After yet another historic selloff it the previous session, which saw equities, bonds and crude oil take a hammering as investors liquidated into cash, today is showing signs that the sell off at least could be slowing. European indices are pointing to slight dip on the open as investors assess stimulus measures from across the globe.

Last night the Reserve Bank of Australia cut its key interest rate by an additional 25 basis points to 0.25% and adopted a Japanese style yield control among a raft of other measures, to shore up the Australian economy.

The move came following the announcement of €750 billion bond purchases by the ECB, in a bid to stabilise the economy and capital markets. This is an all-in programme and Christine Lagarde’s “whatever it takes” moment. The Fed also said that it was launching a programme to support money making mutual funds after slashing interest rates to near zero at the start of the week.

Today attention will move to the Swiss National Bank, which has a strong currency and negative rates, a similar problem to Japan. With the rate already at -0.75% no rate cut is expected, although we could well see other tools being expanded.

Monetary & Fiscal Stimulus

Central banks have thrown what they have at the coronavirus pandemic issue. Governments have also been doing their part. Last night the US Senate cleared an economic relief package that will provide paid sick leave, food assistance and financial help for virus testing. The move came after the UK government pledged £330 billion to support coronavirus business.

Central banks have thrown what they have at the coronavirus pandemic issue. Governments have also been doing their part. Last night the US Senate cleared an economic relief package that will provide paid sick leave, food assistance and financial help for virus testing. The move came after the UK government pledged £330 billion to support coronavirus business.

Is it enough?

However, these pledges of support come as the number of cases continue to grow exponentially in Europe and in the US and as the governments also put in increasingly stringent measures in place to prevent the spread of coronavirus. These very measures will create a huge demand shock and eye watering levels of contraction. A recession is inevitable, the question is whether the fiscal and monetary support can prevent a depression.

The fact that the DAX remains in negative territory implies that traders are dubious over whether these moves are enough. However, the selloff does appear to be slowing suggesting that they are at least considering it.

However, these pledges of support come as the number of cases continue to grow exponentially in Europe and in the US and as the governments also put in increasingly stringent measures in place to prevent the spread of coronavirus. These very measures will create a huge demand shock and eye watering levels of contraction. A recession is inevitable, the question is whether the fiscal and monetary support can prevent a depression.

The fact that the DAX remains in negative territory implies that traders are dubious over whether these moves are enough. However, the selloff does appear to be slowing suggesting that they are at least considering it.

Dax levels to watch

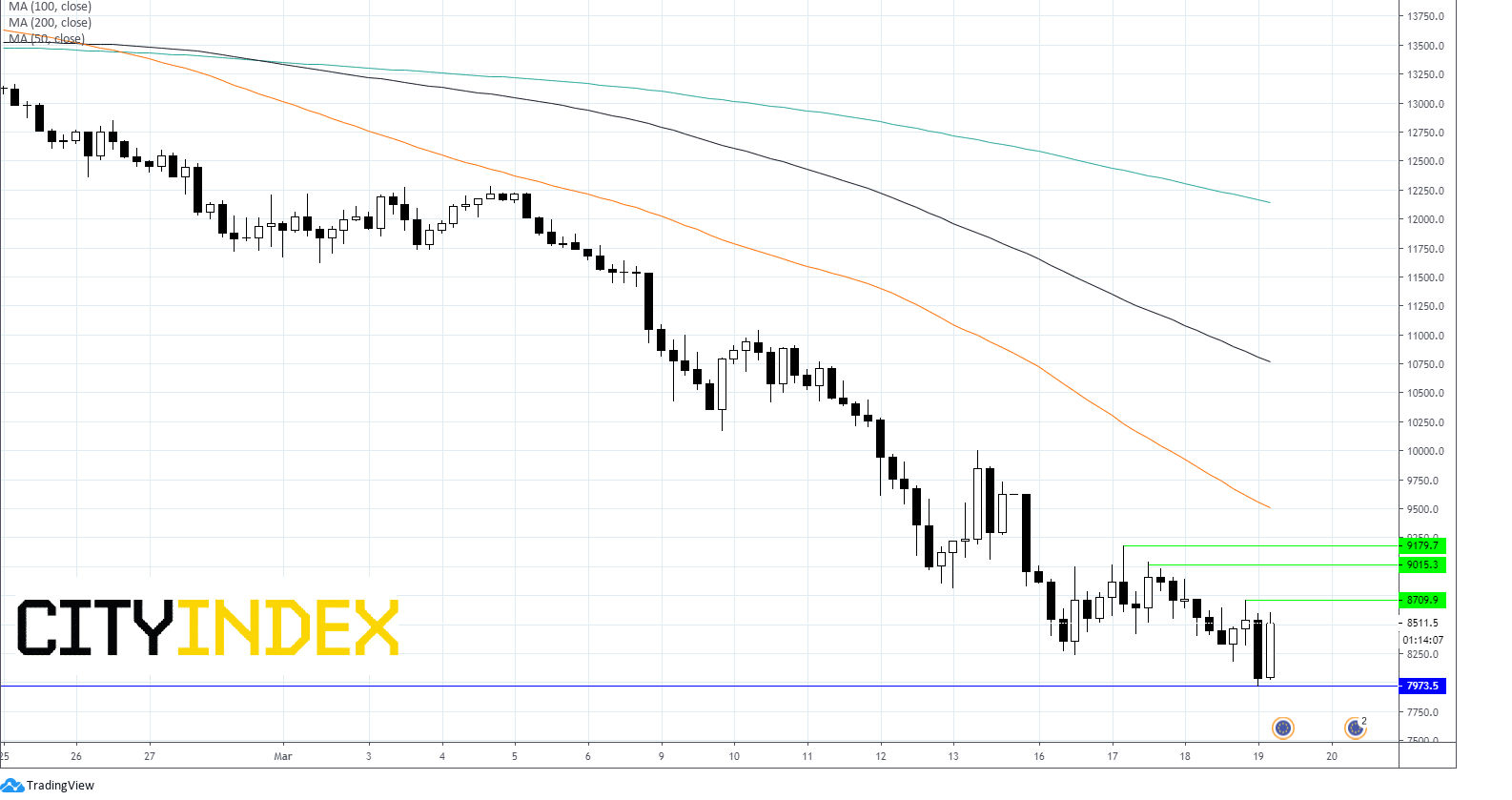

The Dax has opened higher on Thursday at 8464 although quickly gave up initial gains and is now down -0.5%. It continues to trade below 50, 100 and 200 sma on 4-hour chart.

Immediate resistance can be seen at 8707 (today’s high) prior to 9015 (high 17th March) and 9180. A mover above 9483 (50 sma) could negate the bearish trend.

Support can be seen at 9768 (today’s low) prior to 7730 (low 1st July’13) and 7655 (low 1st June’13).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM