Disappointing Canadian Data Continues into 2020

Canada released Housing Starts (MoM) for December earlier today for December 2019 at 197,300 vs an expectation of 210,000. Building Permits (MoM) for November 2019 were released as well at -2.4% vs -1.5% expected. These data points by themselves do not provide much value, however taken with the recent weaker than expected manufacturing data, retail sales data, and trade data, the BOC may have to start considering lowering rates when they meet again on January 22nd. Tomorrow we see the Employment Change (MoM) for December for Canada. While November’s number was surprisingly weak last month at -71,000, December’s expectation is for a return to positive territory at 25,000. One bright side to Canadian data is that inflation has remained in check.

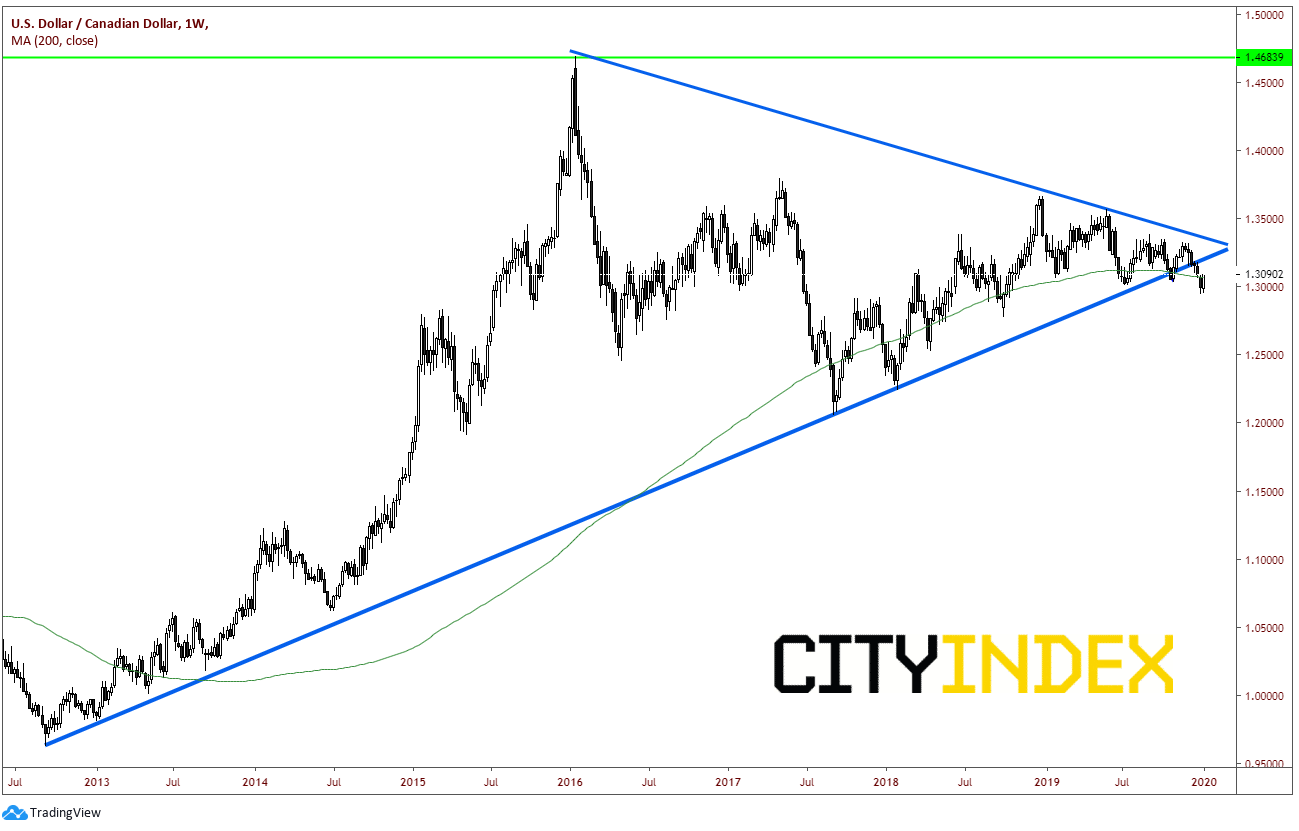

Towards the end of December 2019, USD/CAD finally broke down from its long-term, symmetrical triangle and its upward sloping multi year trendline that has been in place since 2012. In addition, last week the pair broke below the 200-week moving average near 1.3070.

