In yesterday’s article on the ASX200, we noted the overall level of stimulus announced globally by governments and central banks in recent weeks to counter the impact of Covid-19 was on track to exceed Global Financial Crisis (GFC) levels.

That was before the U.S. Federal Reserve announced overnight a package of new initiatives including the potential to buy an unlimited amount of treasury, agency and mortgage back securities, a new U.S $300bn fund to facilitate consumer and business credit flow. As well as an initiative to support the fractured corporate bond market.

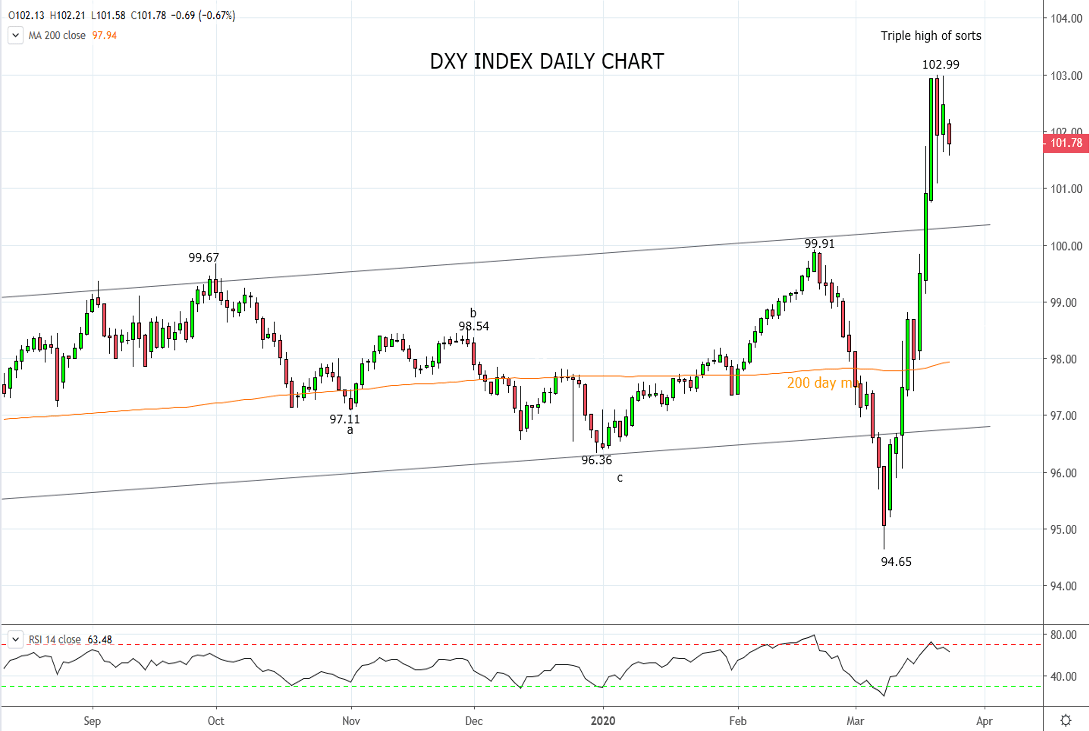

Post the Feds announcement, the U.S. dollar index, the DXY sold off by an amount which appears insignificant in contrast to the rally the DXY index has experienced over the past two weeks. However in the current environment of reduced liquidity, once a move loses momentum it can reverse very quickly as traders rush to lock in profits. For an example of this look at the recent price action in gold.

Apart from liquidity consideration, there are other reasons why the DXY index appears vulnerable to a deeper pullback.

- Assuming the market is close to a turning point in terms of volatility and liquidity, the safe-haven status of the U.S. dollar is at risk of being eroded.

- The yield advantage of the U.S. dollar has been considerably reduced in recent weeks.

- The DXY has experienced a number of false breaks in both directions over the past 15 months. Unless the DXY can soon break above the 2017, 103.63 high it is vulnerable to another.

- There is a type of triple high in place on the daily DXY chart at 102.99.

In summary, the DXY is displaying some vulnerability to a pullback in the coming sessions. Whether the pullback is an opportunity to rebuild energy for a run at the 103.63 high or the start of a deeper pullback is likely to depend on whether support near 100 holds.

Source Tradingview. The figures stated areas of the 24th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation