight the Fed! Yields, Gold, and DXY

The Federal Reserve has been telling us time and time again that they are going to keep monetary policy accommodative until ACTUAL inflation is within the 2%-3% range. They told us inflationary expectations are transitory and that the rising in yields was unsustainable. Yet even with strong US data today (Retail Sales, NY Empire State Manufacturing Index, Philadelphia Fed Manufacturing Index, and Initial Jobless Claims), yields fell, and gold soared. Either someone has decided that it is time to believe the Fed or that now is the perfect time for a short squeeze in bonds! Note that the DXY barely moved all day, which is an indication that it may be the latter. (Stocks are higher too, but stocks always move higher!)

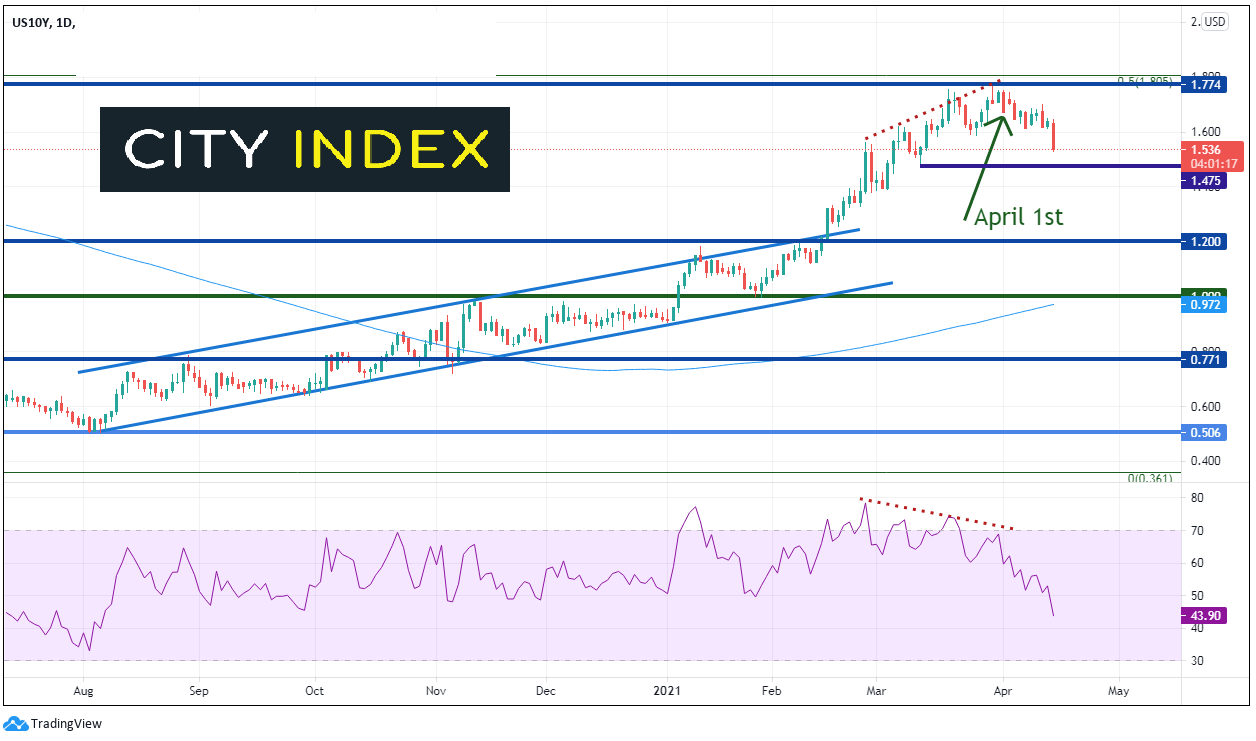

Since the beginning of April and the beginning of the second quarter, bonds have become a “buy” for the markets. Yields move inversely to bonds. Therefore, as bonds rose in price, yields fell. 10-year yields put in new recent highs on March 30th near the 50% retracement level from the November 2018 highs to the March 2020 lows, at 1.774 and have been moving lowed since. Note that at the highs, the RSI was diverging with price while in overbought territory.

