Data showing that the German economy contracted in the second quarter reignited fears of a global recession, dampening demand for riskier assets such as equities. Europe’s largest economy shrank -0.1% after growth of 0.6% in the first quarter. The dramatic slowing of the German economy shows the extent to which the US – Sino trade war and weak demand has negatively impacted the German manufacturing sector.

German GDP data comes following a slew of weak readings from China overnight. Chinese industrial output showed the slowest level of growth in 17 years. Dismal data from Germany and China combined with bond markets flashing recession warning alarms through inverted yields (US 2 year and 10-year yields) has cut short Trump’s tariff delay inspired relief rally. The move by the Trump administration appears to be too little, too late as far as the markets are concerned. Data is showing that damage to the global economy owing to the ongoing trade dispute has already been done.

US retail sales to provide clues?

With little else due on the European or German economic calendars this week, investors will be watching trade headlines closely. Tomorrow’s US retail sales data could also provide clues as to the health of the US economy amid the dragged out US – Sino trade dispute. Signs of weakness could unnerve jittery traders further and pull the Dax lower.

Dax levels to watch:

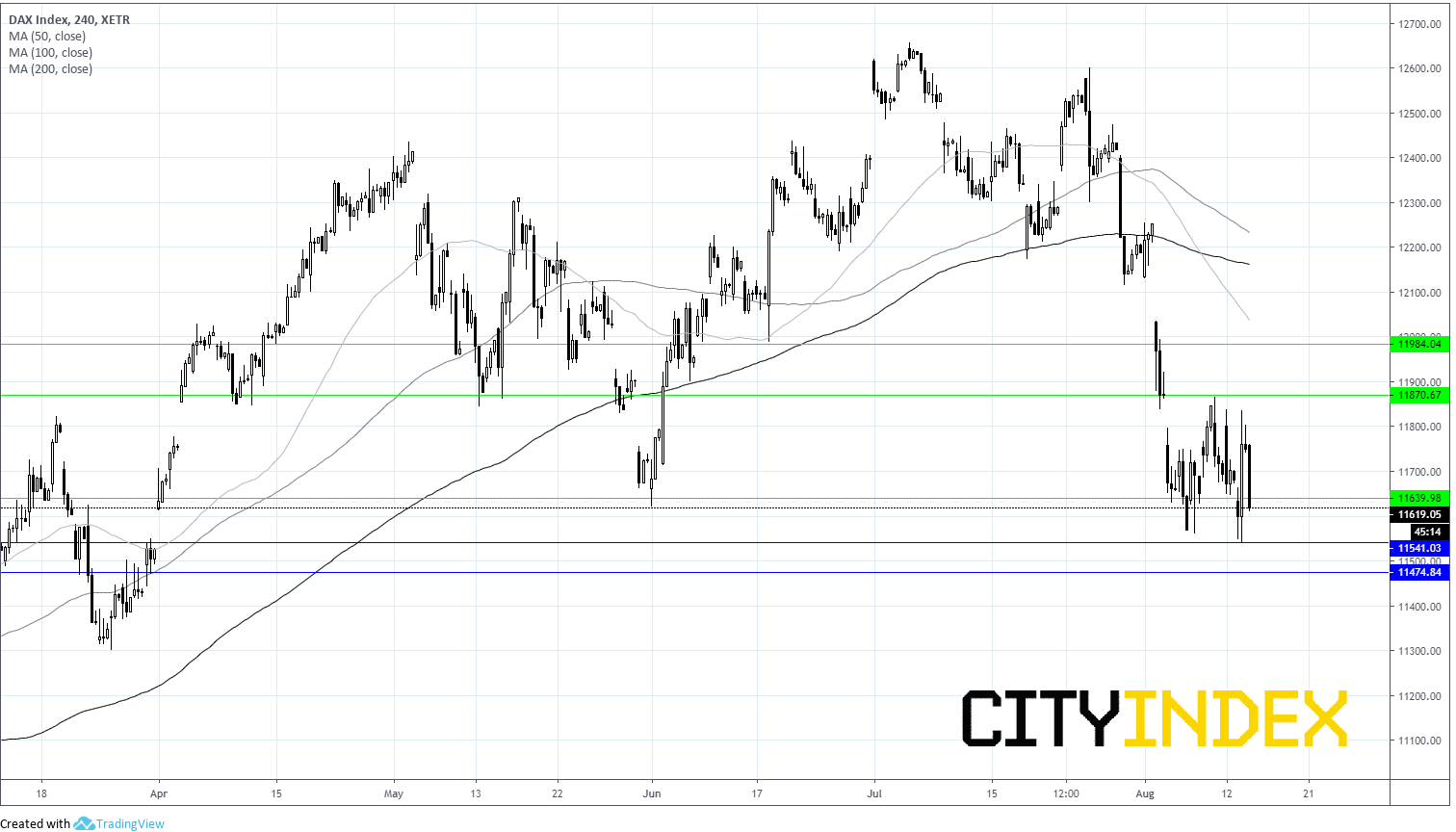

The Dax is down 1.3% and is trading below its 50, 100 and 200 sma on 4 hour chart. The price is has broken through support at 11640. This has opened the door to support at 11540 prior to support at 11470. On the upside, a break back above 11640 could see the Dax advance to 11870.