Apple warns on profits

Apple, considered one of the best bellwethers for the coronavirus impact, warned that their profits could miss expectations owing to low production levels and slow Chinese consumption. China is a big market for Apple, accounting for around one sixth of its global revenues and the source of most of its products. With this in mind, the impact is both on supply and demand. The warning from Apple has served as a reality to check to the financial markets, which had so far been assuming that any impact from coronavirus will be short lived.

German ZEW Sentiment Index Drops

Also dampening the mood for the Dax was today’s German ZEW index for February. The Sentiment Index tanked to 8.7 from 26.6, significantly short of the 21.5 analysts forecast. Investment sentiment has dropped sharply as the effect of the coronavirus outbreak weighed on exporters, painting an increasingly gloomy picture for Europe’s largest economy.

The hit to sentiment comes following a poor run of data from Germany, with economic growth stagnating, and the manufacturing sector suffering its worst year for a decade last year, following a sharp fall in orders.

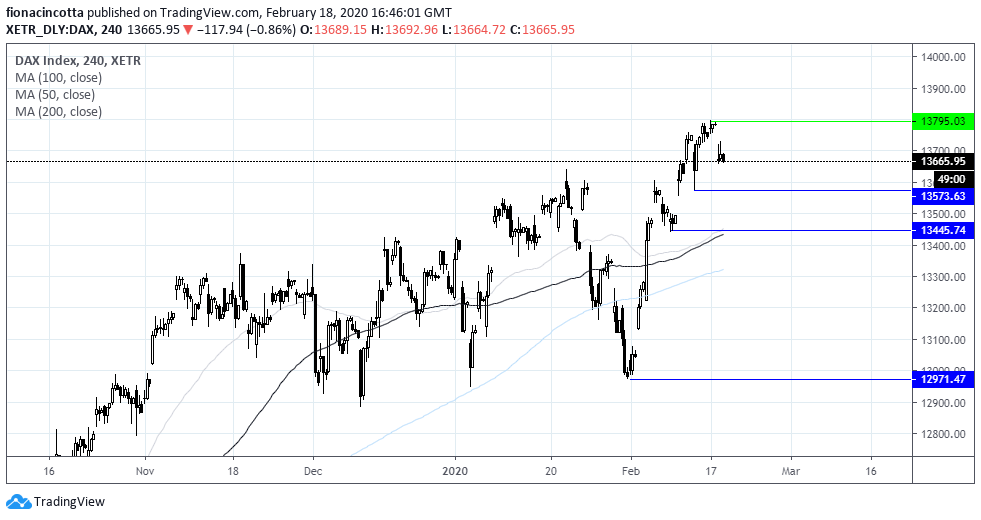

Dax levels to watch:

Despite falling over 100 points today, the DAX remains in an uptrend. A break below 13445 (Feb 10 low & 100 & 50 sma approx.) could negate the current uptrend. This could open the doors to 13320 (200 sma) and eventually 12970.

On the flip side immediate resistance can be seen at 13731 (today’s high) prior to 13795 (all time high).