As the dust settles on the Fed’s emergency 50 basis point rate cut the Dax is extending gains. The German index rallied 1% across the previous session and has added a further 1.3% this morning amid growing expectations of ECB stimulus, and despite mixed data.

On the positive side, German retail sales rebounded strongly in January growing 0.9% month on month, a sharp contrast to December’s 2% decline. On a yearly basis, retail sales increased 1.8% in February, up from 1.7% and beating estimates of 1.5%. The data shows that household consumption remains solid and domestic demand is supporting the economy at the start of the year.

German PMI data showed signs of trouble. The IHS Markit service sector PMI fell to 52.5 in February down from 54.2 in the previous month. This was the weakest reading since November, significantly weaker than the 53.5 estimate. Delving deeper into the data, the slowdown was caused by a stalling of new business, with the figures revealing a sharp decline in demand from abroad.

Here we are seeing the clear impact of coronavirus outbreak on foreign demand. China is Germany’s biggest trading partner. Meanwhile, the domestic market is looking stable. However, this could all change very quickly given how fast coronavirus spreads.

Yesterday’s surprise Fed cut is boosting expectations that the ECB will follow suit at the meeting next week. Whilst the ECB clearly has less ammunition that the Fed given how low interest rates already are, expectations of a 10-basis points rate cut are growing. Furthermore, following the G7 meeting yesterday so far just the Fed has acted. The Fed can’t support the global economy by itself, a more united response is expected. However, the ECB clearly want to buy themselves more time given how empty their ammunition cupboard is. A lower interest rate environment is more business friendly hence the jump in equities on the prospect of further easing.

Levels to watch

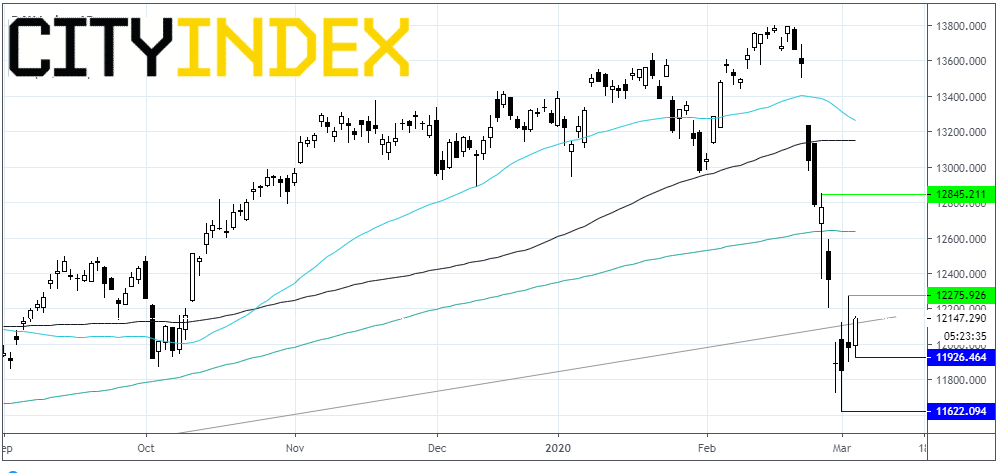

The Dax is trading up 1.35% at 12148, as it moves back above an ascending trend line support which it fell through in the previous session and that has been intact since early late 2018.

A close above this support could indicate more upside is to come.

Immediate support can be seem at 12125 (trendline) prior to 11929 (today’s low) before opening the door to 11624 (Monday’s low).

On the upside, resistance can be seen at 12272 (yesterday’s high) prior to 12642 (200 sma) and 12850 (high 26th Feb)