Demand for riskier assets such as equities are on the rise, whilst the safe haven trade is starting to look tired.

Data from German has been encouraging so far this week.

- German retail sales smashed analysts’ expectations jumping 2.1% mom in November, significantly up from October’s -1.6% decline.

- German service sector pmi also surprised to the upside calming fears of the ongoing manufacturing slump spilling over into the consumer sector.

- Today HIS/Markit data showed that the German construction sector expanded at the fastest pace in 9 months.

Euro weakness supports Dax

Despite the stronger data from Germany, Eurozone inflation ticking higher to 1.3% and eurozone retail sales increasing 2.2%, the euro remains on the back foot and below $1.12. The weaker euro is also offering support to the multinational exporters on the Dax.

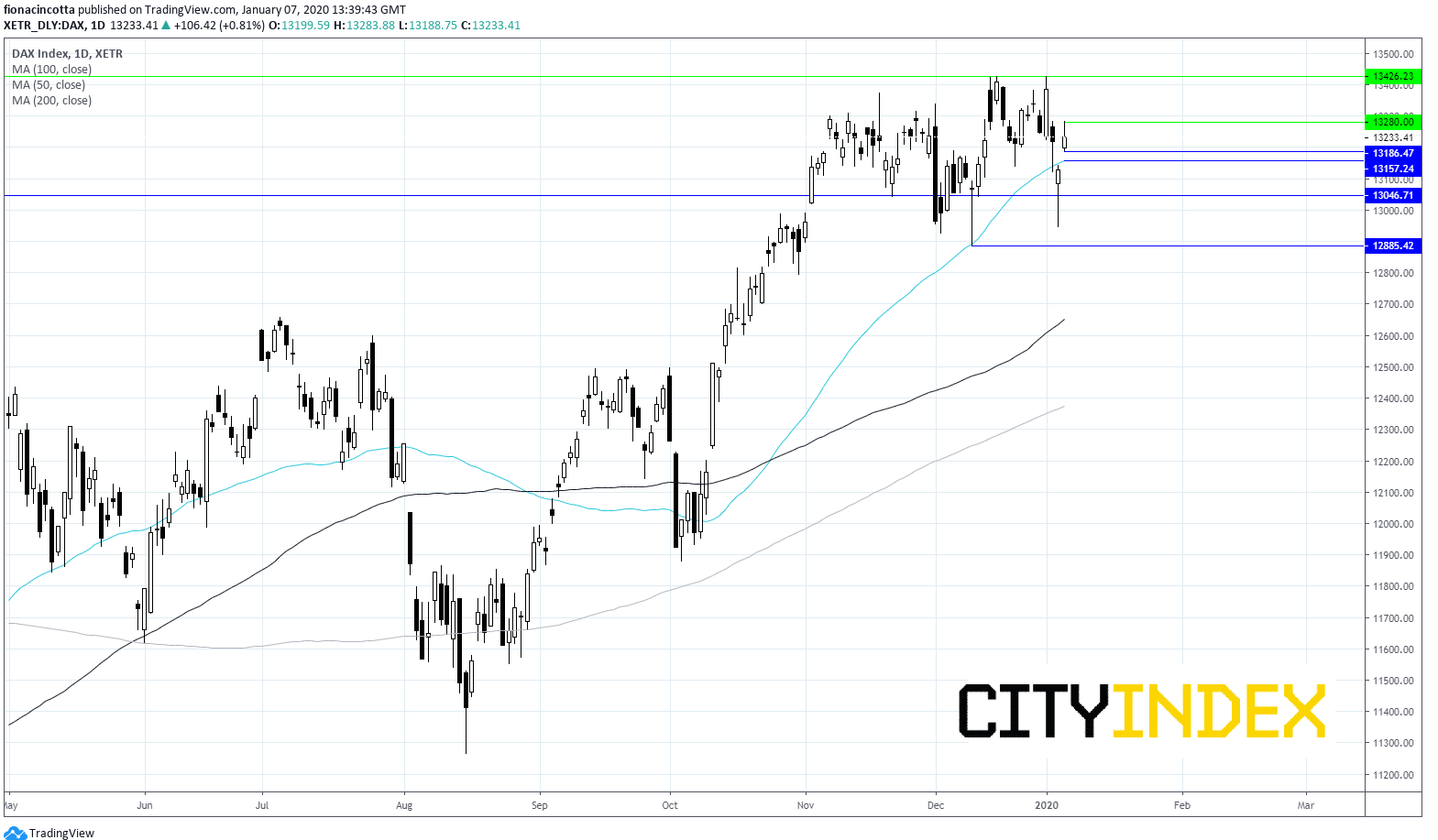

Levels to watch:

The Dax jumped on the open and is trading 0.7% higher. The surge in the Dax has pushed it back above its 50 sma, giving the bulls the upper hand. Immediate resistance can be seen at 13280. A breakthrough here could open the doors to 13425 (2019 high).

On the downside support can be seen at 31188 and the 50 sma at 13157. A breakthrough these levels could see the Dax drop to 12884.