Asian Indices:

- Australia's ASX 200 index rose by 17.7 points (0.24%) and currently trades at 7,398.80

- Japan's Nikkei 225 index has risen by 236.28 points (0.84%) and currently trades at 29,269.44

- Hong Kong's Hang Seng index has risen by 293.48 points (1.15%) and currently trades at 25,703.23

UK and Europe:

- UK's FTSE 100 futures are currently up 9 points (0.13%), the cash market is currently estimated to open at 7,212.83

- Euro STOXX 50 futures are currently up 5 points (0.12%), the cash market is currently estimated to open at 4,156.40

- Germany's DAX futures are currently up 21 points (0.14%), the cash market is currently estimated to open at 15,495.47

US Futures:

- DJI futures are currently down -36.15 points (0.1%)

- S&P 500 futures are currently up 1-point (0.01%)

- Nasdaq 100 futures are currently up 0.25 points (0.01%)

Indices

North Korea fired an ‘unidentified projectile’ to the East Sea according to a report. Not that markets took much notice, with Asian equity markets tracking Wal Street higher, led by the Hang Seng and China A50.

The DAX is trying to build a level of support along the trendline it broke above last week. Unless it breaks immediately higher today then we need to allow for some noise around the trendline, but overall the trend structure from the bullish hammer low (around the 200-day eMA) appears promising for the bull camp. Furthermore, futures markets are pointing to a higher open today in Europe.

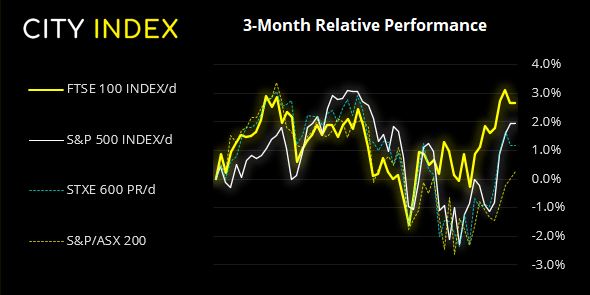

We were right to question the FTSE’s ability to close above the August high again yesterday, given it only just managed it on Friday. A bearish engulfing candle took prices back below that milestone high, so a (minor) correction now appears to be underway. Next support sits around 7160 which makes it a likely target for bears, but should prices form a base around that level we’d reconsider bullish setups.

FTSE 350: Market Internals

FTSE 350: 4127.24 (-0.42%) 18 October 2021

- 158 (45.01%) stocks advanced and 181 (51.57%) declined

- 15 stocks rose to a new 52-week high, 7 fell to new lows

- 57.26% of stocks closed above their 200-day average

- 34.76% of stocks closed above their 50-day average

- 19.09% of stocks closed above their 20-day average

Outperformers:

- + 58.1% -Playtech PLC(PTEC.L)

- + 4.66%-Diversified Energy Company PLC(DEC.L)

- + 4.52%-888 Holdings PLC(888.L)

Underperformers:

- -4.69%-Carnival PLC(CCL.L)

- -4.68%-Aston Martin Lagonda Global Holdings PLC(AML.L)

- -3.94%-International Consolidated Airlines Group SA(ICAG.L)

Forex:

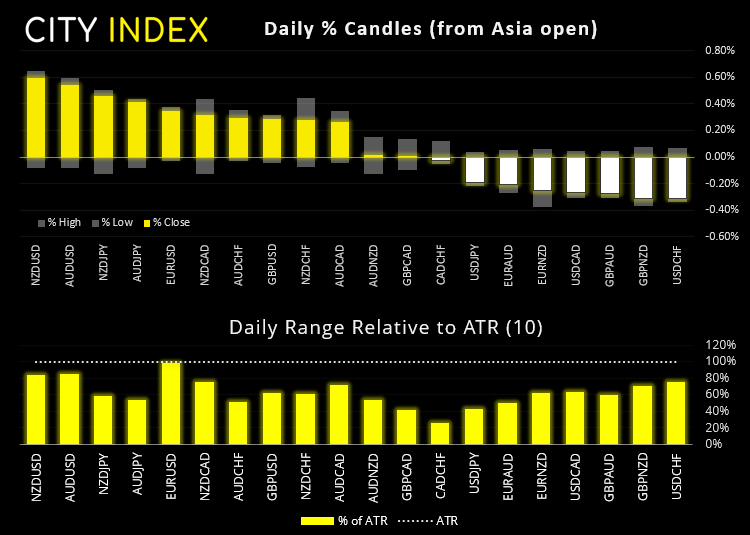

The US dollar tracked US yields lower overnight and weakened against all its major peers (and most emerging markets excluding the Turkish Lira) overnight, with NZD and AUD at the top of the leader board.