Source: Tradingview, City Index

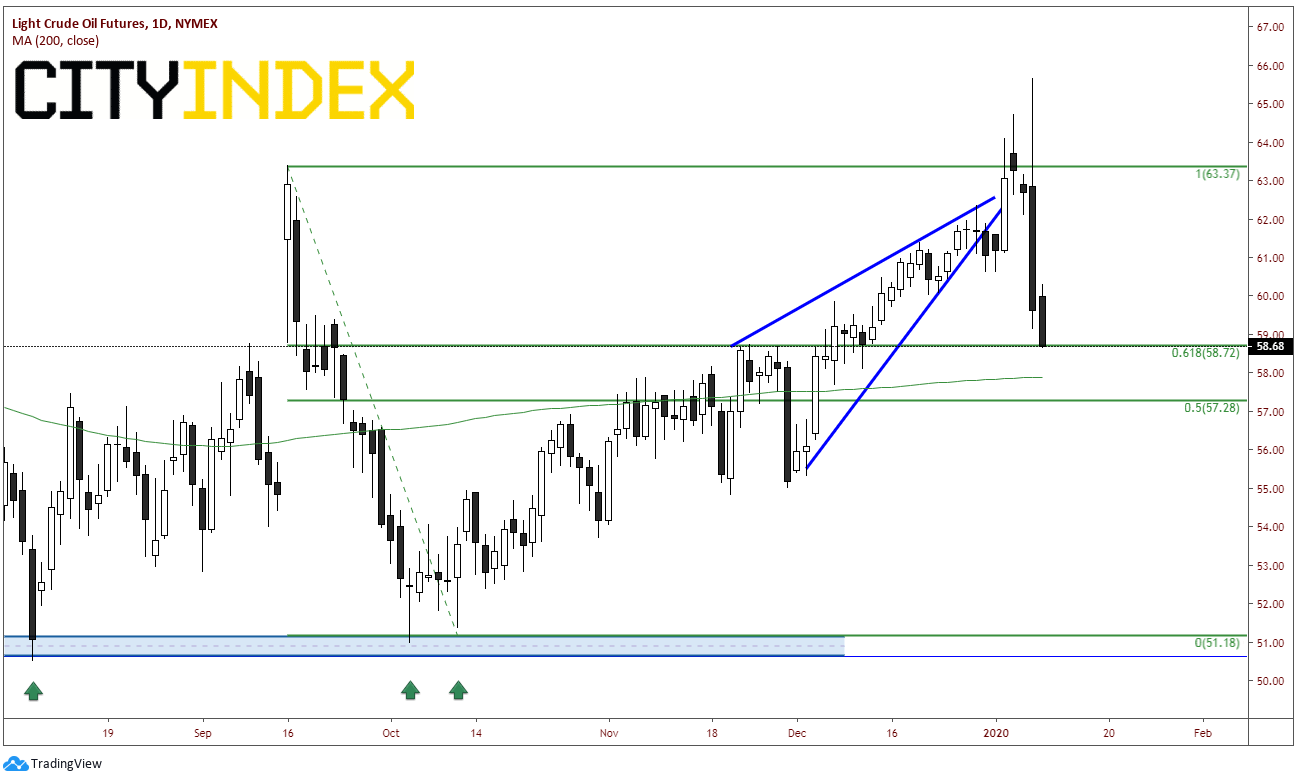

The rise in crude oil prices likely helped contribute to this move as the direction of crude oil and the price of the Canadian Dollar are positively correlated (crude oil and USD/CAD are inversely related). However, with yesterday’s large move lower in oil (and today’s continued selloff), prices in USD/CAD have reversed. Crude oil futures are currently holding support near 58.65.

