Dollar still under pressure on disappointing Jobs data

Yesterday, U.S. official data showed that Initial Jobless Claims rose to 1.416 million for the week ended July 18 (vs 1.300 million expected), which led to further U.S. dollar weakness.

Due later today are reports on Markit U.S. Manufacturing Purchasing Managers' Index (a rise in July preliminary reading to 52.0 expected) and New Homes Sales (an increase in June annualized rate of 700,000 units expected).

Due later today are reports on Markit U.S. Manufacturing Purchasing Managers' Index (a rise in July preliminary reading to 52.0 expected) and New Homes Sales (an increase in June annualized rate of 700,000 units expected).

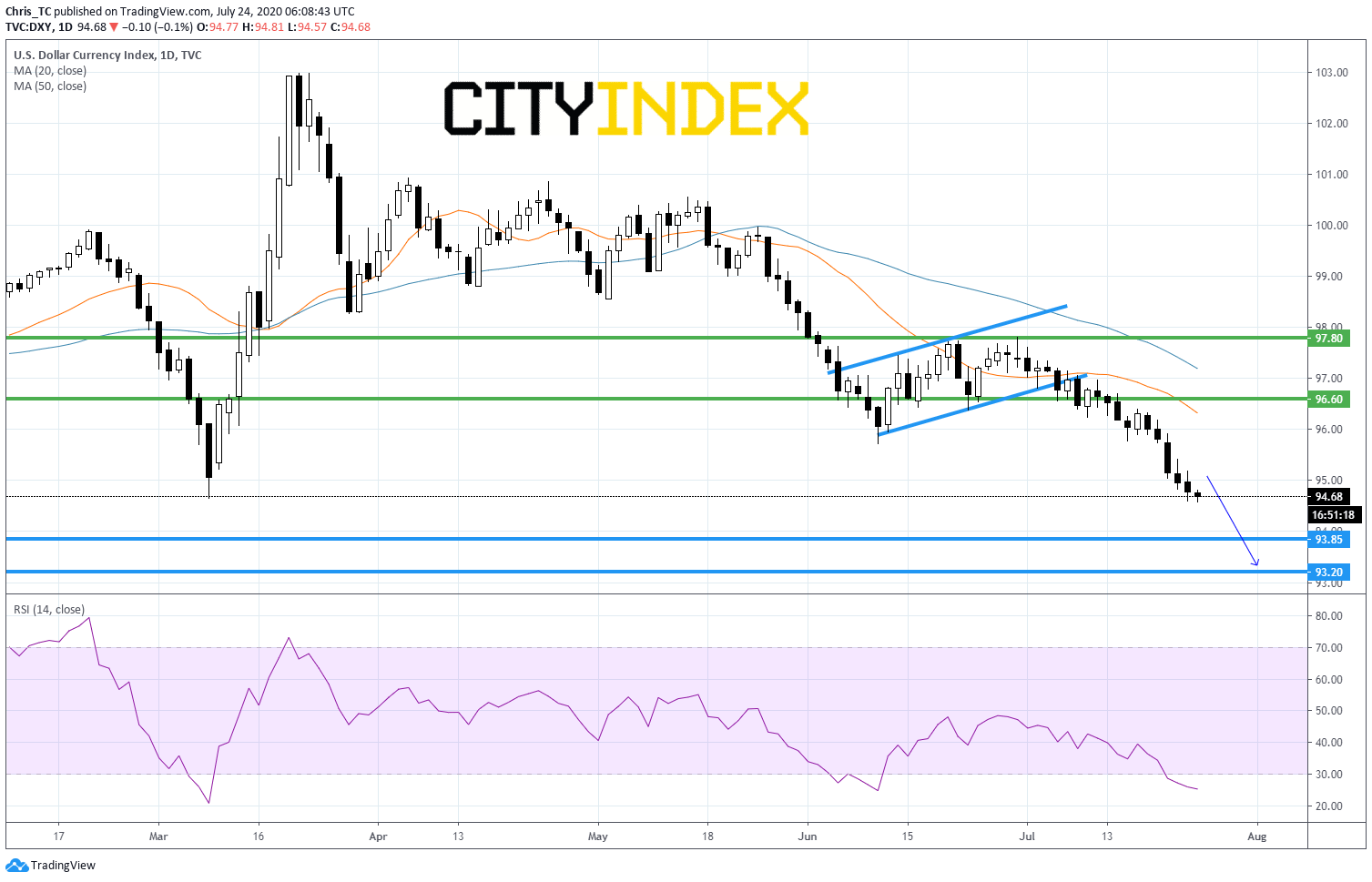

From a technical point of view, on a daily chart, Dollar Index has validated a bearish flag and remains on the downside, capped by its declining 50-day moving average (in blue). The daily RSI stands within its selling area. Readers may therefore consider the potential for further weakness as long as 96.60 is not broken to the upside. The nearest support would be set at September 2018 bottom at 93.85. A second one would be set at horizontal support at 93.20.

Source: TradingView, GAIN Capital

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM