Lockdown & COVID in focus

Austria announced its fourth lockdown as COVID cases surge. The picture in Germany is also going from bad to worse.

COVID cases are rising, deaths are also picking up sharply and given the ongoing change of power in the Eurozone’s largest economy, authorities have been slow to respond.

With cases climbing and hospitals being overwhelmed in some areas, outgoing Chancellor Angela Merkel, along with regional leaders have decided to restrict access to the unvaccinated to restaurants, bars and events in the areas where cases are surging.

Germany reported a record 65,000 cases on Thursday. Germany has less than 70% of the population vaccinated, less than in other European countries. The outlook for the winter months is darkening.

Separately, German’s PPI data revealed that inflation at the factory gate surged 18.4%, up from 14.2% in September. The PPI is often considered a lead indicator for consumer prices given that firms will need to pass on at least some of that increase. Germany’s CPI was 4.5% in October an almost 30 year high. The PPI suggests this could still have further to rise. Even so, the ECB continue with their dovish verse.

Surging prices and COVID cases means the clouds are gathering over Germany and its economic recovery, although the weaker Euro is offering some support..

Where next for the DAX?

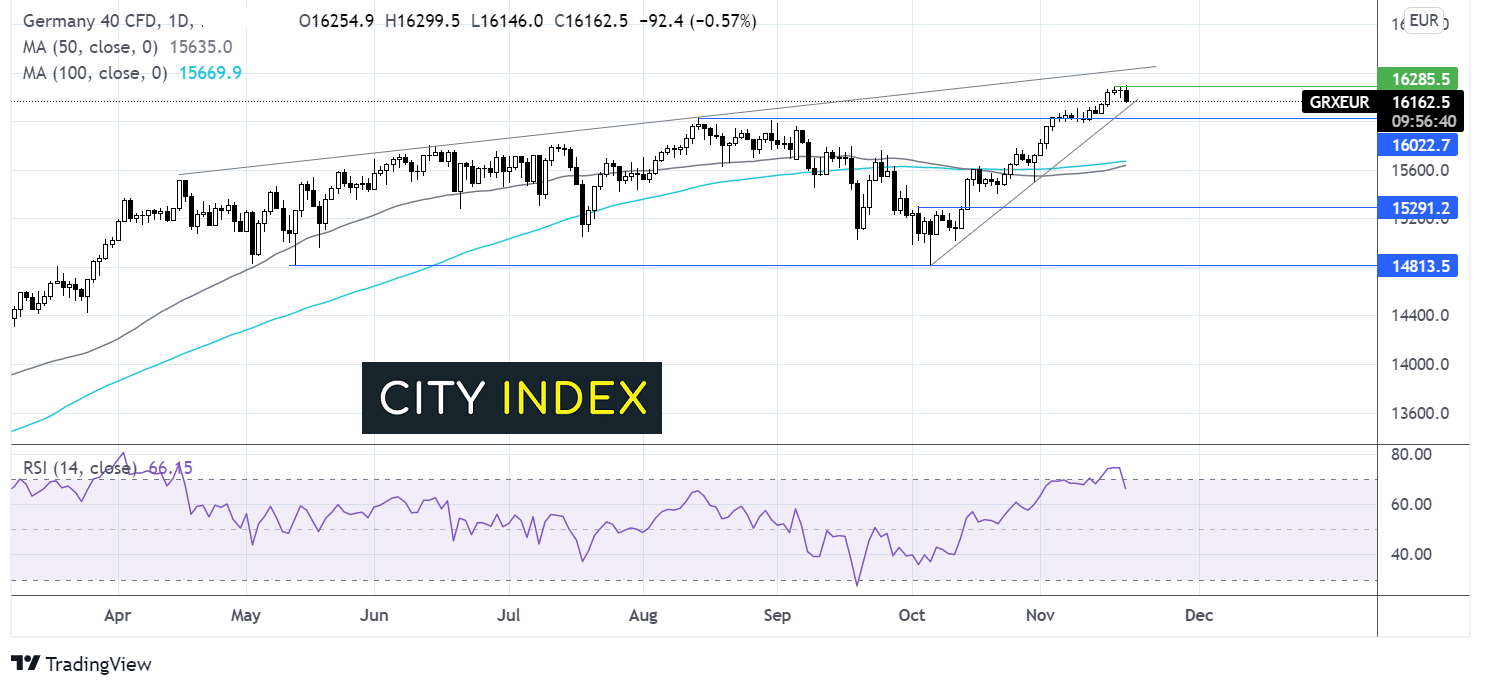

The DAX has been extending its recovery from 14812 the October 6 low, running into resistance at 16300 a new all-time high.

From reaching the all time high, the DAX is easing lower, bringing the RSI out of overbought territory.

Immediate support can be seen at 16125 the rising trendline. A move below here could see 16000 round number and August high tested. It would take a move below this level to negate the near term uptrend and expose the 50 and 100 sma at 15650.

Buyers will look for a move above 16300 to bring 16450 the rising trendline dating back to April and fresh all time highs.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.