Source: Tradingview, NYMEX, City Index

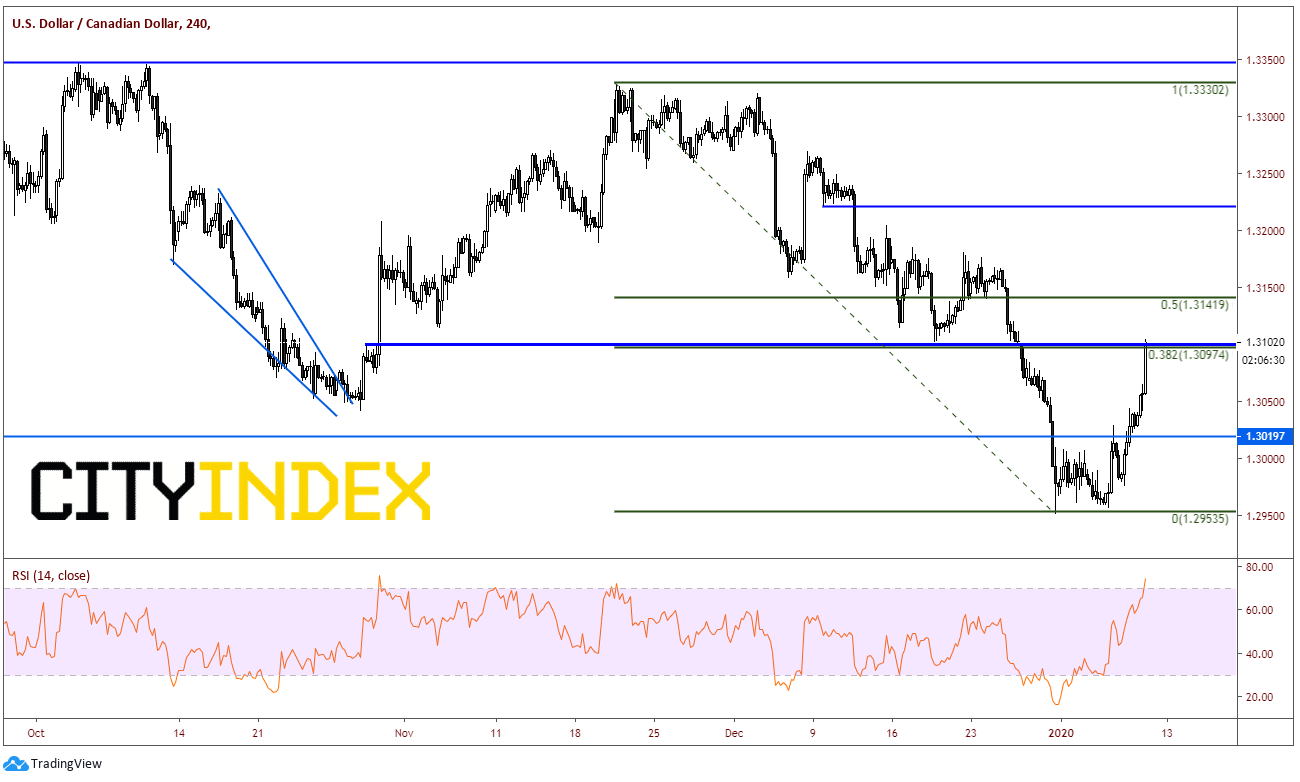

USD/CAD is currently running right into horizontal resistance near 1.3100. This level also coincides with the 38.2% Fibonacci retracement from the November 20th highs to the December 31st lows. The RSI has also moved into overbought territory, and indication that prices may turn lower soon. Short term resistance comes across at the 50% retracement level of the previously mentioned timeframe near 1.3140, and then a cluster of resistance near 1.3200, including the 61 8% Fibonacci retracement level, horizontal resistance, and a retest of the upward sloping trendline on the weekly timeframe. Support comes across at the 200-week moving average at 1.3070 and recent lows near 1.2950.

Source: Tradingview, City Index

Later today, Bank of Canada’s (BOC) Governor Poloz speaks. He may try and clarify the BOC’s position on interest rates. In addition, traders may try and position themselves ahead of both US and Canadian payroll data tomorrow morning. We also need to continue to watch crude oil for price direction. The combination of these factors should keep USD/CAD volatile over the next 24 hours.