Source: Tradingview, City Index

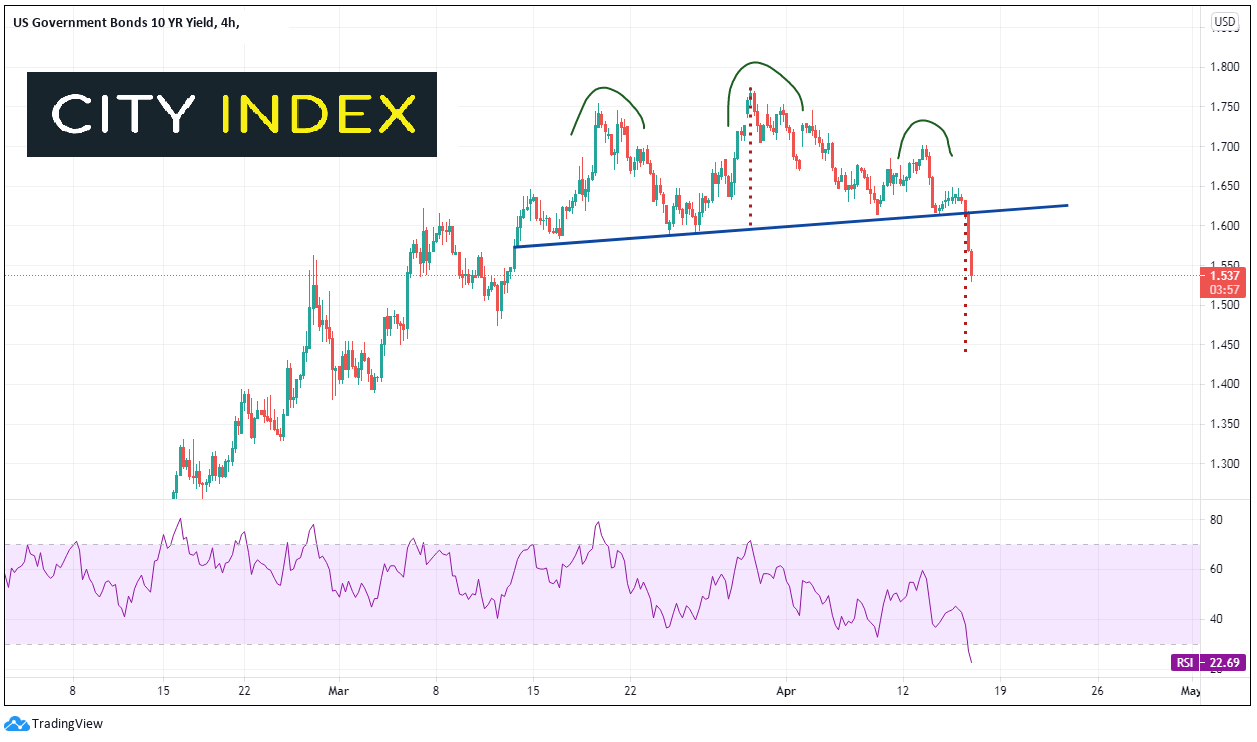

One can also argue that the move in yields was purely technical driven. On a 240-minute timeframe, as 10-year yields were moving higher into late March they formed the left shoulder of a head-and-shoulders pattern. Today, with the move lower, yields broke the below the neckline of the pattern. The target for a head-and-shoulders pattern is the height from the head to the neckline, added to the breakdown point of the right shoulder, which in this case is near 1.437. However, the RSI has moved into oversold territory, which indicates a near-term bounce is possible. Horizontal support is just above the target at the March 11th lows near 1.475 and then way below the target at 1.20 (see daily). Resistance is now back at the neckline at 1.618 (not the Fib level!) and then the top of the right shoulder at 1.701.

