Data from Germany suggests the economic rebound is losing momentum

The latest German GFK consumer confidence figures revealed that the mood amount consumers has darkened amid rising covid concerns and higher inflation. The GFK forward looking index declined by a more than forecast -1.2 points in September, down from -0.4 in August and worse than the -0.7 points forecast.

Today’s figures come following disappointing business sentiment data yesterday. The German IFO index declined for a second straight month in August and by more than forecast to August to 99.4. This was below the 100.4 level forecast and down from 100.8 in July. Whilst the current assessment actually improved, IFO expectations saw the largest drop since the pandemic started.

Making it a hattrick of weaker numbers, the German manufacturing PMI at the start of the week also surprised to the downside. Whilst both the German manufacturing and service sector expanded in August, the manufacturing PMI was the notable decliner dropping to a 7 month low of 62.7, down from 65.9 in July. Activity in the service sector slowed less ticking lower to 61.5, down from 61.8.

So, what does this all mean?

The data suggests that the German economic recovery from the pandemic is starting to slow. Whilst the IFO numbers bode well for growth this quarter, the outlook for the coming quarter is weaker. The loss of momentum comes as the Robert Koch Institute warned that Germany’s fourth covid wave had clearly begun. Political uncertainty ahead of the German elections and supply chain issues amid the ongoing global chip shortage are adding to headwinds for the German economy

Looking ahead any gains in the Dax could be capped by political uncertainty as attention shifts to the first German elections in 15 years without Chancellor Angela Merkel. The latest polls show that the SPD have overtaken Merkel’s CDU party for the first time in a decade and a half.

It’s also worth mentioning that next month the Dax 30 will become the Dax 40, with 10 additional companies joining. This is an important change which will make the German benchmark index more representative of the economy

Where next for the Dax?

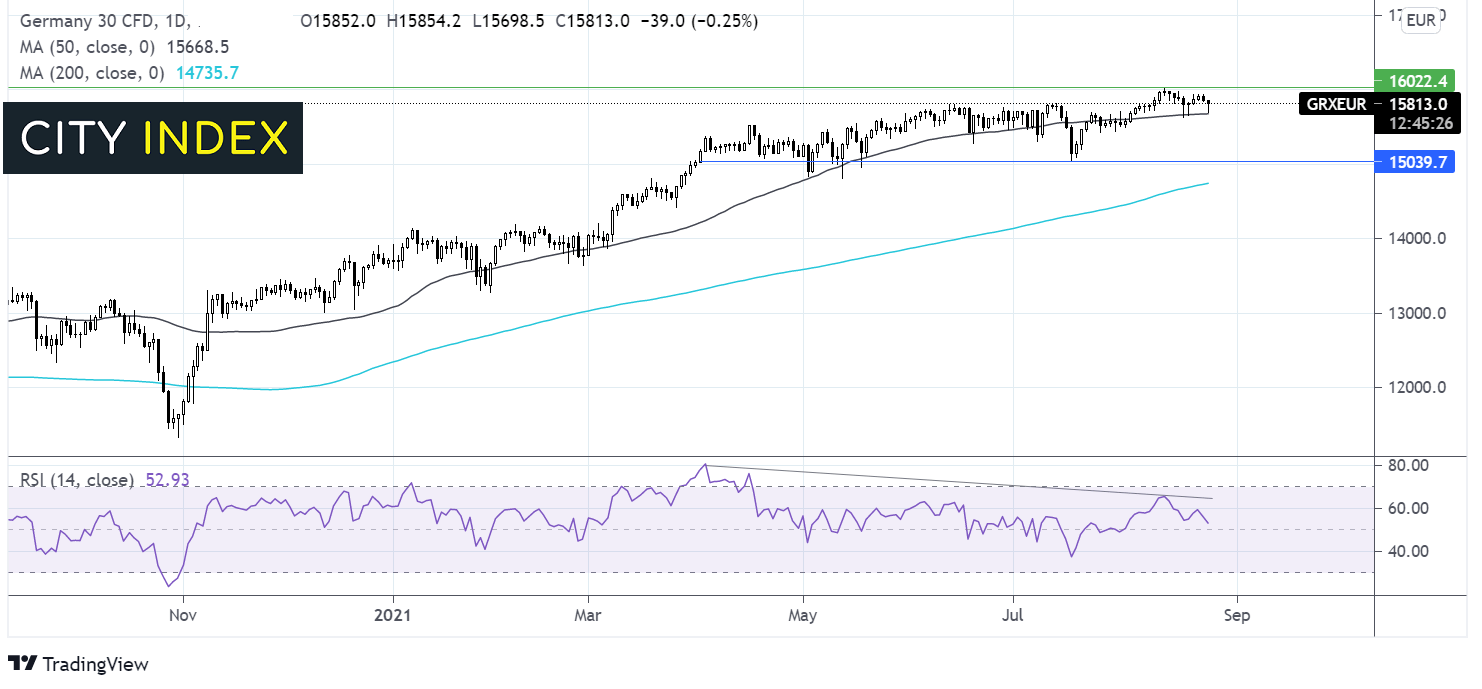

The Dax once again found support on the 50 sma in early trade at 15675. The 50 sma has proved to be an important across the run up this year. The index is grinding higher with the bullish trend intact so it makes sense that we could see another test of 16000 soon. A break above this level would be a bullish signal and could boost the price fresh all-time highs. However, it is worth pointing out the bearish divergence on the RSI which suggests that momentum is slowing.

On the downside side, a close below the 50 sma at 15675 would be significant and could open the door to 15000 the July low before sellers look towards the 200 sma at 14700.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.