DJIA: Bulls still in charge despite Delta-driven 1,000-point plunge and recovery

As of writing at the midpoint of the trading week, the widely-followed Dow Jones Industrial Average (Wall Street) is trading near 34,750, within about 50 points of where it closed Friday’s trading session.

So clearly, it’s been a quiet week right?

Bad jokes aside, traders are still trying to wrap their heads around the popular index’s 1,000-point collapse on Monday and subsequent 1,000-point recovery over the last day and a half. The move was ostensibly driven by fears over the spread of the delta COVID variant, and while its impact on developing market economies with slow vaccine rollouts will undoubtedly be severe, the (early) low hospitalization rates among double-vaccinated populations suggests that it’s impact may be limited in more developed markets. In any event, traders are seemingly reassured by the perception that fiscal and monetary policymakers remain on standby to backstop any economic slowdown as needed.

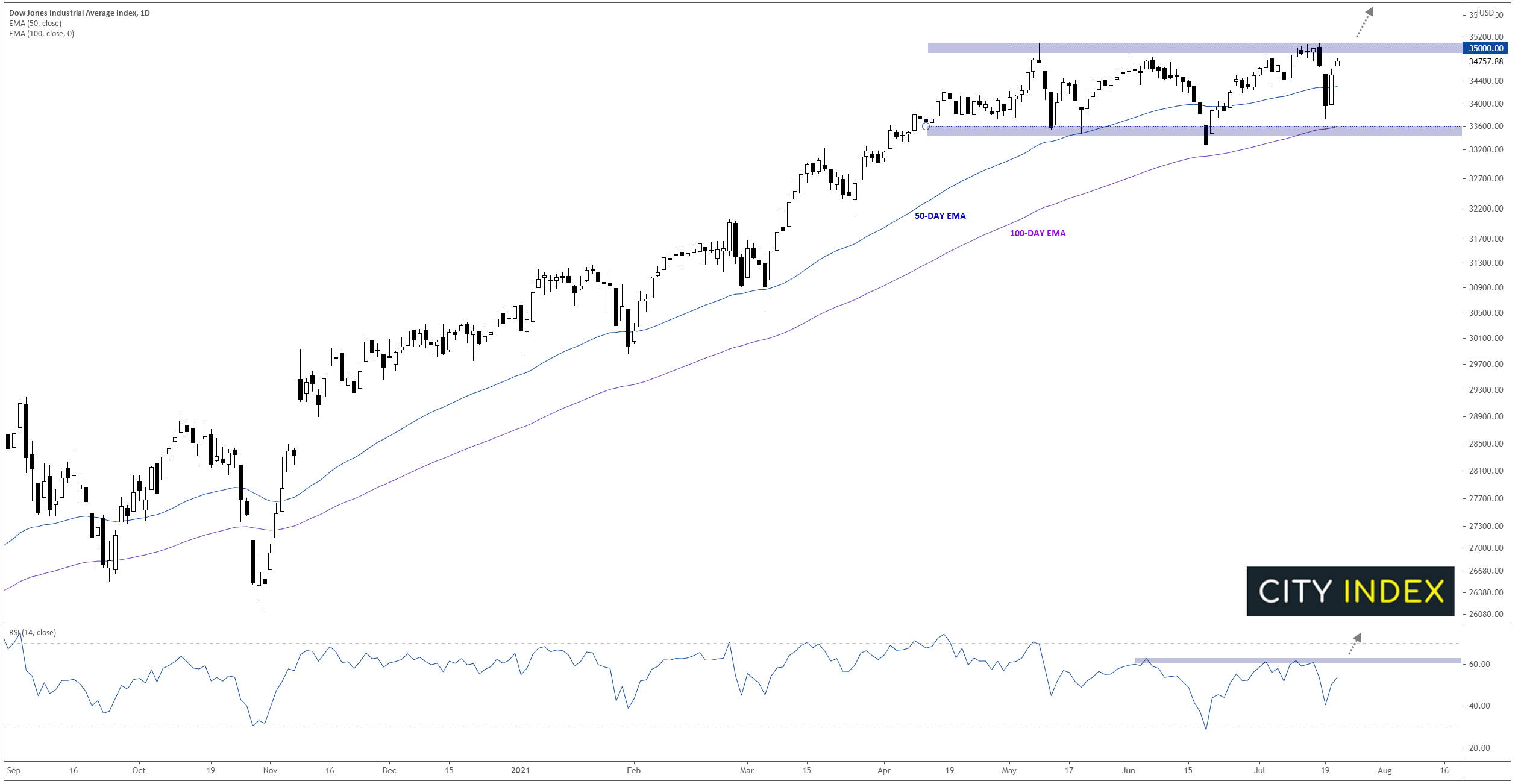

From a technical perspective, the DJIA remains in a longer-term uptrend, with price rising above the upward-trending 50-, 100-, and 200-day EMAs. More recently, the index has carved out a sideways range over the last three months between support in the 33,600 area and resistance up at 35,000:

Source: StoneX, TradingView

Combining the longer-term uptrend with the near-term consolidation, a bullish breakout into record territory is still the more likely scenario; astute traders will be watching for a breakout above about 65 in the 14-day RSI indicator to lead and/or confirm any bullish breakout in the index itself for a potential rally to 36,000 or higher heading into late summer. On the other hand, a confirmed bearish breakdown through the 100-day EMA and range low near 33,600 would point to a deeper retracement toward the mid-32,000s next.

As a reminder, six of the seven largest companies on the planet (Apple, Microsoft, Amazon, Google/Alphabet, Facebook, and Tesla Motors) all report Q2 earnings next week, so that will be the most important fundamental storyline to monitor in the immediate future – see my colleague Fiona Cincotta’s full “Big Tech” earnings preview report for more on these names!

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.