Source: Tradingview, City Index

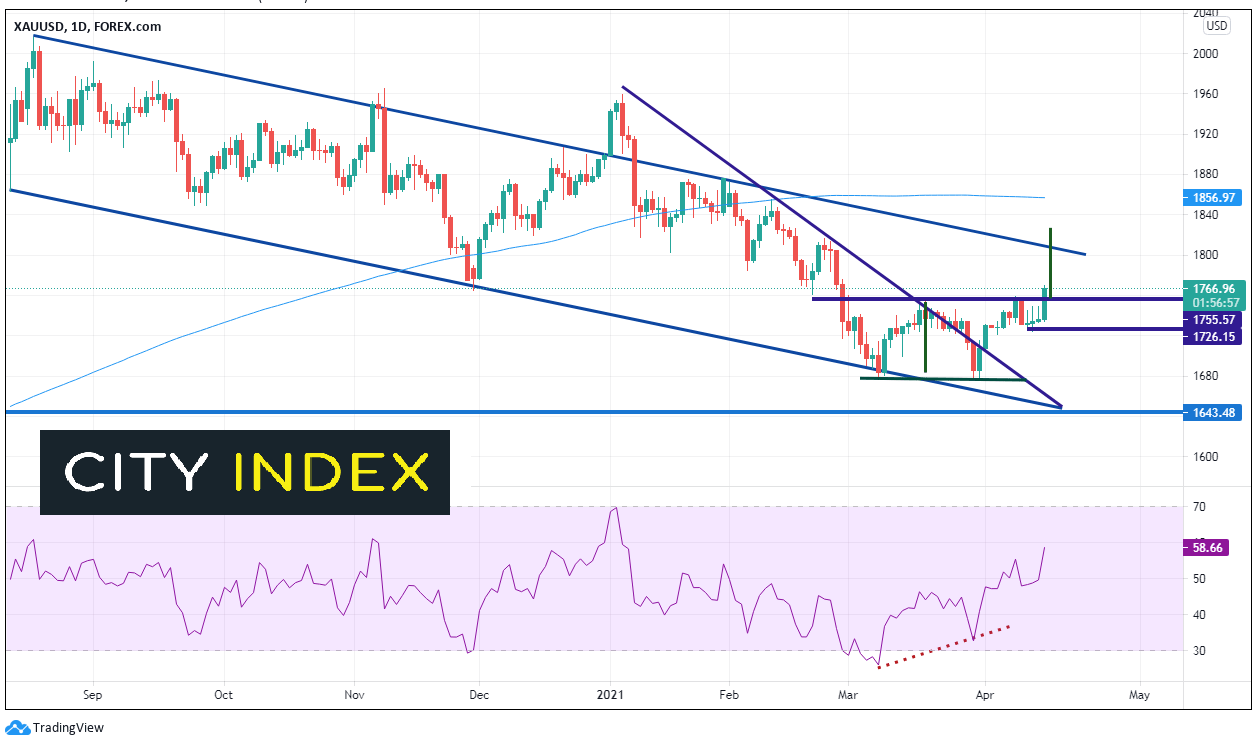

Gold (XAU/USD) moves inversely to yields. Therefore, as yields move lower, gold moves higher. With the move lower in yields today, gold pushed higher above resistance at 1755 and formed a double bottom pattern. The target for a double bottom is the height of the pattern added to the breakout point, which is near 1830. Gold has been in a long-term channel downtrend since the summer of 2020. Resistance is at the top downward sloping trendline of the channel near 1810. Above the target, next resistance is at the 200 Day Moving Average near 1856.97. Horizontal support is at the April 13th lows near 1727 and then the double bottom lows at 1678.

