There is no hiding from the coronavirus, and it appears few industries are safe from the reaches of the killer virus.

Airlines, travel and tourism stocks are the obvious victims, owing to travel restrictions - be those forced or self-imposed. We have seen travel and tourism stocks lead the charge southwards earlier this week with easyJet down 17% at one point on Monday.

However, lock downs or simply the fear of being in public spaces where you could be vulnerable to catching coronavirus is impacting a much wider set of industries.

Asia Pacific Diageo’s key market

Diageo is the latest to warn on the impact of coronavirus. The world’s biggest spirits maker warned today that the coronavirus outbreak is expected to knock £200 million off operating profits this year, which equates to roughly 5%.

Diageo is the latest to warn on the impact of coronavirus. The world’s biggest spirits maker warned today that the coronavirus outbreak is expected to knock £200 million off operating profits this year, which equates to roughly 5%.

Sales in Asia are drying up. Bars and restaurants in China, a rapidly growing market are closed, sales in airports have been hurt, conferences and banquets have been reduced or cancelled and not just in China, this is across Asia.

The Asia Pacific region is a key growth area for Diageo. Last year it accounted for 21% of sales alone and China saw organic sales lift 11%.

Consequently, net sales are now expected to take a hit in the region of £225 to £235 million. The stock is down 1.9% today and 4.75% so far this week.

Consequently, net sales are now expected to take a hit in the region of £225 to £235 million. The stock is down 1.9% today and 4.75% so far this week.

Disruption Until March?

Diageo have said that they expect the disruption until at least until the end of March. They expect normal trade to resume by June when it expects sales to return to normal levels. Whilst the spread of coronavirus is showing signs of slowing in China, it is picking up across the rest of Asia and the world. Given that we are according to many scientists on the cusp of a pandemic, these forecasts could be a little bullish from Diageo.

Diageo have said that they expect the disruption until at least until the end of March. They expect normal trade to resume by June when it expects sales to return to normal levels. Whilst the spread of coronavirus is showing signs of slowing in China, it is picking up across the rest of Asia and the world. Given that we are according to many scientists on the cusp of a pandemic, these forecasts could be a little bullish from Diageo.

Any sign of travel restrictions or more lock downs across Europe or the US could see the share price take another leg lower.

Chart thoughts

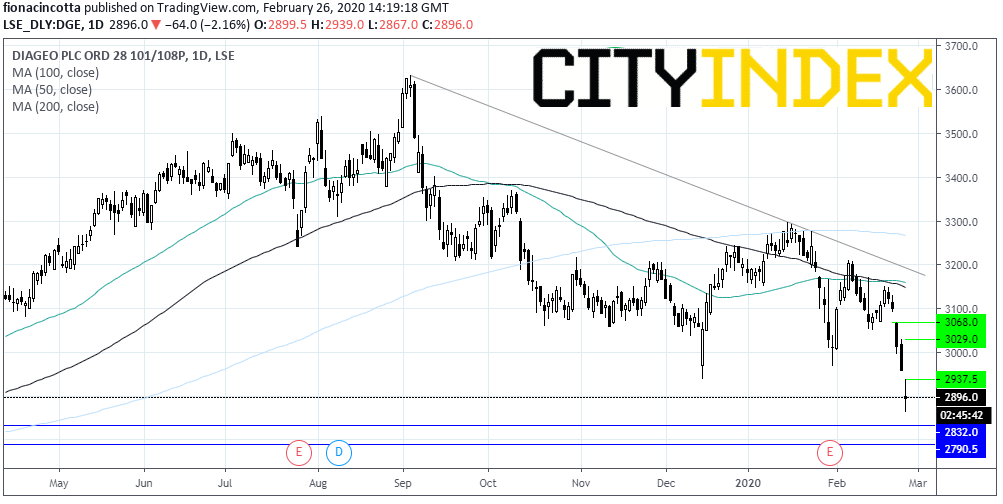

Diageo is trading at an 11-month low, below its 50, 100 and 200 sma, with bearish momentum.

Support can be seen at 2830 (30th Jan ’19 low) prior to 2790 (low 4th March’19).

Resistance can be seen at 2937 (today’s high) prior to 3029 (yesterday’s high) and 3069 (Monday’s high).

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM