Utility firms will be in focus over the coming sessions as both SSE and National Grid are due to report their full year results.

Thinking back a year ago, fears of a Corbyn government and nationalisation saw the stocks under pressure. Fast forward a year and the world is a very different place. Rather than politics weighing on demand for these shares, it’s the covid-19 crisis and lower price caps.

However, these stocks are defensive stocks, as opposed to cyclicals. They are not dependent on the broader performance of the economy. People need utilities regardless. With this in mind defensives tend to perform well in recessions. Given that the UK economy contracted by 25% over the past two months, we would be expecting these two utilities to be performing a little better, particularly as they are expected to keep their dividends whilst companies en masse suspend dividend payments. At the time of writing around half of the FTSE 100 companies had cut or suspended their dividends.

Attention will be firmly on the dividend when both SSE and National Grid report. Strong safe dividends can make a stock more attractive, particularly to large pension funds, who buy in boosting the price of the stock.

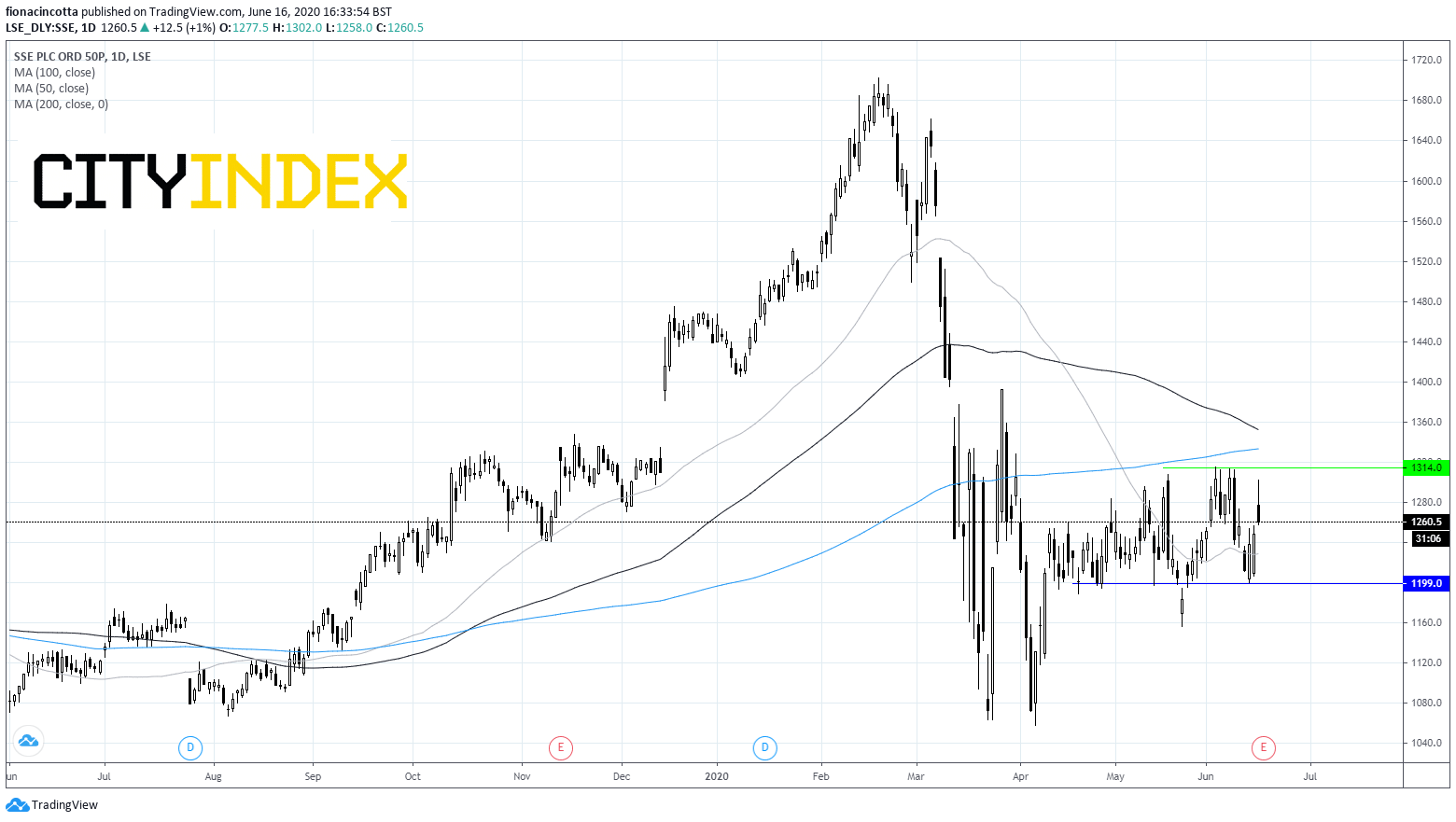

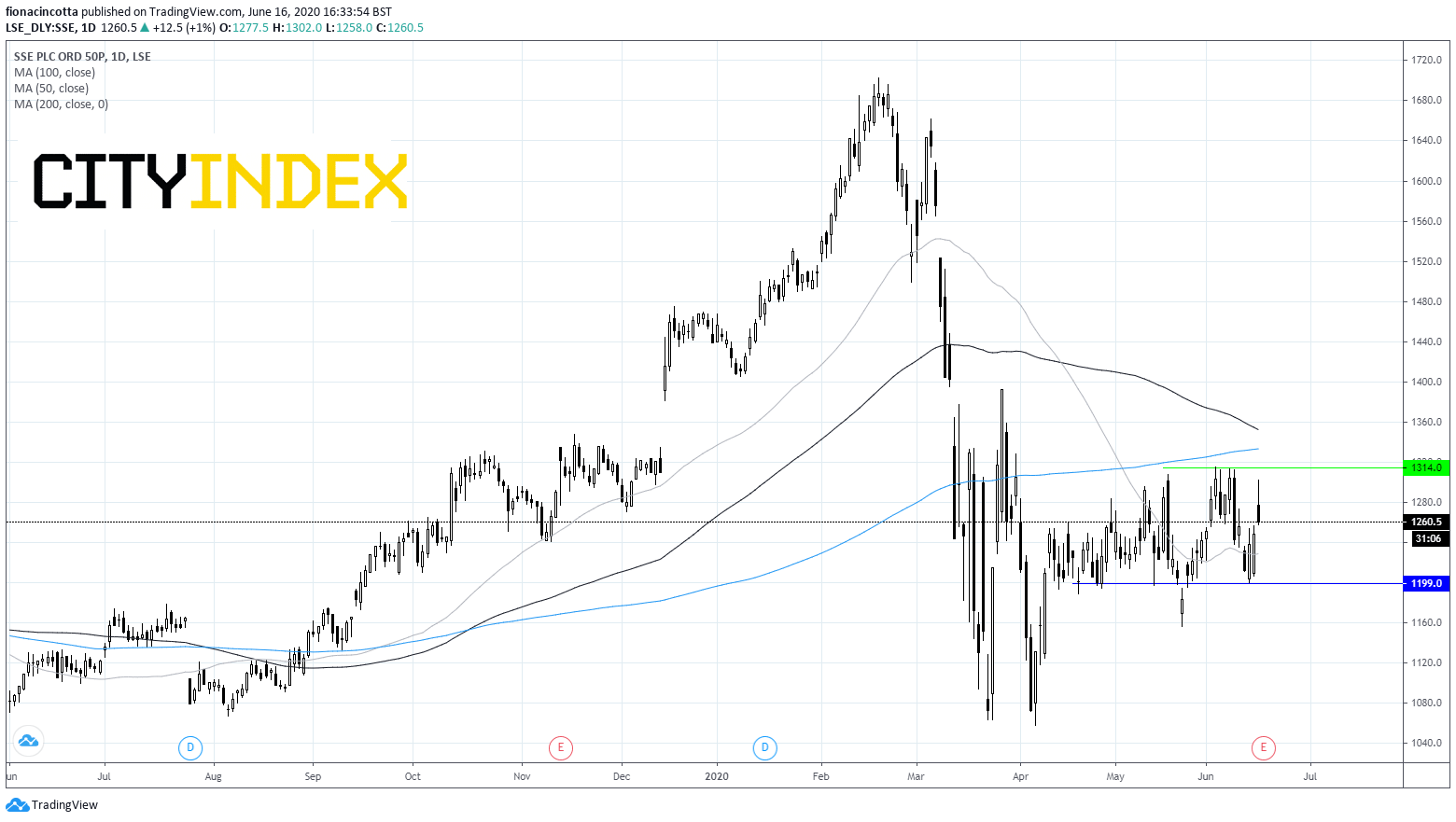

SSE

SSE said back in March that it expected a full year payout of 80p per share. However, it cautioned that this could be reconsidered if circumstances changed. However, we would expect utilities to show their strength in times like these. Whilst companies, almost across the board, have suspended dividends, it should be business as normal for the utilities.

Earnings per share have been guided to the lower end of 83p – 88p range.

The stock is down 14% so far this year, outperforming the broader market but still disappointing performance given its efforts to work smarter rather than harder. The firm sold off its under performing retail arm earlier in the year.

The stock trades above its 50 sma at 1263p. A move above 1315p would see the stock breakout of its current holding channel. Meanwhile a move below 1200p could see more bulls jump in.

National Grid

National Grid’s dividend will also be in focus when it reports on Thursday. Investors will also be looking for any clues on future payments.

Earlier this year NG said that it had not suffered any material impact from covid-19. However, it was expected to monitor the situation before announcing a final decision regarding its dividend.

Broker outlooks are mixed on the stock ahead of results. Whilst Goldman Sachs and Barclays Capital reiterated their neutral stance, both lowered their target price to 1000p and 1040p respectively. Meanwhile JP Morgan has raised its price target to 1060p.

The stock trades over its 50 sma had has just breached its 200 sma at 925p, the uptrend is still intact. A move above 100 sma at 950p could see a further leg higher.