As expected, the ECB kept its main interest rate unchanged at -0.5%. However, the central also surprised the market by deciding not to increase its bond buying programme even as the Eurozone economy shrinks at the fastest pace on record in Q1. There had been a broad expectation that the ECB would expand its Pandemic Emergency Purchase Programme (PEPP). However, there was a clear willingness to increase if deemed necessary.

The ECB added a few additional liquidity measures. For example, in order to keep banks’ lending the ECB said it would lend to banks at rates as low as -1% through a planned programme.

Lagarde also stepped up the pressure on European governments to do more. The response from EU governments has been too little, too late. Lagarde once again called for more fiscal stimulus hours after data revealed that the Eurozone GDP shrunk -3.8%. This could just be the beginning as Christine Lagarde warned that the Eurozone economy could contract by 12% this year.

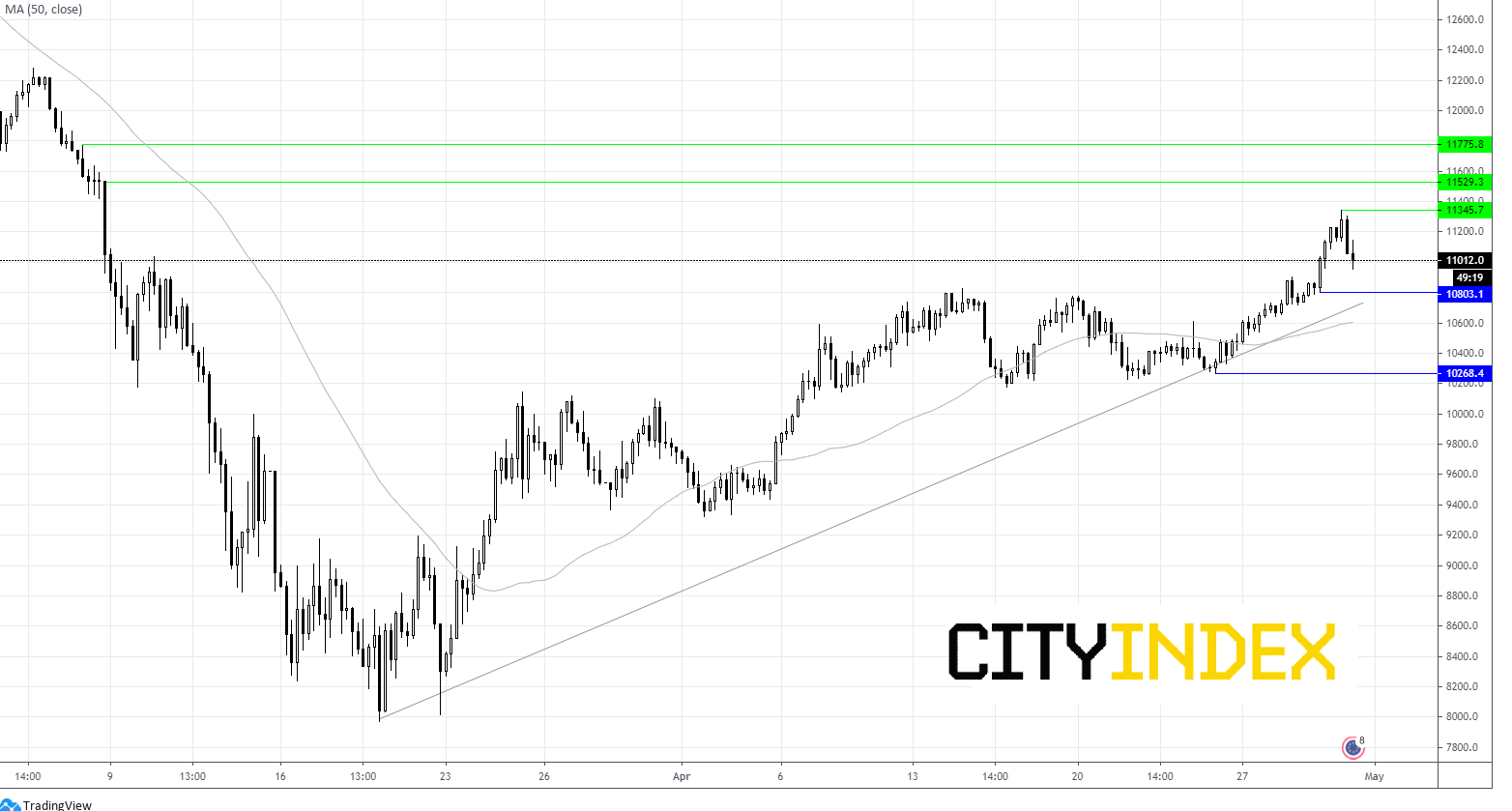

Dax levels to watch

After starting the session on the front foot, the German index is trading almost 3% lower. Even so, the bullish chart remains intact as the index continues to trade above its ascending trend line. A breakthrough the trend line at 10710 could see the Dax under more pressure.

Immediate support can be seen at 10797 (low yesterday) prior to 10710 trendline support.

Immediate resistance can be seen at 11342 (today’s high) followed by 11530 (high 6th March)