The US dollar index on Wednesday clawed back a small portion of its recent losses after data from the ADP employment report showed a better-than-expected 235,000 private sector jobs added to the US economy in February. Though this data does not necessarily foretell a positive outcome for the US Government’s official non-farm payrolls data scheduled to be released on Friday, it does provide some confidence that the US employment landscape remains strong. This helps keeps expectations high that the Federal Reserve is on still on track to raise interest rates at a relatively brisk pace, which provides a measure of support for the dollar.

More urgent for the markets than jobs data, however, especially for US equities and the dollar, are the recently developed concerns of a potential global trade war in the making after US President Trump announced last week that US import tariffs would be instituted as early as this week. That pivotal announcement unleashed a series of events that included forceful pushbacks and threats of retaliation from major US trading partners, most notably Canada, the UK, and the European Union.

Global stock markets and the dollar were hit hard as the specter of an eventual trade war that could choke economic growth loomed. This culminated on Tuesday afternoon in the resignation of President Trump’s chief economic advisor, Gary Cohn, a fiercely pro-trade advocate. Cohn’s resignation did much to strengthen the standing of the White House’s current protectionist contingent, most notably led by National Trade Council Director Peter Navarro, and sent a signal to the markets that a global trade war is even more likely now that Cohn, one of the only major moderating voices in the Trump Administration, is now gone. Trump must now choose a new chief economic advisor. His ultimate choice will likely have a far-ranging impact on the US economy, stocks, and the dollar.

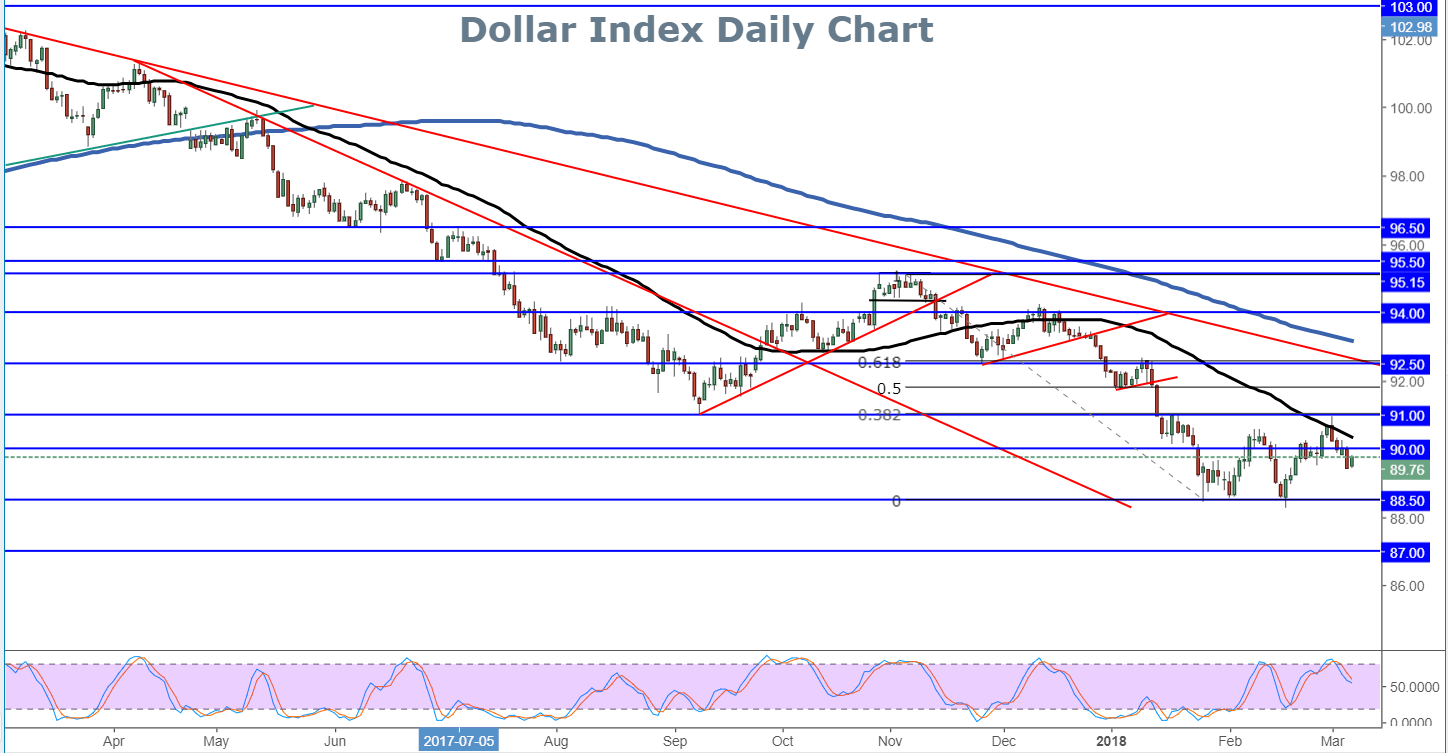

Amid the forces pushing and pulling the US dollar in different directions over the past several weeks – including speculation over the Federal Reserve’s monetary policy path and the noted concerns over a global trade war – the US dollar index has remained in a range between its recent multi-year low at 88.25 and a high near 91.00 resistance. Most recently, the index has fallen sharply from the 91.00 resistance area after Trump made his tariff announcement late last week. It has also fallen from its 50-day moving average, suggesting a possible continuation of the prevailing downtrend and bearish bias. With any concrete announcement of US tariff implementation, further global trade retaliation, and/or appointment by Trump of a protectionist economic advisor, the dollar could have significantly further to fall. The next clear downside target in this event is around the 88.50-area support lows. Any further breakdown below that level would confirm a potential continuation of the longstanding downtrend for the dollar.