AUD/USD nudged its way to a 6-week high and now trades above its 200-day eMA. RBA minutes revealed nothing new of any great value, although they expect the setback to the economy from the latest round of lockdowns to be short lived. NZD/USD is comfortably above the 0.71 handle and the monthly R1 pivot. EUR/USD moved to a 3-week high, USD/CAD looks set to hit new lows and GBP/USD looks set to break to a new high.

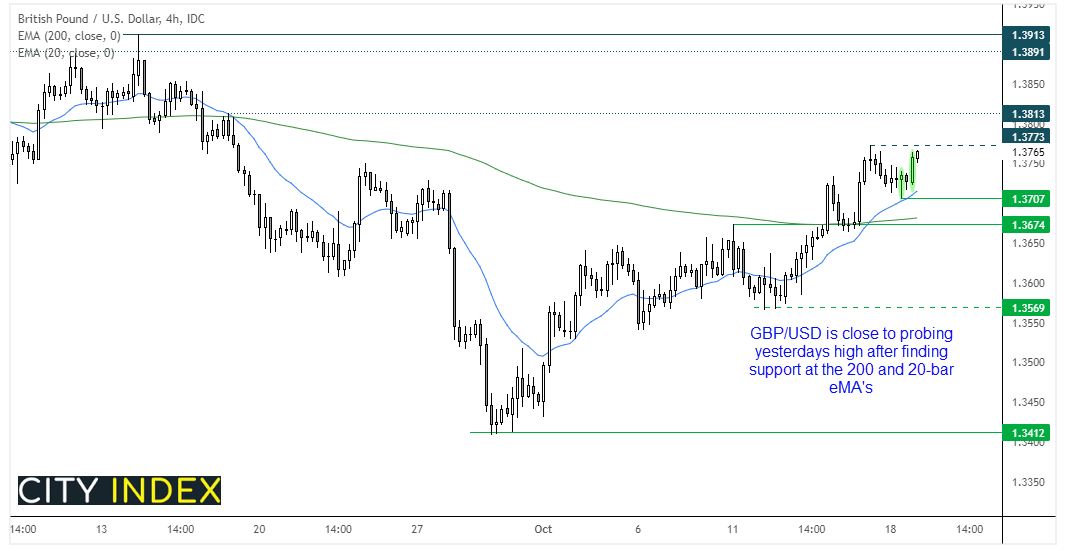

GBP/USD closed above its 200-day eMA on Friday, before yesterday’s small bearish inside candle confirmed the average as support. A nice bullish trend is forming on the four-hour chart and recent swing lows have found support at the 200-bar eMA and 20-bar eMA on this timeframe. A small bullish hammer formed at 1.3707 to suggest a higher low is in place before bullish momentum pushed it close to yesterday’s high. Our bias remains bullish above 1.3707 and we now anticipate a break above 1.3773 as part of its trend continuation.

Commodities:

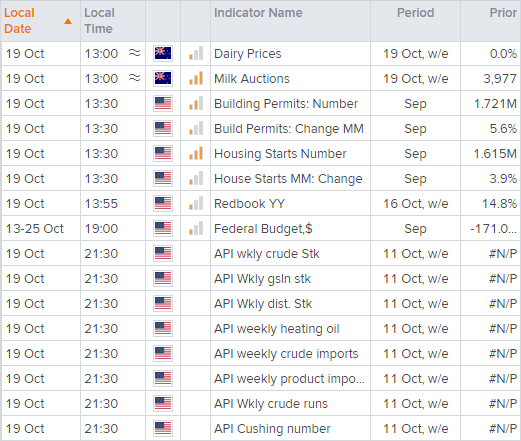

The weekly API crude stock report (American Petroleum Institute) is scheduled for 91:30 BST. We have noted in recent reports that prices for WTI had been rising whilst volumes were in decline, so we took great interest in yesterday’s bearish hammer on higher volume around 83.0 resistance. Should crude stocks rise it could help provide further selling pressure (or tempt profit taking from bulls). However, keep in mind that the weaker US dollar is also helping to support oil prices.

And that means the dollar is also providing support for silver, which (so far) has managed to hold above $23 and might consider a break to new highs today – to keep the inverted head and shoulders pattern alive.

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade