Dollar index vs Covid and Presidential election

Investors become cautious ahead of the Nov. 3 presidential election, and remain concerned over the record-breaking Covid-19 cases around the world. On the economic front, the U.S. Commerce Department will report September construction spending (+1.0% on month expected) and the Institute for Supply Management will post its Manufacturing Index for October (55.6 expected). Research firm Markit will publish final readings of October Manufacturing PMI for the U.S. (53.3 expected).

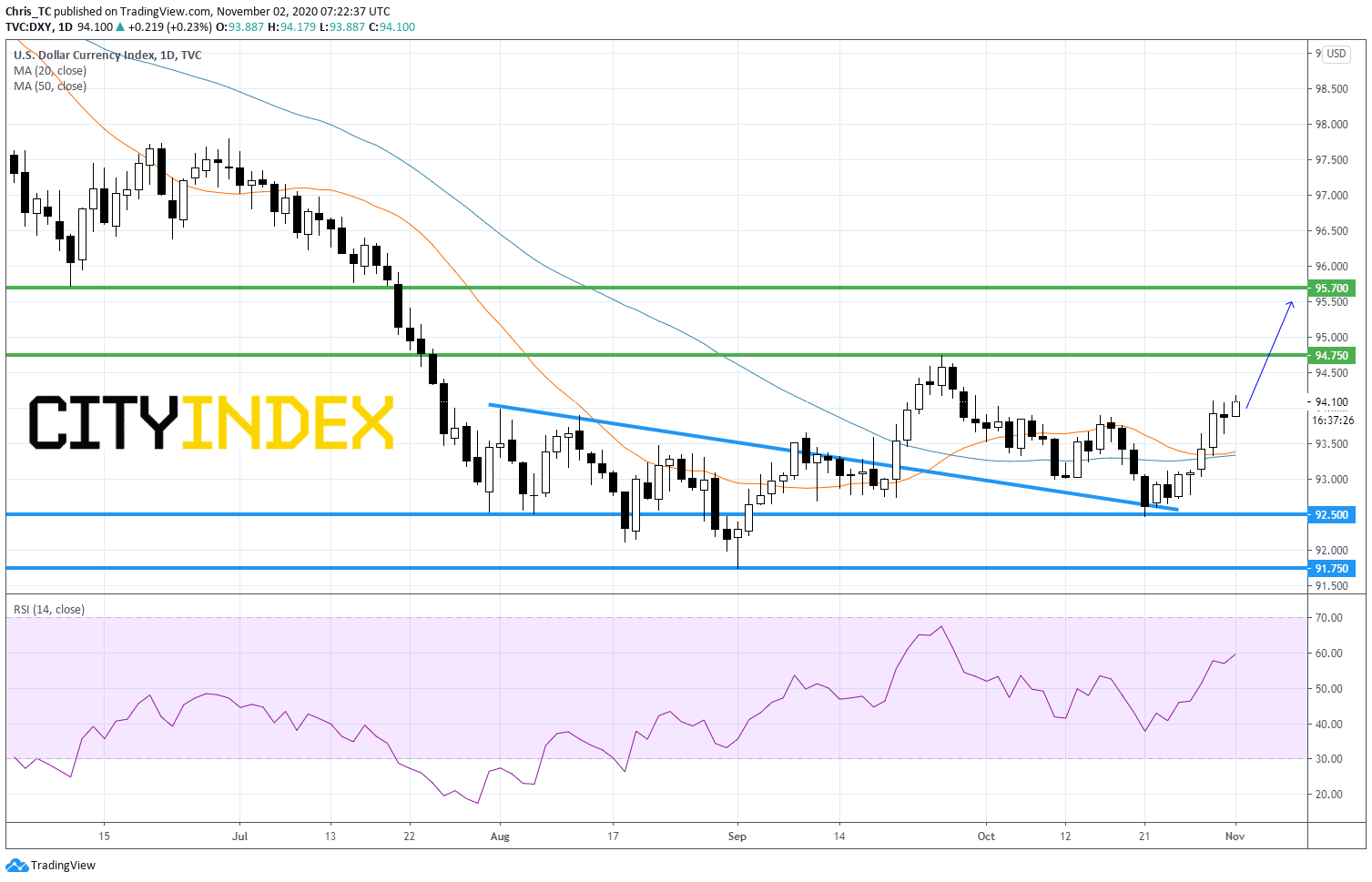

From a technical point of view, on a daily chart, Dollar Index is rebounding on its former declining internal trend line and stands above its 50-day moving average (in blue). The daily RSI is well directed. Readers may therefore consider the potential for further advance as long as 92.50 is not broken to the downside. The nearest resistance would be set at previous overlap at 94.75. A second one would be set at horizontal resistance at 95.70.

Source: TradingView, GAIN Capital