The Fed has finally started paying ball, giving signals to the market that it stands ready to loosen policy to support the economy in the case of a downturn. Wall Street experienced its second-best trading day of the year after Powell’s dovish shift, giving the markets what they wanted to hear. The fact that today’s stronger than forecast ISM non-manufacturing report, shortly after the ADP report put stock indices into reverse goes to show just how keen the markets are for a rate cut.

Mixed signals for Friday’s NFP

ADP payroll figures showed that the US private sector added just 27,000 jobs in May, the fewest number of jobs created since 2010 and sharply lower than the 275,000 created in April. Given the strong positive correlation between the ADP private payroll report and the non farm payroll numbers, today’s stats don’t bode well for Friday’s closely watched Labour Department jobs report. However, on the other hand the employment component of the ISM non-manufacturing was notably strong which is an encouraging sign for Friday’s NFP report.

Whilst the ADP numbers will have raised eyebrows, one bad number by no means constitutes a trend. Investors will be more focused than usual on Friday’s jobs report for a clearer picture of how the labour market is holding up and in the case of weaker job creation whether weekly wages have also been hit. Any sign of weakness could see Wall Street extend its rally.

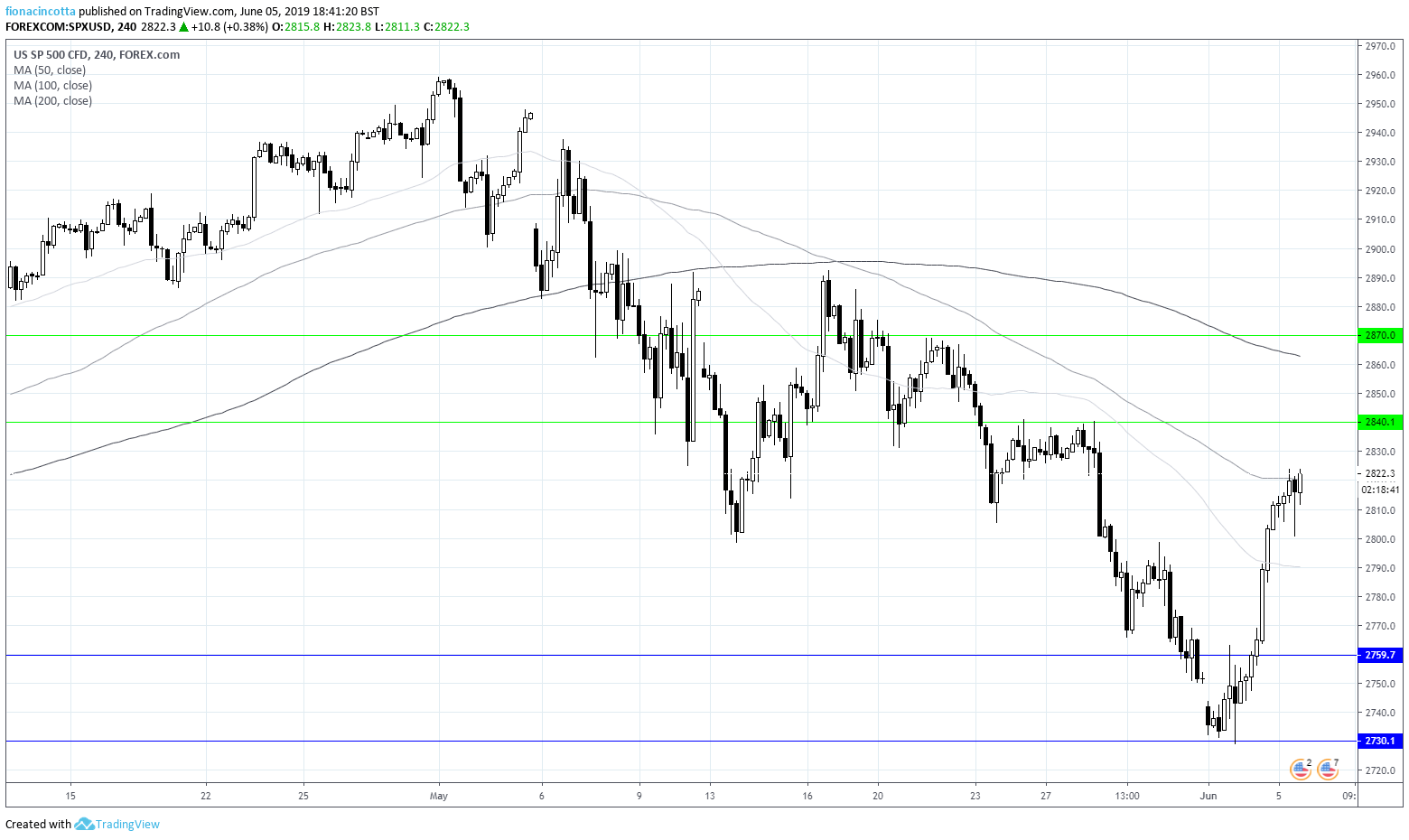

S&P levels to watch:

The S&P pushed through 2800 in the previous session and has extended gains on Wednesday. If the bulls manage to break 2820, 2840 and 2870 will become targets. Support can be seen at 2760 and 2730.