Source: Tradingview, City Index

Learn how to start gold trading

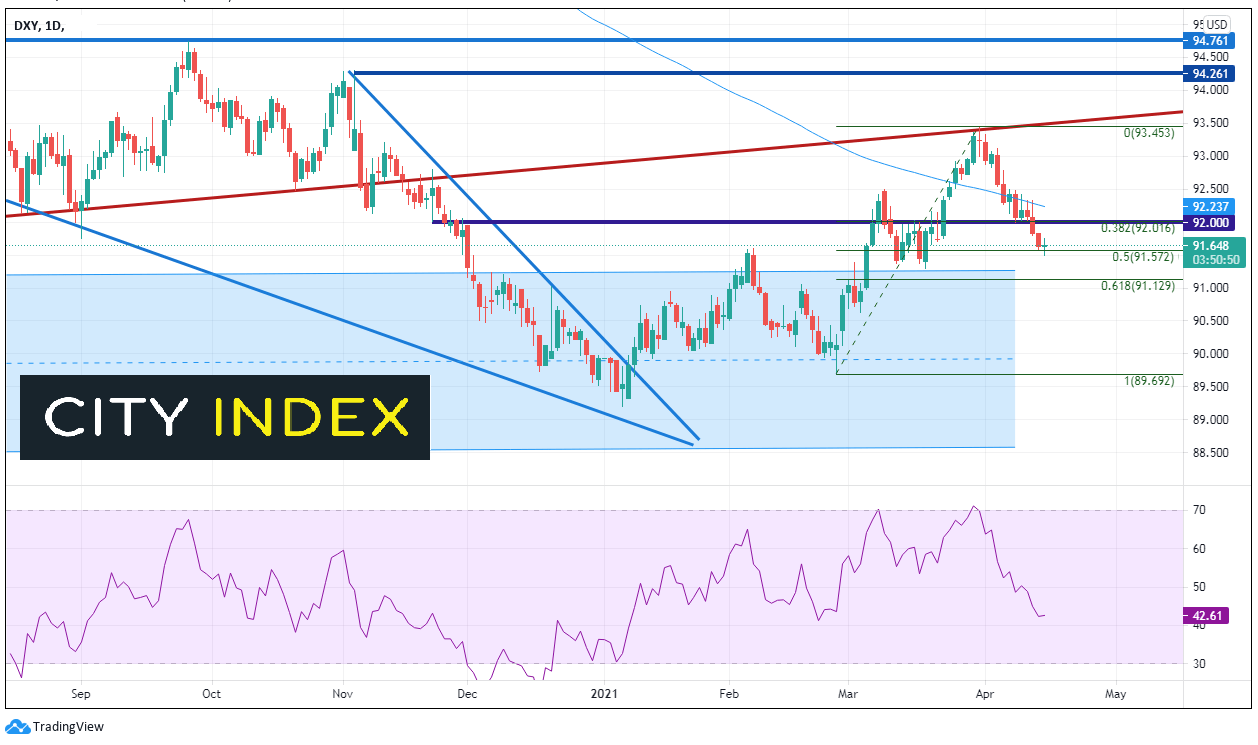

Last week, we discussed how DXY and gold are also inversely related and that a break of 92.00 in the DXY should push gold above the neckline of a double bottom at 1755. Was the DXY a leading indicator? On Tuesday, DXY broke below 92.00. However, it took until today for Gold to push above 1755. With Gold up 1.7% and 10-year yields down over 6%, the DXY was nearly unchanged, holding the 50% retracement level from the February 25th lows to the March 31st highs near 91.57.

Source: Tradingview, City Index

Everything you need to know about DXY

Today’s move in yields could have been position related (don’t fight the Fed), a short-squeeze, technical, or “catch up” to the DXY. The reason doesn’t matter. However, markets rarely move in a straight line. Interpreting key levels in the markets, such as head-and shoulders necklines, double bottom breakout levels and important retracement levels, are important for traders to know. Traders must also understand how a break in one market could affect price action of other correlated markets!

Learn more about forex trading opportunities.